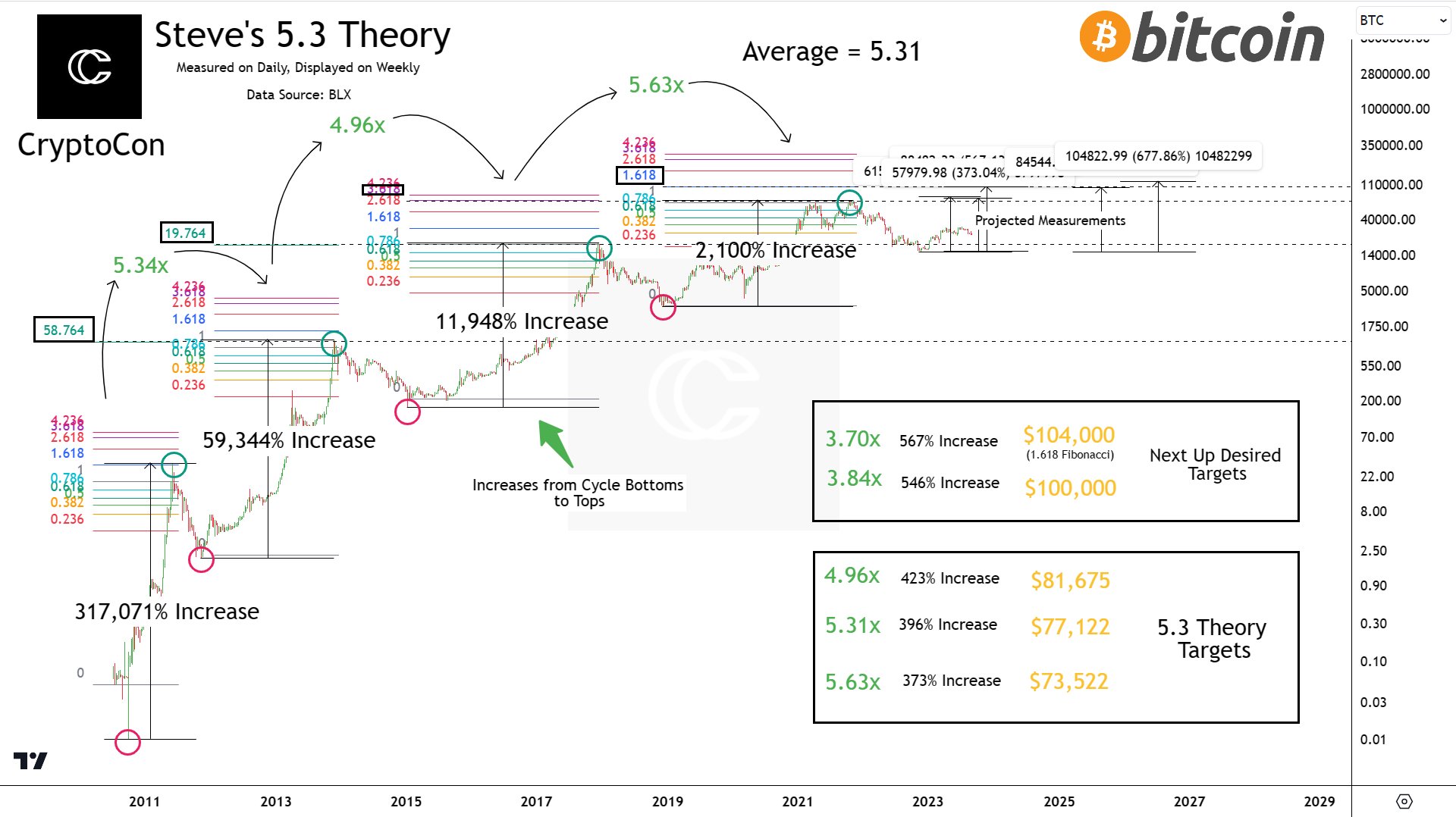

Cryptocurrency enthusiasts are constantly on the lookout for insights that can help them predict the future performance of their beloved digital assets. Among the theories gaining traction on social media is Steve’s 5.3 Bitcoin Theory, recently highlighted by CryptoCon in a tweet. This theory posits that returns on Bitcoin investments decrease by a factor of 5.3 from cycle bottoms to tops. If proven accurate, this theory could hold significant implications for the future price of Bitcoin.

What you'll learn 👉

The 5.3 Bitcoin Theory Unveiled

Steve’s 5.3 Bitcoin Theory posits that each new cycle will yield returns 5.3 times lower than the previous one. In practical terms, this suggests that the next cycle’s peak could reach approximately $77,000.

To assess the validity of this theory, extensive mathematical analysis was conducted, scrutinizing the returns from cycle bottoms to tops on a daily timeframe. The findings revealed a slight discrepancy with the 5.3 factor. Instead, the observed returns were as follows:

5.34x

- 4.96x

- 5.63x

However, there is a compelling argument for the 5.3 factor, as the average of these numbers approximates 5.31. But before we can confidently assert that this will be the actual return, it’s essential to acknowledge that this figure presents a range of possibilities. Here are the real numbers, arranged from the lowest to the highest:

- Lowest Cycle Top: $73,522

- Average Cycle Top: $77,122

- Highest Cycle Top: $81,675

Admittedly, none of these numbers align with the sky-high expectations of crypto enthusiasts. So, what would it take for Bitcoin to reach a more optimistic target of $100,000, which would necessitate a 3.84x diminish?

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Quest for $100,000: Breaking the Mold

To attain a price of $100,000, Bitcoin would have to exhibit a significantly lower diminishing return rate during this cycle. Notably, Bitcoin has historically conformed to Fibonacci extension levels at cycle peaks, and the $77,000 target appears to challenge this trend.

Past cycles have adhered to the following Fibonacci extensions:

- 58.764

- 19.764

- 3.618

Yet, the lowest Fibonacci extension for this cycle, measured from weekly candle bodies, is the 1.618. This would imply a price of $104,000, requiring a mere 3.7x diminish compared to the previous cycle.

The ETF Factor

Many market observers are pinning their hopes on the potential impact of Exchange-Traded Funds (ETFs) on Bitcoin’s price dynamics. ETFs are seen as a game-changer that could potentially defy existing models and projections.

Concluding Thoughts

In conclusion, it is evident that returns on Bitcoin investments are diminishing, but the exact magnitude of this decline remains uncertain. While the 5.31 average return of $77,122 appears plausible, the crypto market is known for its unpredictability. Whether Bitcoin can break the mold and reach $100,000 or higher this cycle will depend on various factors, including the influence of ETFs and the market’s ability to adapt to changing dynamics.

One thing remains certain: the future of Bitcoin is a topic that will continue to captivate the imaginations of investors and enthusiasts alike. What are your thoughts on the 5.31 Bitcoin Theory?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.