Kaiko an eminent trader and technical analysis expert, recently voiced apprehension on Twitter about a troubling development in the cryptocurrency sphere: the breaking of Tether’s (USDT) peg to the US dollar.

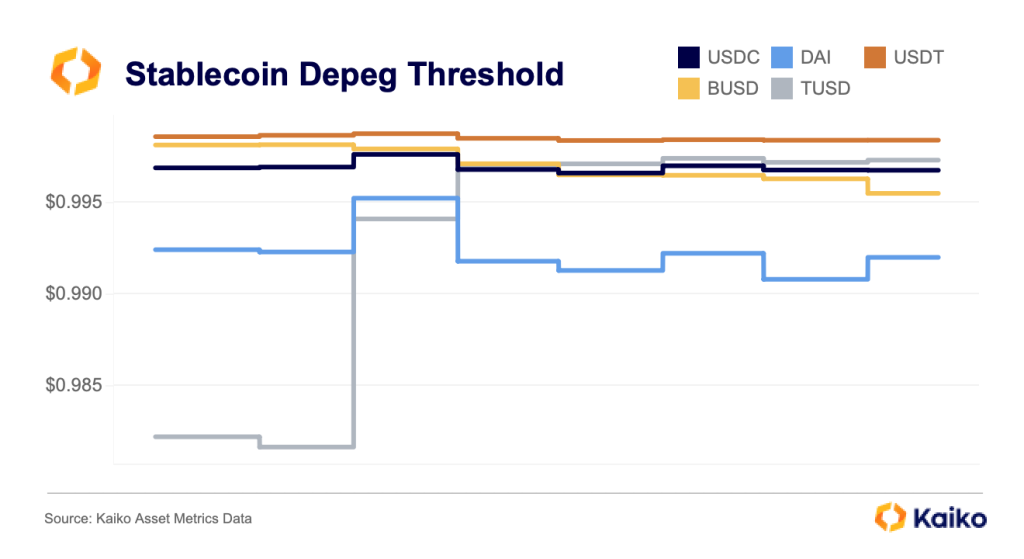

Kaiko has developed a new metric to assess the severity of stablecoin depegging, and his findings are eye-opening.

Kaiko’s new metric involves creating a unique depeg threshold for each stablecoin. The idea is that stablecoins with higher trading volumes should have less room for depegging. More value being exchanged means more significant consequences if the peg deviates from its intended value.

