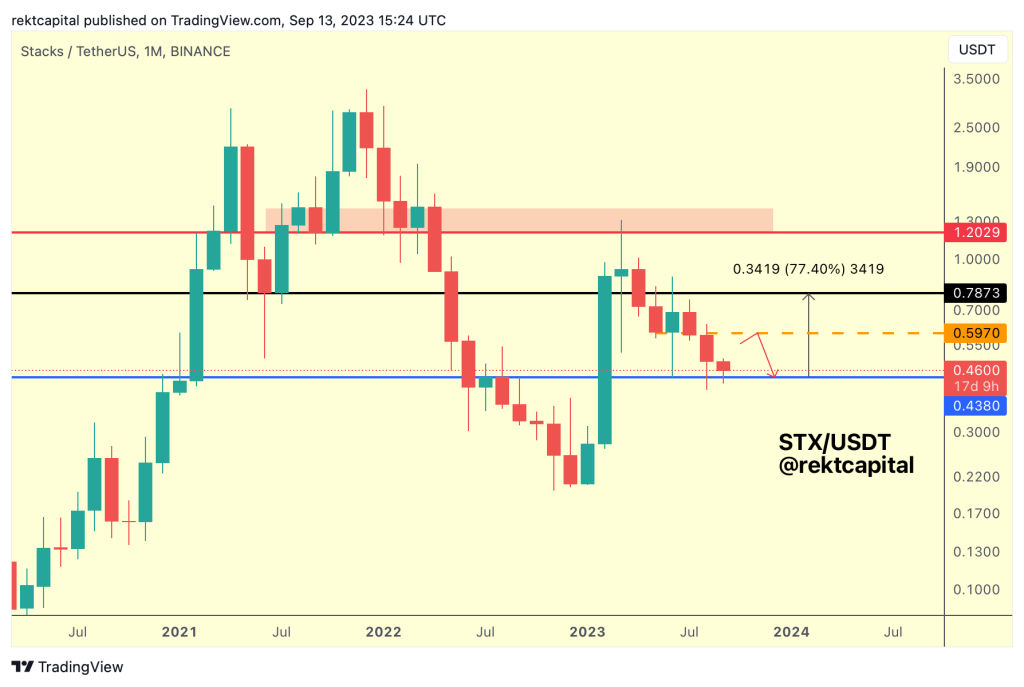

Crypto analyst Rekt Capital identified late May as a critical moment for STX. At that time, Rekt Capital outlined that STX was primed for a drop into the so-called blue “Range Low” support level. When this played out, STX saw a robust +77% rebound from this key support, only to be rebuffed at the $0.78 “Range High” resistance level.

What you'll learn 👉

The Current Landscape

Fast forward to today, and STX has once again found itself at the blue Range Low. But what does this signify for the crypto’s future trajectory?

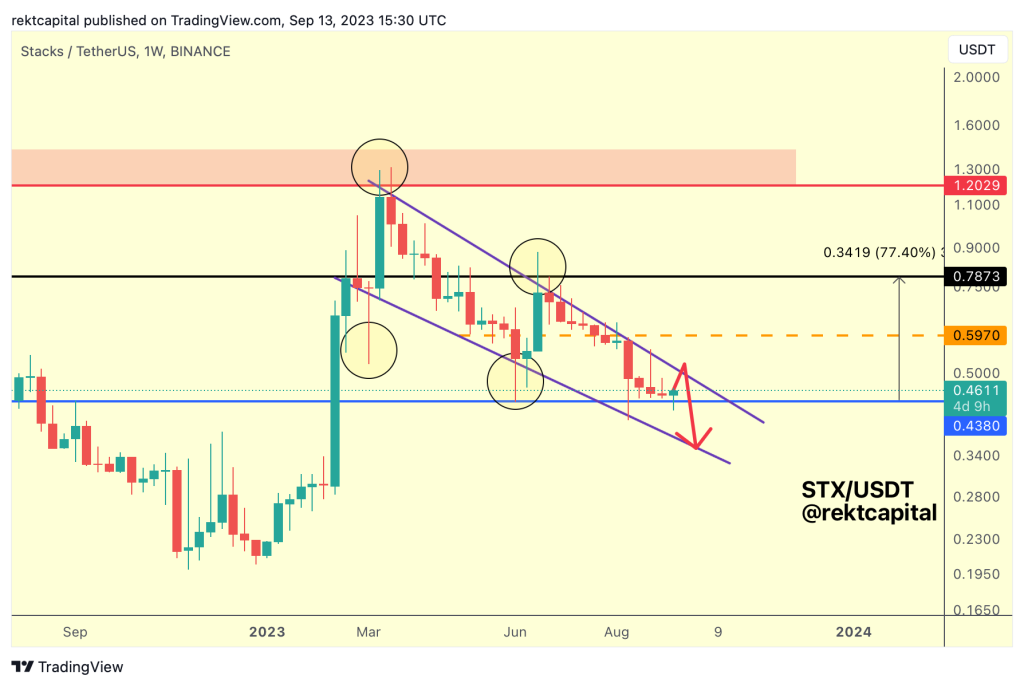

Patterns and Indicators: The Downtrend Channel

For an extended period, STX has been navigating within a purple downtrending channel. This is where it gets interesting: now that STX has retraced back to the blue Range Low, it could be setting up for a rally that challenges the top boundary of this channel.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Importance of Weekly Closures

Before investors break out the champagne, it’s vital to note that several upside wicks have protruded beyond the channel top in the past, as indicated by the yellow circles on the chart. Therefore, a Weekly Close above the channel top would be essential for validating any breakout.

Risk Factors: The Downside Scenario

If STX fails to secure a Weekly Close above the channel top, the asset could revert to the blue Range Low, or worse, slip below it to test the channel bottom. This would signify a failed breakout attempt and suggest that lower prices may be on the horizon.

In Summary: The Critical Juncture

To encapsulate, STX is at a crossroads:

- A rally to challenge the channel top could be imminent.

- Success in breaching the channel top must be confirmed with a Weekly Close above it to signal a potential breakout.

- Failure to maintain support at the blue Range Low could result in a downward spiral, pushing the asset to the channel bottom for a retest.

The blue Range Low support level is, without question, a make-or-break point for STX at this moment. Keep your eyes peeled for how the asset behaves at this critical juncture; it could very well dictate its market behavior for the weeks to come.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.