Analysis by crypto analyst @nobrainflip suggests the long-awaited altcoin bull runs have yet to truly commence, despite Bitcoin’s recent highs. Several key metrics indicate retail investors have not fully re-entered the market, a typical precursor to previous crypto bull cycles. However, the analyst remains confident a substantial rally will eventually unfold, pointing to historical patterns.

What you'll learn 👉

Metrics Signaling More Upside Ahead

The analysis cites multiple data points suggesting the current market has ample room for growth before retail frenzy sets in:

Lack of Mainstream Attention

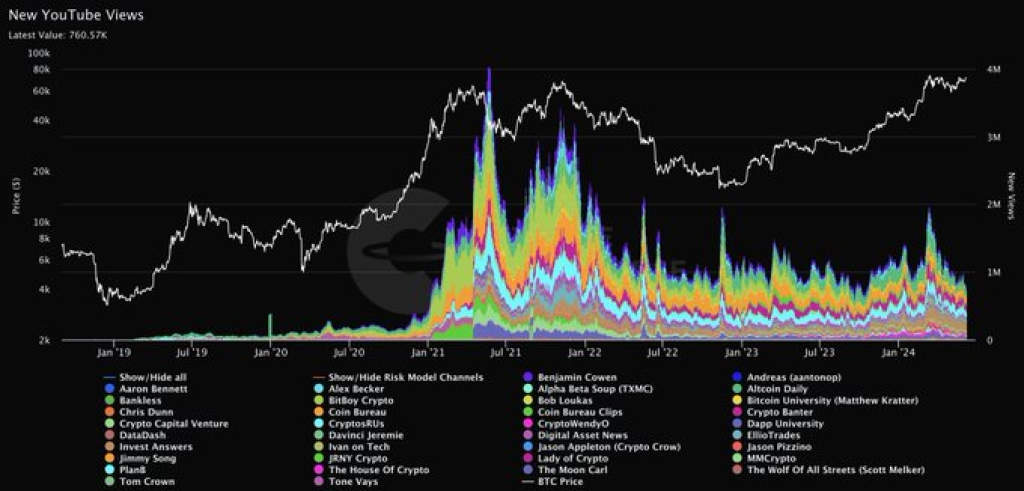

- YouTube crypto views are nearly 5x lower than the 2021 peak

- Google searches for “Bitcoin,” “crypto,” and “altcoins” are just 40% of 2021 levels

- Major app downloads like Coinbase are nowhere near previous cycle highs

Muted Trading Activity

- Overall trading volumes significantly trail the 2021 bull market despite higher Bitcoin prices

- Relatively few short liquidations and hyper-speculative “0 IQ gamblers”

Delayed Altcoin Movement

- Most altcoins are 80% below their all-time highs, compared to Bitcoin’s 10% deficit

- Only a handful of altcoins like Render Token and Injective have set new highs

Nascent Price Impulses

- Bitcoin has surged 400% from recent lows, while altcoins have risen just 180%

- Typical pattern sees Bitcoin lead, followed by Ethereum, large-caps, mid-caps, meme coins

Token Dilution Headwinds

- Nearly 1 million new tokens launched in May, double the historical Ethereum high

- $50 million in major token unlocks hit the market daily, totaling $200 million overall

Cycle Timing Patterns

The analyst argues cyclical timing patterns from 2017 and 2021 suggest this bull market could peak around October 2025 if it follows historical norms. Previous cycles saw Bitcoin top around 880 days before the halving, after deep bear market bottoms lasting 370 days.

While not expecting an exact replay, the analyst believes the core principles of market cycles will likely hold: “Liquidity will flow eventually, as market cycles inevitably do.”

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Mixed Signals and Uncertainty

The uneven distribution of returns and breakage of typical market patterns like “Bitcoin leads, altcoins follow” has sown doubts. Resilient meme coin performance, lack of major Bitcoin corrections, and the struggle of traditional leaders Ethereum and Bitcoin have disrupted familiar trajectories.

However, telltale signs like lack of retail frenzy, relatively few short liquidations, and altcoins yet to exhibit parabolic moves have the analyst confident, “Every bull cycle is a bubble, and it ends a few months after retail joins in. Normies are still not in crypto…We’re still early.”

While the timeline remains uncertain, the analyst concludes that the current market position, relatively muted hype levels, and anticipated trajectory of liquidity shifting to altcoins once Bitcoin cools off portends substantial further upside: “Remember my words: June 2024, we’re still early.”

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.