In the latest edition of his newsletter, popular crypto analyst Rekt Capital highlighted that The Graph (GRT) and Optimism (OP) cryptocurrencies are facing crucial price levels that will determine their next major directional moves. Readers should reference the charts closely to understand the use of colors in the descriptions below, which are based on Rekt Capital’s technical analysis.

What you'll learn 👉

The Graph (GRT) at a Pivotal Range Midpoint

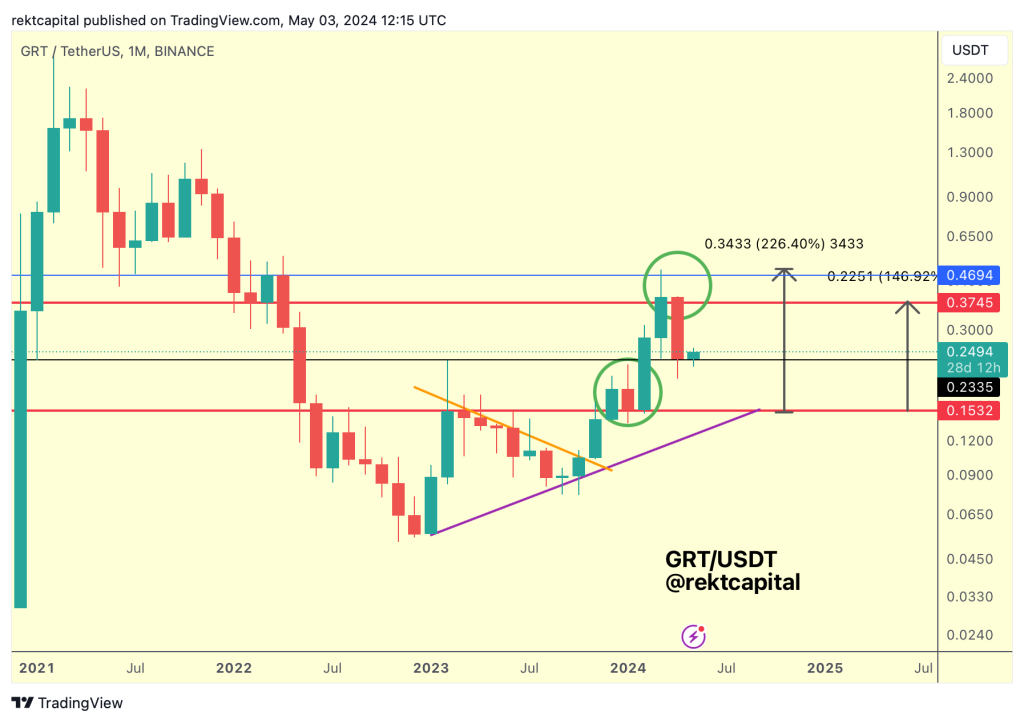

According to Rekt Capital, GRT has been trading within a red-red macro range between $0.15 and $0.37 throughout 2024. After breaking out from an ascending triangle pattern in November 2023, GRT rallied an impressive 226% from the range low to reach the blue resistance at $0.46 before entering a downtrend.

Currently, GRT is situated around $0.23, which represents the midpoint (black) of its red-red range. This level will be critical in determining whether GRT continues to occupy the upper half of the range, potentially rallying towards $0.34, or if it breaks down into the lower half, risking a dip to $0.15.

As long as the midpoint around $0.23 holds as support, Rekt Capital suggests there is scope for consolidation within the upper half of the range. However, if this level flips into resistance, GRT could revisit the range low over time around $0.15. For now, the upper half of the range remains intact until further notice.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Optimism (OP) Aims to Reclaim Key Range Level

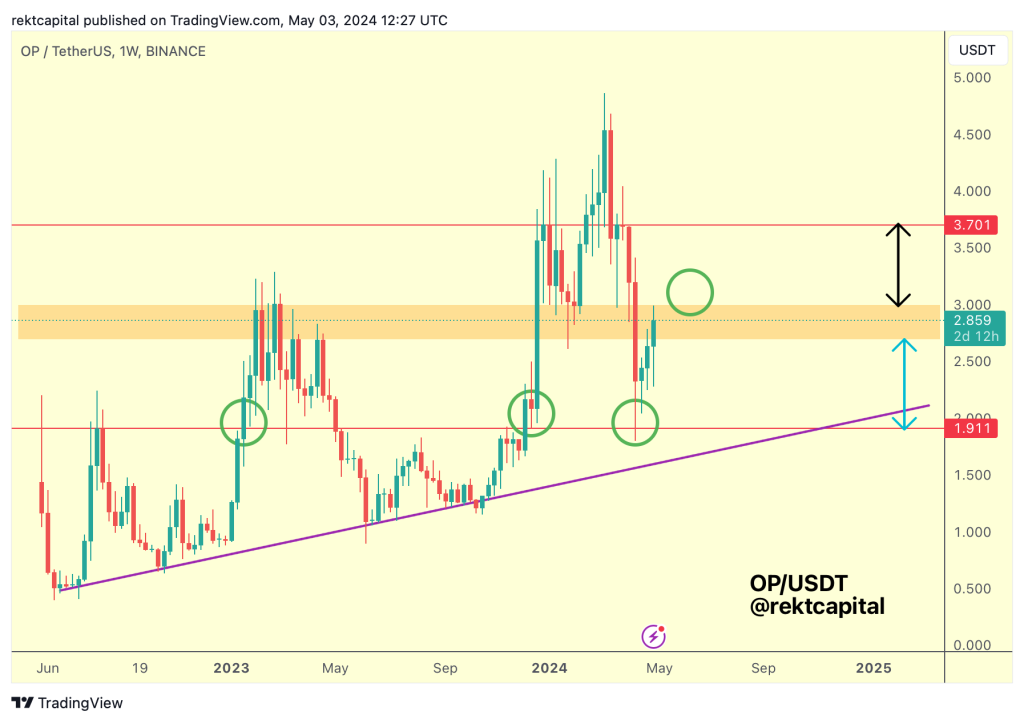

Optimism’s OP token is currently located within a red-red macro range between $1.91 and $3.70. The orange box around $3 represents the midpoint of this range. According to Rekt Capital, a reclaim of this orange area as support would mean that OP is ready to enter the upper half of the macro range, occupying the space highlighted by the black arrow.

To confirm a reclaim of the orange area, OP would need to perform a Weekly Close above it, followed by a retest, similar to previous instances at the red Range Low (green circles). However, a Weekly Close below the orange box could position OP for rejection into the lower half of the range, with a chance of dipping to around $2.

At the moment, the orange area around $3 is acting as resistance, making the upcoming Weekly Close quite crucial for OP’s near-term trajectory.

Both GRT and OP are facing key technical levels that could potentially trigger significant price movements in either direction. Crypto traders and investors will closely monitor these levels in the coming days and weeks.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.