The price of Chainlink’s LINK token has surged over 25% in the last two days. According to on-chain analyst Lookonchain, this rise appears driven by whale accumulation – but that also presents risks down the road. Let’s examine the data.

What you'll learn 👉

Whale Buying Preceded the Rally

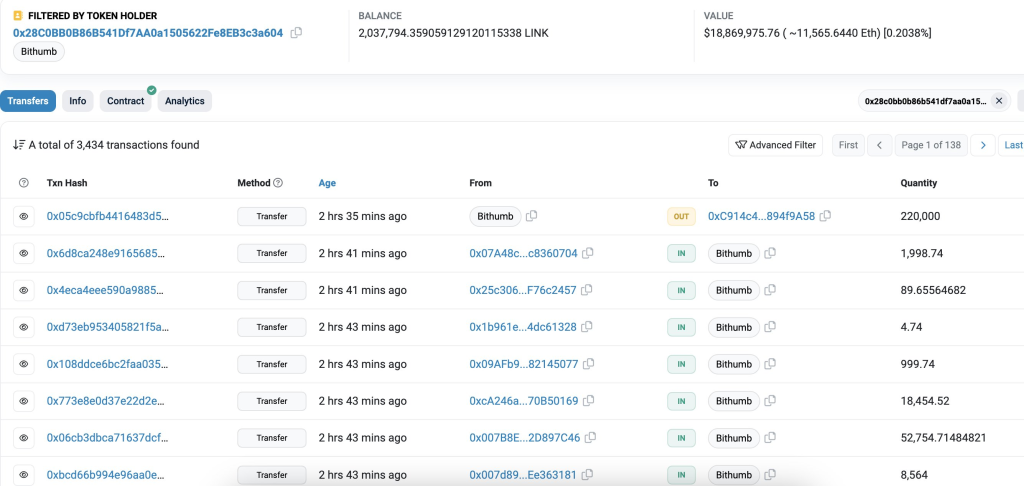

Lookonchain noticed that leading Korean exchanges Bithumb and Upbit accumulated around 945,000 LINK (worth $9 million) during the rally. This large purchase volume likely helped propel LINK’s price upward.

However, Bithumb stopped accumulating and withdrew 220,000 LINK (worth $2.05 million) just as the rally was peaking. LINK’s price began dropping from its highs shortly after.

Large Holders Could Take Profits

Per the analysis, exchanges hold over 202 million LINK worth nearly $2 billion – accounting for 20% of the total supply. With so much consolidated in a few entities, a coordinated sell-off could sink the price.

One identified whale already scored a $2.1 million profit on a 1.25 million LINK position obtained around $7.58. As Lookonchain cautions, traders should be wary of more whales cashing out gains.

Short Positions Emerging

Some wealthy traders do appear to be hedge short positions now. One whale that profited earlier from LINK’s swings has begun shorting the token by borrowing and selling 38,747 LINK worth $369,000.

Conclusion

In summary, Chainlink’s price rise looks driven by exchange accumulation and whales. But with so much LINK concentrated in a few hands, those same entities could spark an abrupt reversal by selling. Savvy traders will watch for distribution by large holders, as the data suggests the rally remains precarious.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.