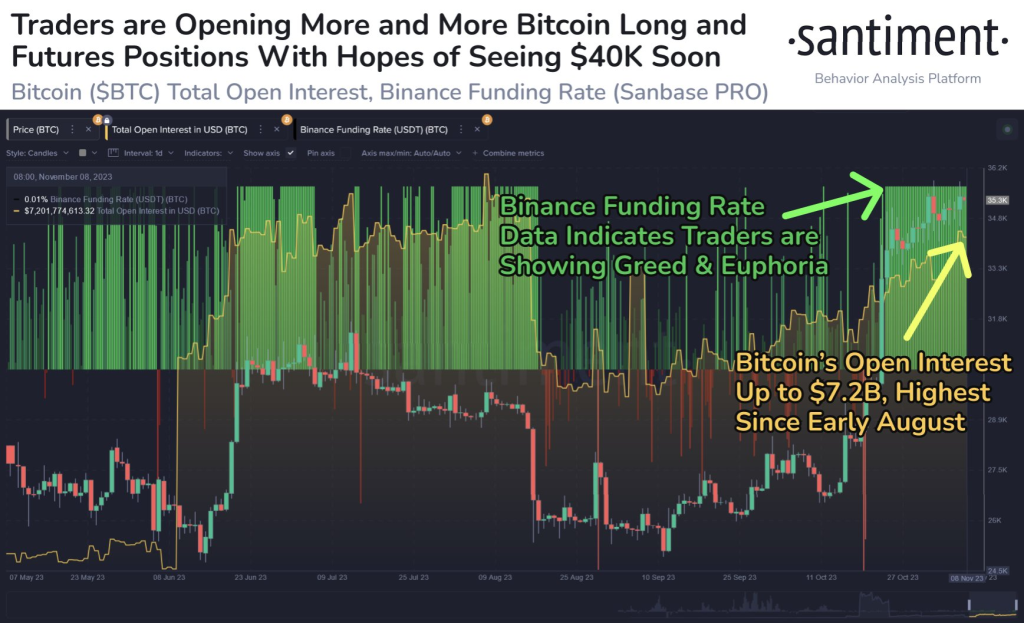

Bitcoin has seen a nice rally over the last couple months, gaining 37% to trade around $35,470 as of Wednesday night. According to data from Santiment, this rise has been accompanied by a shift to a more bullish sentiment among traders.

Specifically, Santiment reported that the ratio of traders opening bullish positions versus bearish positions on bitcoin recently hit 3-month highs. This indicates that after bitcoin’s sell-off earlier this year, traders are now positioning for more upside by betting on continued gains rather than losses.

Source: Santiment – Start using it today

Bullish trading positions like long futures contracts or call options profit when an asset’s price rises. So the increase in this ratio shows traders believe bitcoin’s uptrend will continue. In contrast, bearish positions like short selling or put options bet on declines.

Santiment also noted that the total open interest on exchanges has surged to $7.2 billion. Open interest refers to the total number of outstanding derivative contracts, like futures and options, that have not been settled. A rise in open interest alongside a rising price often signals increased enthusiasm and new money flowing into an asset.

Read also:

- Why is Moonriver (MOVR) Price Up? Exploring the Catalysts Behind the Rally

- Estonian Banker’s $469,000,000 Ethereum Fortune Locked Away Forever After Losing Keys – Can Anyone Crack the ETH Wallet?

- Join eTukTuk’s revolution – Only few hours left at the current price

The ballooning open interest indicates traders are actively taking on leverage to increase their exposure to bitcoin’s gains at this current stage of the bull market. However, as Santiment points out, extremely high open interest can sometimes signal frothy conditions and more volatility ahead.

Overall though, the shifting trader sentiment and surging open interest provides evidence that bitcoin’s uptrend still has room to run versus the rally getting overheated. Unless Something fundamental changes, the technicals and behavioral signs point toward bitcoin’s price continuing to trend higher as the bulls assert control once again.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.