Crypto analyst Sjuul from AltCryptoGems recently shared on X (formerly Twitter) five DeFi tokens with high growth potential in this market cycle. By analyzing over 100 DeFi projects, the analyst pointed to advancements in scalability, affordability, and real-world utility as key drivers behind DeFi’s comeback. Each tweet in the thread offers insights into the DeFi market’s resurgence and the analyst’s top picks for the cycle.

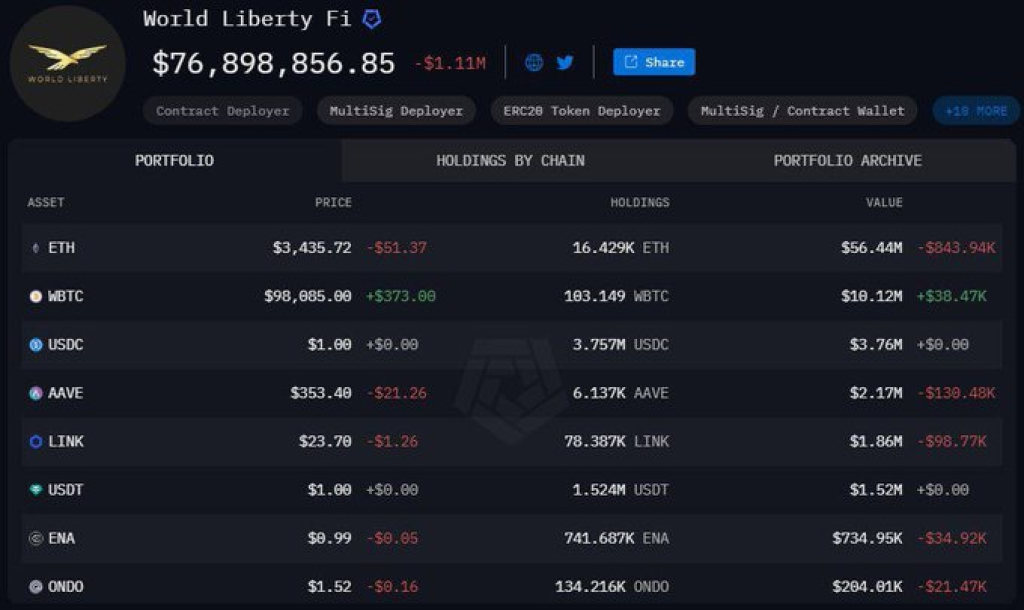

Sjuul set the stage by highlighting the renewed interest in DeFi. The analyst attributed this resurgence partly to Donald Trump’s involvement, stating that Trump’s win has sparked a “DeFi renaissance.” Trump has reportedly launched his own DeFi project and invested heavily in multiple DeFi coins, reinforcing his unexpected position as a major DeFi proponent.

Read Also: Here’s Why Movement (MOVE) Price Saw a 30% Christmas Rally—Analyst

What you'll learn 👉

Real-World Utility and Evolving Fundamentals

The analyst emphasized the sector’s evolution since the previous cycle. While earlier DeFi projects focused primarily on lending, borrowing, and basic DEXes, the current landscape encompasses functionalities comparable to traditional finance (TradFi).

DeFi protocols now handle everything from trading futures to lending and fundraising, including launch pools. The numbers show this growth—we’re seeing record-breaking TVL and more users than ever joining these platforms daily. Some DEXes even outperform centralized exchanges (CEXes) like Coinbase in daily trading volume.

Read Also: Why Is Bitget Token (BGB) Price Rising?

Affordability and Scalability Address Past Challenges

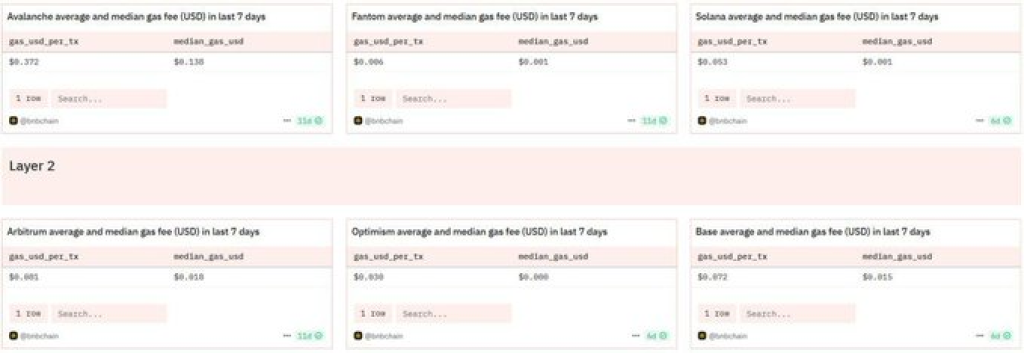

Sjuul pointed out that high gas fees and slow transactions were barriers in the previous cycle. However, advancements in Layer 1 and Layer 2 solutions such as Solana, SUI, Base, and Arbitrum have made transactions faster and more affordable.

