A big PEPE whale who recently experienced a thrilling journey with a meme-based digital currency, as he achieved substantial gains, amassing 1,219 Ethereum (ETH) valued at $2.2 million through astute trading of PEPE has been on the move again.

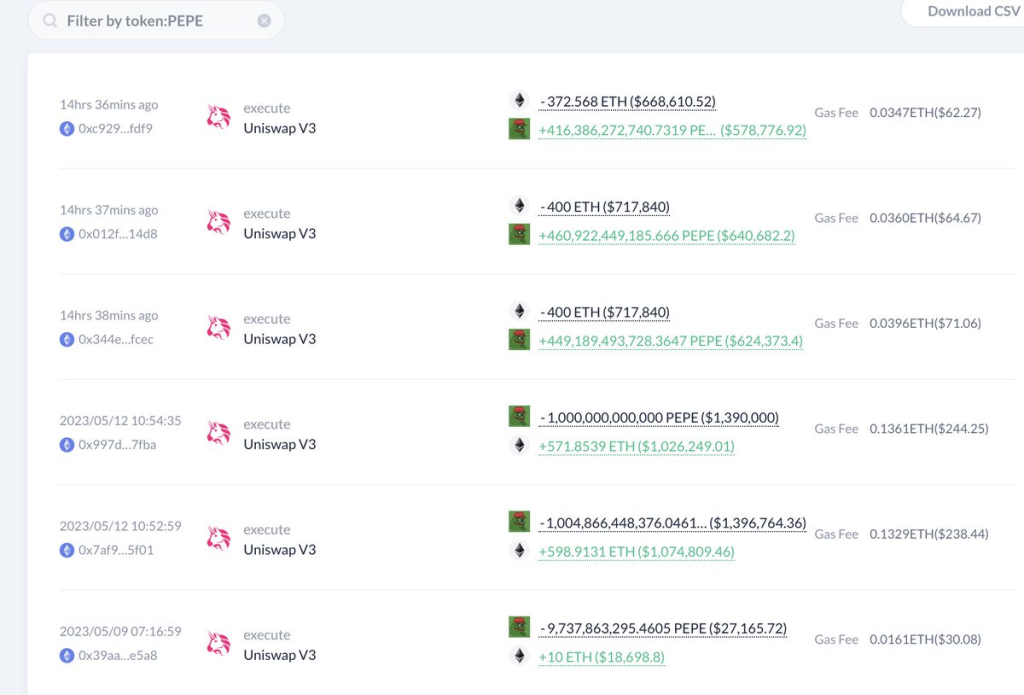

After profiting from PEPE, the whale reinvested 1,173 ETH ($2.1 million) to purchase 1.33 trillion PEPE tokens 10 days ago, acquiring them at a price of $0.000001586 per token. Their optimism continued as they engaged in further trading, buying 2.24 trillion PEPE Coins with 26 ETH ($48,000) at a remarkably low price of $0.00000002166.

This bold move paid off handsomely when SmartMoney sold the tokens for 1,245 ETH ($2.24 million) at a price of $0.0000009985, realizing an impressive 48-fold gain on their initial investment.

However, in a surprising twist, the whale recently chose to divest themselves of all their PEPE holdings. Approximately eight hours ago, they sold 1.33 trillion PEPE Coins at a breakeven price, receiving 1,162 ETH ($2.115 million) at $0.000001595 per token.

The implications of whale’s actions have led to speculation regarding the future of PEPE Coin. Some observers believe that this high-profile exit could signal a decline in interest and profitability for the meme-based cryptocurrency, prompting questions about the sustainability of such ventures. Notably, alternative projects such as LADYS, BEN, and PSYOP have started gaining attention as potential alternatives for influential investors like SmartMoney.

While meme-based cryptocurrencies offer the allure of significant returns, caution should always be exercised due to their inherent volatility. These assets, primarily driven by social media trends and viral memes, lack intrinsic value and are susceptible to rapid price fluctuations. SmartMoney’s experience with PEPE Coin serves as a reminder of the unpredictable nature of such investments.

As the crypto community navigates this dynamic landscape, it is crucial for investors to approach meme coins with careful consideration, conducting thorough research, and understanding the potential risks involved. Although profits can be made, it is essential to recognize the speculative nature of these assets, which can lead to substantial losses if not approached with caution.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies carries risks, and readers are advised to conduct their own research and seek professional guidance before making any investment decisions.