Big Bitcoin numbers grab attention fast. $1 million. $1.5 million. Even higher. These targets sound bold, confident, and easy to believe during strong market phases. But there is a side of these predictions that rarely gets discussed.

This breakdown is based on analysis shared by Crypto Patel, who took a closer look at how these targets are presented and why they tend to work in favor of institutions, not retail.

One name comes up again and again: Cathie Wood. Over the past few years, her Bitcoin price targets have stayed large, but the timeline keeps moving. The year changes. The number stays impressive.

The message feels optimistic, but the structure matters. Each new forecast keeps attention locked on a distant upside, not on what happens between now and then.

That gap is where most people struggle. Big numbers keep people holding through drawdowns without a plan.

However, here is the uncomfortable question Crypto Patel raises. If large institutions truly expected Bitcoin to multiply many times over in a short window, why broadcast it to millions?

Institutions do not share private conviction as public advice. They manage risk, liquidity, and positioning. Public targets often serve a different purpose.

They anchor expectations. Retail holds. Institutions manage exits, rotations, and re-entries. This is how liquidity forms in markets. Not through secrets, but through narratives.

Bitcoin Can Reach $1M – Just Not the Way It’s Sold

Crypto Patel is clear on one point. Bitcoin reaching $1 million is possible. That idea is not dismissed. The issue is timing and behavior.

The Bitcoin price does not move in straight lines. Every major advance came with deep crashes, long resets, and years of patience.

Anyone expecting a clean run because a target was mentioned on television is setting themselves up for frustration. Wealth in Bitcoin has always favored those who survive multiple cycles, not those chasing headlines.

What the Bitcoin Chart Actually Shows

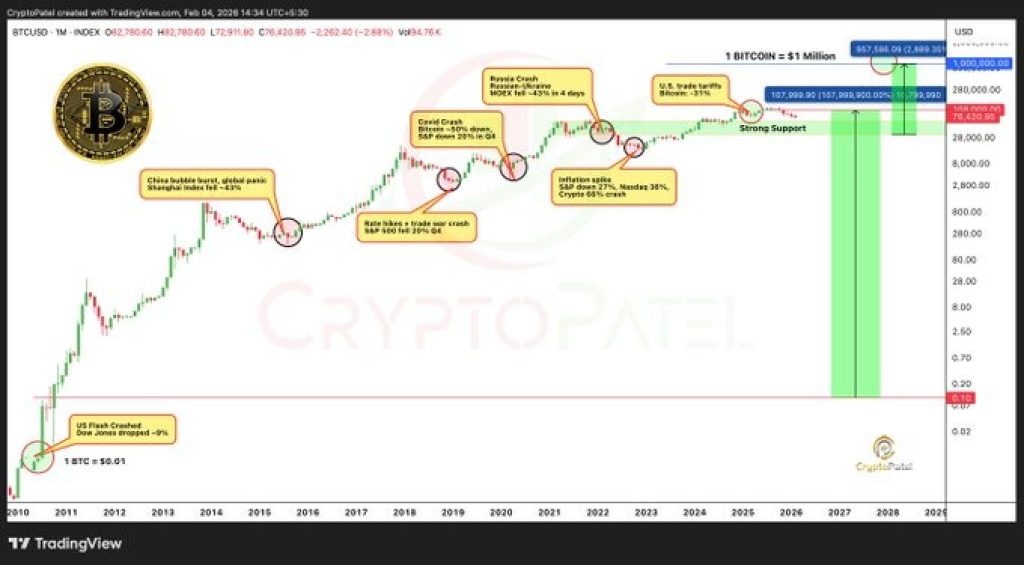

The chart shared alongside this discussion highlights Bitcoin’s long-term structure. Strong supports formed after major crashes. Long flat periods followed explosive moves. Each cycle took time to mature.

The green projection zones on the chart are not promises. They represent what happens when the BTC price reclaims long-term structure after resets.

These phases do not begin during excitement. They start after boredom, fear, and disbelief. That context matters more than any single price target.

Read Also: How Mastercard Opens the Door to XRP Liquidity At Global Scale

Crypto Patel’s message is for everyone to know that Institutions are not mentors. They are market participants with plans. Public predictions help shape behavior. They do not replace strategy.

The Bitcoin price may reach $1 million one day. The path there will test patience far more than optimism. Anyone building long-term exposure needs clear entries, exits, and expectations grounded in reality. Big numbers sound good. Plans build wealth.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.