The world of stablecoins, digital currencies pegged to stable assets like the US dollar, has been in a state of flux. With the rise of decentralized finance (DeFi) and the increasing prominence of stablecoins, understanding the underlying mechanics and strategies of major players is crucial.

At the heart of the stablecoin ecosystem is the revenue model adopted by issuers. As explained by the famous Twitter analyst, DeFi Made Here, users deposit cash with stablecoin issuers and receive stablecoins in return. These issuers then invest the cash, often in high-yield assets, to earn interest. With the recent surge in “risk-free” US Treasuries bonds yield, this business model has become more lucrative than ever.

With the recent surge in “risk-free” US Treasuries bonds yield, ranging from 5.3% to 4.1%, the stablecoin business has become more profitable than ever before. This lucrative environment is best illustrated by a hypothetical scenario where a company issues $100 billion in stablecoins and invests $80 billion in short-term bonds at a 5% yield. Such a strategic investment would result in an impressive annual profit of $4 billion, showcasing the immense revenue potential in the stablecoin landscape.

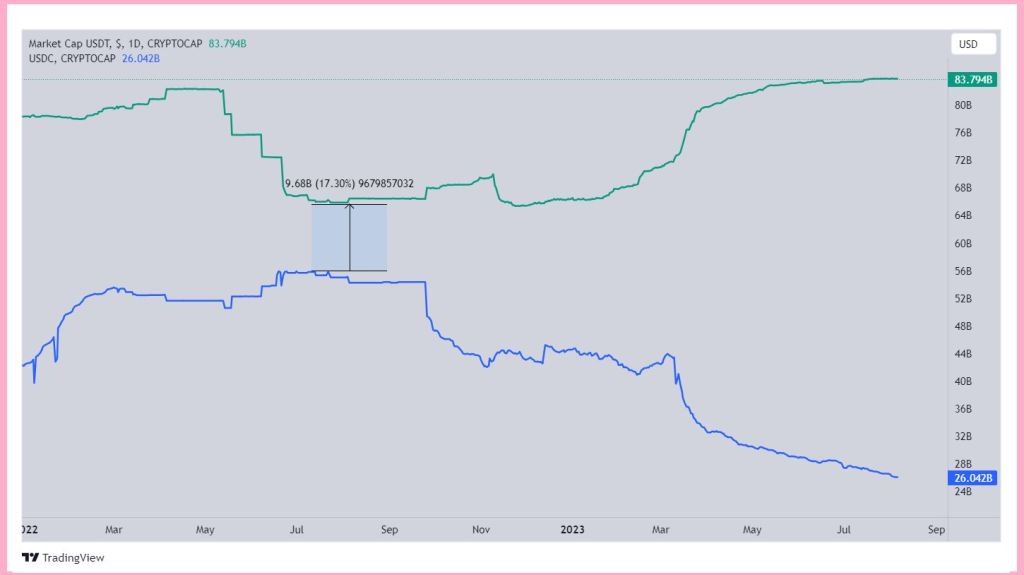

Circle’s $USDC and Tether’s $USDT are two of the most dominant centralized stablecoins in the market. Despite launching four years after USDT, Circle’s aggressive strategy of offering 0% minting and redemption fees allowed it to rapidly gain market share. This approach significantly narrowed the market cap gap between the two stablecoins by July 2022.

However, the landscape took another turn with the entry of Binance’s BUSD. Recognizing both the strengths and vulnerabilities of $USDC’s fee strategy, Binance’s CEO, @cz_binance, initiated the auto-conversion of $USDC into $BUSD and subsequently delisted all USDC trading pairs. This strategic move was aimed at consolidating dollar liquidity and reducing dependency on $USDT. But the tables turned when the SEC labeled BUSD as an “unregistered security,” a tag not applied to Tether.

In a twist of events, Tether began to exploit Circle’s reserves in what can only be described as a predatory manner. The process involved minting USDT, swapping it for USDC, cashing out the USDC, and then using the cash to back the newly minted USDT. This cycle, as illustrated by DeFi Made Here, drained Circle’s cash reserves while bolstering Tether’s position.

The implications of this strategy were stark. Tether’s market capitalization swelled by $15 billion, while Circle witnessed a corresponding decline. The dynamics suggest a possible transfer of funds from Circle to Tether, although concrete evidence remains elusive.

For Circle to counter this onslaught, they face a series of challenges. Any attempt to buy $USDT would entail a rigorous KYC/AML process with Tether, which could be indefinitely prolonged. The ball, it seems, is not in Circle’s court.

Looking ahead, DeFi Made Here anticipates some strategic shifts. Circle might introduce measures, such as redemption fees, to shield its reserves from Tether’s advances. Furthermore, Binance’s CEO is unlikely to remain a passive observer. Recent moves, like the listing of $fdUSD, a Hong Kong-issued stablecoin, hint at Binance’s exploratory approach to alternative stablecoin options.

In conclusion, the stablecoin market, as depicted by the technical analysis expert DeFi Made Here, is a realm of fierce competition and strategic maneuvering. With players like Tether, Circle, and Binance vying for dominance, the landscape is set for further evolution. As the narrative unfolds, it will be intriguing to witness the next chapter in this financial saga.

I think USDT will prevail this as they have less regulatory hold-backs than USDC.