Recently, Tether has been in the spotlight for its significant holdings in Bitcoin. According to a recent quarterly report by CryptoQuant, Tether holds an impressive $1.6 billion worth of Bitcoin. This substantial amount positions Tether roughly as the 11th largest Bitcoin holder globally.

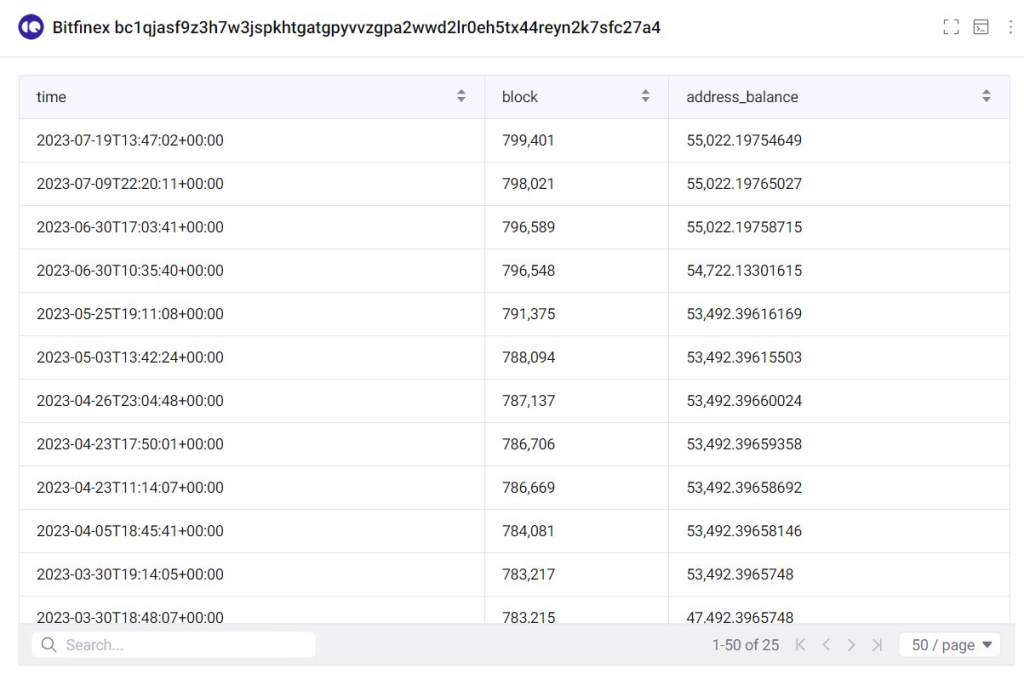

However, there have been some discrepancies noted. Observers have pointed out that the so-called Tether Bitcoin holding wallet, which is often discussed on social platforms, doesn’t align with the descriptions provided in Tether’s quarterly report. Interestingly, while there were no Bitcoin holdings mentioned in the previous year’s Q4 report, it seems the wallet began accumulating Bitcoin subsequently.

It’s essential to understand that Tether’s disclosed Bitcoin holdings might not be confined to a single wallet. The vast world of on-chain data provides a valuable tool to verify such claims, especially when doubts arise. On-chain data can offer insights into the actual holdings and transactions of entities like Tether.

On a related note, the term ‘whales’ is frequently used in the crypto community to describe entities holding significant amounts of Bitcoin, typically more than 1,000 Bitcoins. However, this classification can sometimes be misleading. There’s a tendency to group these entities under the ‘whale’ category, but this approach has its blind spots. For instance, by broadly labeling entities as ‘whales,’ one might overlook individual characteristics or nuances. A classic example of this is the potential mislabeling of “wallets on exchanges.” These could be classified as whales when, in reality, they might be internal wallets used for different purposes.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

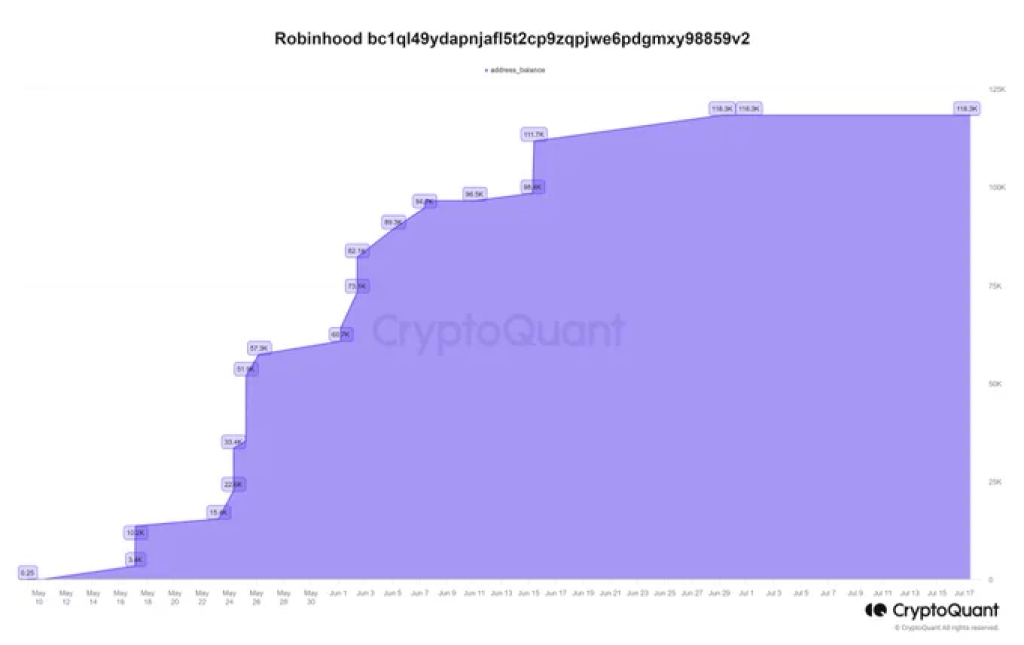

Show more +The interpretation of on-chain data requires a careful approach. Between May and July, there was a notable movement of Bitcoin, ranging from 1,000 to 10,000 and even 10,000 to larger amounts. This period also saw a significant uptick in exchange withdrawals. Some of this activity seems to be associated with wallets within platforms like Robinhood. Notably, the Bc1 wallet received a whopping 118,300 BTC coins over approximately three months.

In conclusion, while Tether’s Bitcoin holdings have garnered attention, it’s crucial to approach on-chain data with a discerning eye. The crypto landscape is vast and intricate, and understanding the nuances can make all the difference.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.