The decentralized finance ecosystem on Solana continues to gain momentum, with trading volumes on Solana-based decentralized exchanges (DEXs) hitting fresh all-time highs.

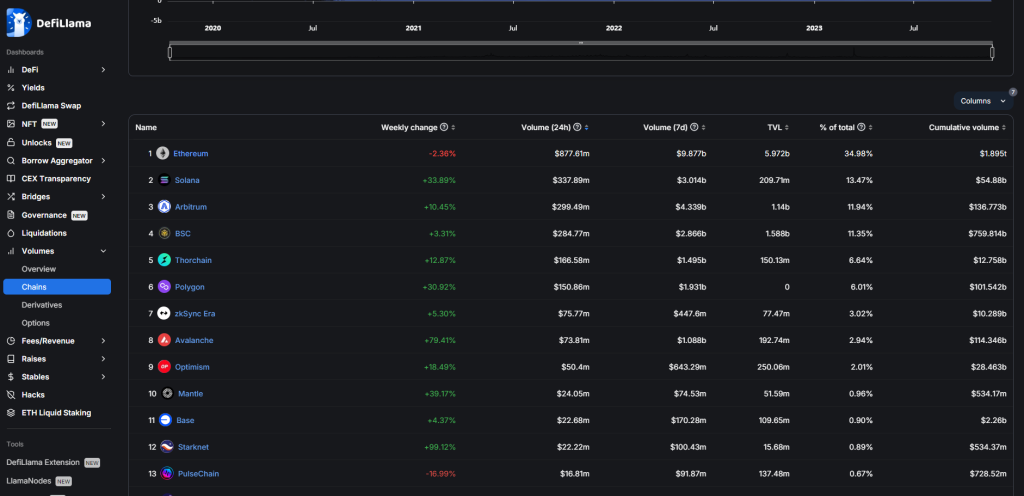

According to data tracked by DeFiLlama, trading volume across Solana DEXs jumped 54% over the past week to over $3 billion. This marks a new record high for Solana’s nascent but rapidly expanding DeFi sector.

Leading Solana DEXs Orca and Raydium saw trading volumes spike by more than 70% each, contributing to the overall growth. Orca crossed $1 billion in weekly volume for the first time ever.

The parabolic growth in Solana DEX volumes reflects the rising popularity of Solana’s high-speed, low-cost blockchain among yield-seeking traders. Solana can currently handle up to 65,000 transactions per second (record) with fees of a fraction of a penny, making it ideal for high-frequency decentralized trading.

With over $3 billion in weekly volume, Solana has cemented itself as the third-largest blockchain in terms of transaction activity, behind only Ethereum ($9.97 billion) and Arbitrum ($4.49 billion).

The rapid surge in volumes signals that Solana is gaining traction against rival smart contract platforms. Solana’s combination of speed, scalability, and low fees make it a compelling alternative to Ethereum and its congested network.

Read also:

- Solana Bullish as SOL Reaches $60 First Time Since May, But Initial Retracement to This Level Is Possible

- This BTC Indicator Makes It ‘Incredibly Easy’ to Know if Bitcoin Is in a Bull or Bear Market

- Analyzing Future Prospects: $ROE, XRP, and SOL’s Potential for Market Growth

As Solana continues to onboard projects and users at a breakneck pace, its DeFi ecosystem looks poised for even more explosive growth. With volumes already topping major chains and setting new records consistently, Solana appears ready to challenge the dominance of Ethereum and other established players in decentralized finance.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.