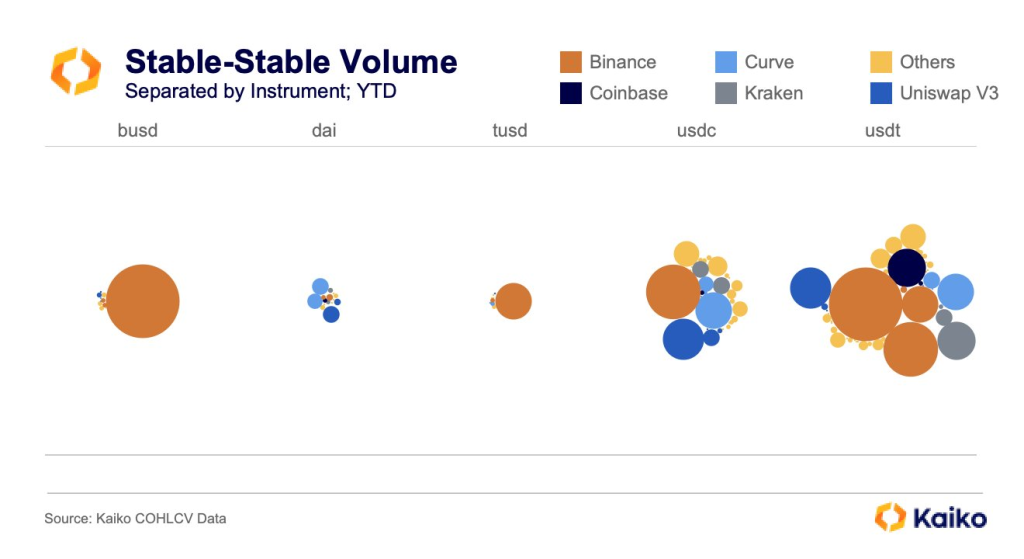

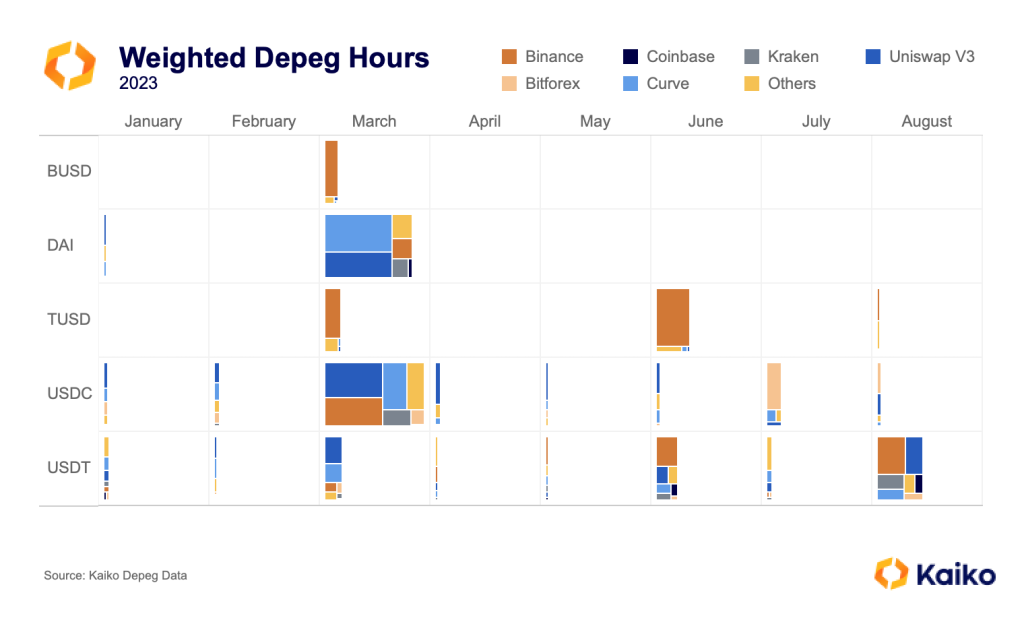

According to Kaiko, USDT has the smallest depegging threshold, while DAI has the largest. He also introduced a weighting system for each stablecoin pair on specific exchanges. For example, BUSD-USDT on Binance accounts for a significant portion of BUSD’s volume, and thus has a higher weight in the data set.

Kaiko pointed out that the top 5 stablecoins have very different volume profiles. For instance, BUSD has a trading volume of $97.5 billion, with $93 billion of that coming from the BUSD-USDT pair on Binance. On the other hand, USDC has $150 billion in volume distributed across 48 different trading pairs.

Kaiko highlighted the significance of trading volume in the peg stability of stablecoins like USDC and USDT. He specifically noted that USDC’s diversified trading volume makes it less vulnerable to peg instability. Kaiko also set a threshold, excluding any trading pair that accounts for less than 0.01% of a stablecoin’s total volume, to focus only on significant trading activities. This nuanced approach offers valuable insights into the factors that contribute to the stability or instability of stablecoins.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Using hourly low prices and cross prices, Kaiko showed that USDT depegged on virtually every instrument on August 7. He prefers to use daily data, which revealed that USDC and DAI had significant depegs in March, while USDT had a less severe but still concerning depeg in August.

It’s worth noting which exchanges have been most influential in the depegging hours for each stablecoin. According to Kaiko, a well-known trader and technical analysis expert, BUSD and DAI have maintained remarkable stability since April. On the other hand, USDC has experienced minor fluctuations, primarily on the Bitforex exchange. Most concerning, however, is the ongoing struggle of USDT to maintain its peg.

Kaiko concluded that USDT has a peg stability problem. Its redemption fee and minimum mean that it’s often more rational for holders to sell USDT on the market rather than redeem it for USD. As liquidity has dwindled, the market is less able to absorb significant USDT selling, leading to depegging events.

The obvious solution, according to Kaiko, is for Tether to remove its redemption fee and minimum. He argues that this would not significantly impact Tether’s profits but could restore faith in USDT’s peg.

Final Thoughts

Kaiko’s analysis provides a comprehensive look into the complex issue of stablecoin depegging, particularly focusing on USDT. His new metric and subsequent findings serve as a cautionary tale for those invested in or considering investment in Tether.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.