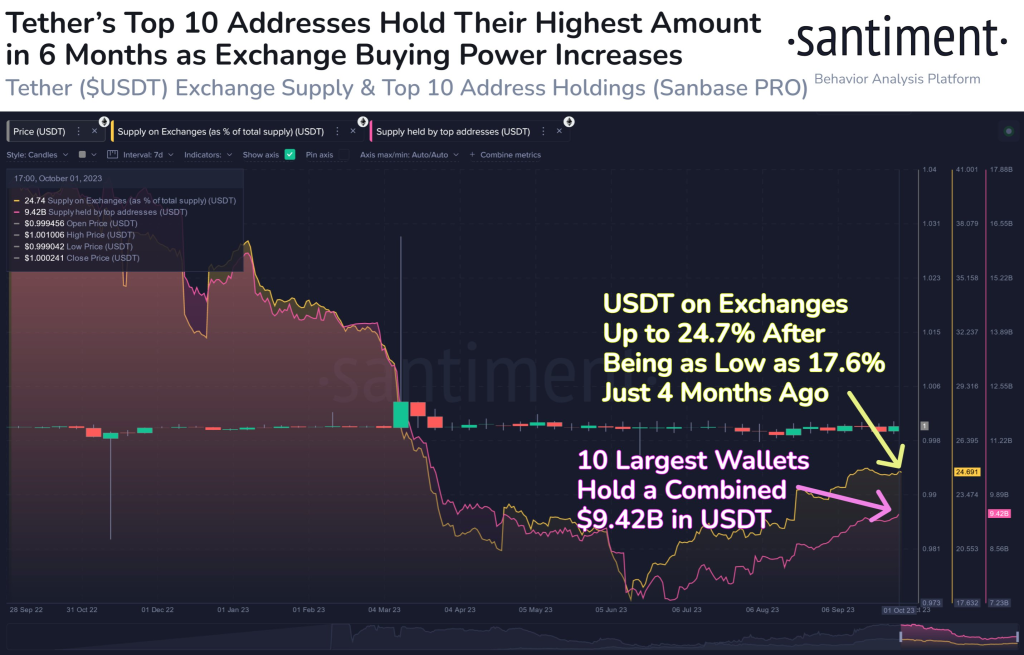

Santiment is reporting an interesting trend around the stablecoin Tether (USDT) that could have implications for the broader crypto market. Over the past few months, the amount of Tether on exchanges has increased substantially, going from accounting for 17.6% of the total supply to now representing 24.7%.

This is the highest proportion of exchange-based Tether in approximately 6 months. A growing supply of USDT on exchanges indicates there is an expanding pool of stablecoin capital that could potentially be deployed to purchase other cryptocurrencies like Bitcoin.

In addition, the 10 largest Tether addresses, likely exchanges and major crypto traders, have increased their USDT holdings considerably over the last 3 months. These key players in the market have boosted their Tether reserves from $7.30 billion to $9.42 billion.

Source: Santiment – Start using it today

This build-up suggests they are stockpiling stablecoins in preparation for potential trades. More Tether in the hands of large-scale investors and exchanges means more dry powder available to amplify volatility.

At the same time, Tether’s trading volume has jumped over 15% in the last 24 hours. Heightened trading activity of stablecoins like USDT often precedes increased volatility and trading volume for cryptocurrencies as a whole.

This all comes while Bitcoin is still trading around $27,500, which is towards the lower end of its recent range. The takeaway is that the expanding stablecoin supply and activity among major exchanges and traders likely signals heightened bullishness and more crypto trading volume ahead.

If these influential market participants deploy their Tether stockpiles into Bitcoin and other cryptocurrencies, it could very well drive prices higher. The rapid growth in exchange-based Tether indicates traders may be gearing up for a period of increased volatility in the crypto markets.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.