Solana (SOL) has been one of the top performing cryptocurrencies in 2023, surging from $11 in January to over $110 at the time of writing. Meanwhile, Ethereum has lagged behind both Bitcoin and many alternative blockchains. This has led many traders to shift their attention and investments towards Solana and other “Ethereum killer” chains.

However, according to Metaquant, a highly regarded on-chain analyst, Ethereum still has much brighter long-term prospects compared to the likes of Solana. Here’s a summary of his in-depth Twitter thread analysis:

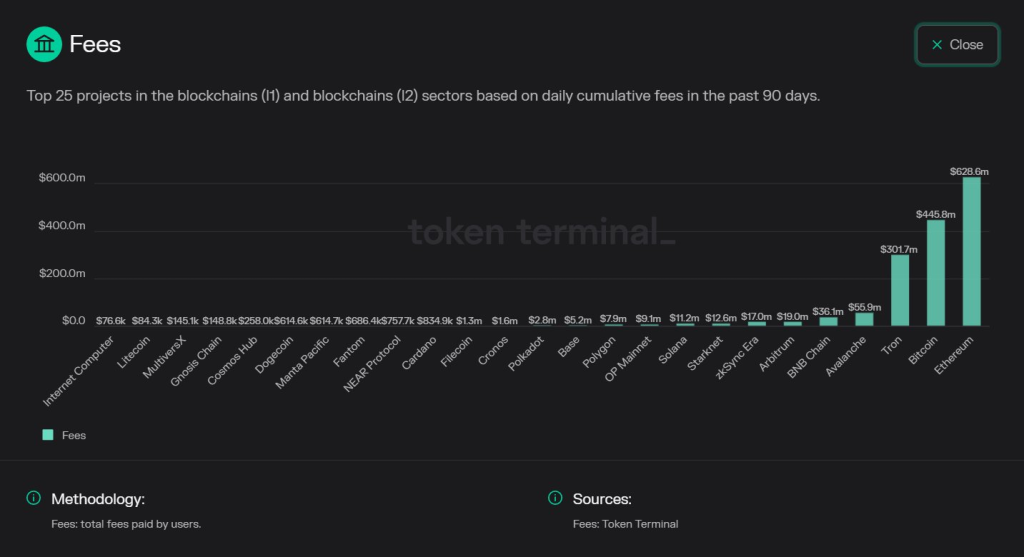

Despite underperforming alt L1s like Solana in terms of price action recently, Ethereum remains the most lucrative business among all layer 1 blockchains. It continues accruing cumulative value through fees each week, which reached over $60 million in the past 90 days – more than double any other chain.

Ethereum’s upcoming Cancun upgrade in early 2024 will introduce proto-dank sharding, allowing it to scale to over 100,000 transactions per second (TPS) while also reducing L2 gas fees 10x. This will make Ethereum L2s competitive again with alt L1s like Solana in terms of fees and performance.

In the long run, Ethereum L2 rollups will likely achieve greater decentralization than the still somewhat centralized Solana while also accessing Ethereum’s deeper liquidity pools and network effects. So they represent the smarter long-term investment bet.

Metaquant highlights how the ETH/BTC ratio has been grinding downwards all year. It is approaching price levels against BTC not seen since June 2022 – highlighting Bitcoin’s recent outperformance.

Similarly, Metaquant shows the ETH/SOL ratio declining towards previous lows seen earlier this summer. This could indicate a reversal is coming in the months ahead if historical patterns hold.

Despite Ethereum rollups like Arbitrum and Optimism having similar total value locked (TVL) figures to alt L1s like Avalanche and Solana, Metaquant notes they have much lower market valuations. For example, Arbitrum and Optimism have just $13.4B and $14.5B market caps respectively, compared to Solana’s $63.8B. This suggests they are likely undervalued.

Additionally, Metaquant showcases data indicating significant momentum shifting to Solana from Ethereum in recent weeks when analyzing daily active addresses and DEX volumes. Solana has outpaced ETH in both areas – an important signal despite Ethereum’s vastly greater long-term development.

So in summary, investors have favored other Layer 1s over Ethereum in recent months across both price action and key on-chain activity metrics. However, as highlighted earlier, Metaquant believes this outperformance is only temporary.

Ethereum has lagged at similar stages of previous bull market cycles before exploding in value later on. For example, ETH went from $200 to $4800 last cycle after initially lagging behind. Several key potential catalysts could drive a similar breakout this cycle.

These include the high likelihood of a Bitcoin spot ETF approval in early 2024, which would turn attention to a potential Ethereum spot ETF afterwards. There’s also hugely anticipated launches of networks like Eigenlayer which will boost Ethereum’s staking yields to 20-30%, making it the most attractive crypto yield asset.

So while the market has temporarily shifted towards Solana and other alt L1s, Ethereum still represents the smart long-term bet for investors according to the data and on-chain analysis. Once catalysts like its Cancun upgrade kick in, Ethereum is likely to massively outperform the likes of Solana in the next bull run.

You may also be interested in:

- Analyst Urges Kaspa Enthusiasts to Reconsider Selling KAS Post-Coinbase Listing, Draws Parallel to ADA

- Why Was $1.3 Billion in Bitcoin Moved to Binance? A Hot New Altcoin Prepares for Launch

- Ripple (XRP) Price Set to Soar in 2024; Render (RNDR) & RebelSatoshi ($RBLZ) Poised for 1,980% Increase

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.