With fees as low as $0.01, DeFi is now more accessible, even during market surges. The analyst projected significant growth, with DeFi TVL potentially exceeding $400 billion by the cycle peak.

Moreover, in a series of tweets, Sjuul detailed his top five DeFi picks for this cycle:

- Hyperliquid (HYPE): Known for conducting the largest airdrop of this cycle, distributing $8 billion to its community. The project boasts $2 billion in TVL, $4 billion in daily perpetuals trading volume, and plans to launch its Layer 1 blockchain next year.

- Jupiter Exchange (JUP): The largest DEX on Solana, offering $2.5 billion in TVL and $700 million in daily perpetual volume. With a 40% community token allocation and a second airdrop scheduled, the analyst predicts JUP’s price could hit $5 this cycle.

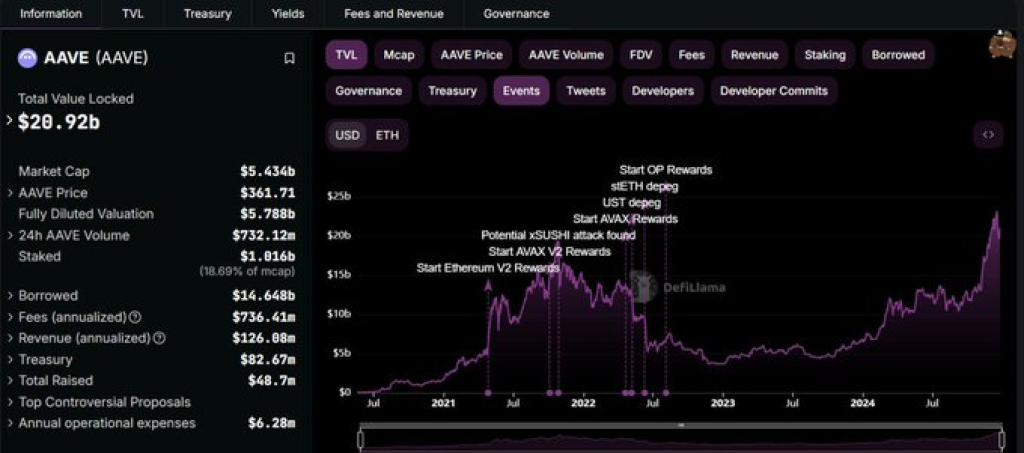

- Aave (AAVE): This is Ethereum’s biggest lending platform right now, holding around $20 billion and making about $100 million per year. What makes it even more interesting is Trump’s recent investments – analysts think this could push the price up 6 to 8 times higher.

- Pendle Finance (PENDLE): A protocol allowing users to tokenize and trade future yields, supported by $5.2 billion in TVL and $36 million in annualized revenue. With backing from Binance Labs and Spartan Group, PENDLE’s price is expected to reach $30.

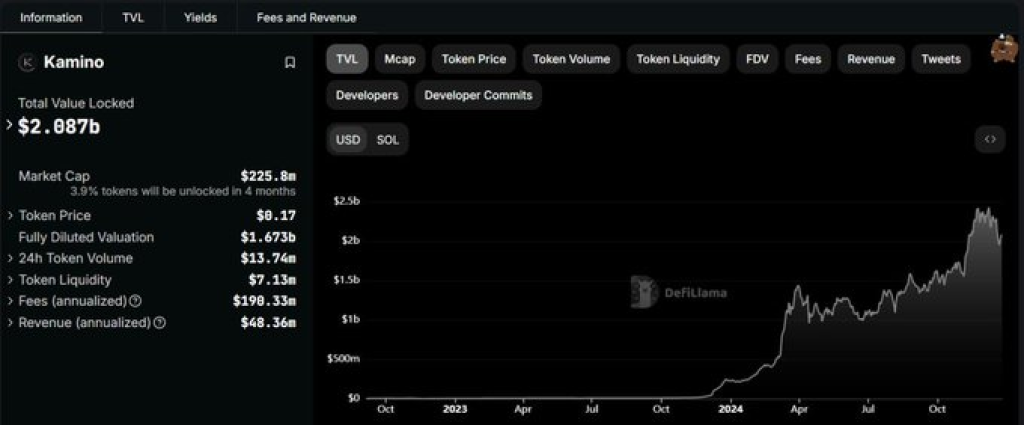

- Kamino Finance (KMNO): Operating on Solana, this lending platform manages about $2 billion and brings in roughly $50 million yearly. They’ve been expanding with new features like Kamino Swap. Plus, no tokens will be unlocked until April 2025, which could mean the price has room to grow significantly.

Sjuul’s analysis highlights DeFi’s growing maturity and potential, fueled by technological advancements and a diverse range of innovative projects.

Read Also: This Pattern Signals Potential 30% Price Correction for ONDO

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.