Solana’s native token, SOL, now appears vulnerable to further declines after shedding gains from a multi-week rally. According to crypto analyst Rekt Capital, losing two crucial price floors suggests gathering weakness.

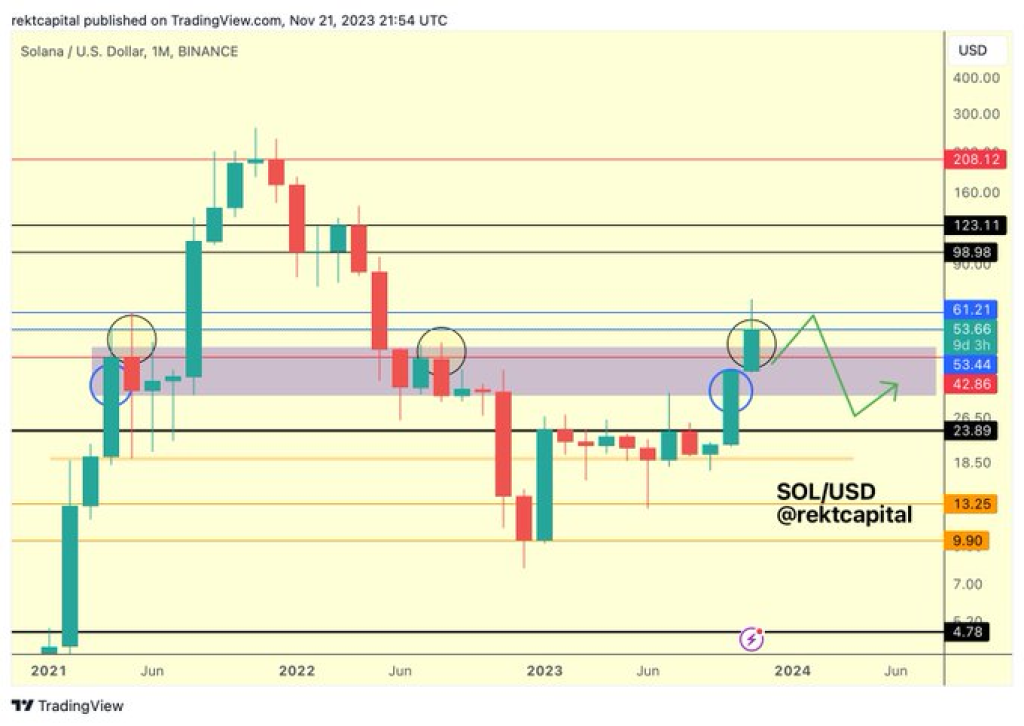

Rekt Capital notes Solana had climbed nearly 80% off its November lows before encountering stiff overhead resistance around the $61 and $53 levels on its ascent. SOL now shows reversal signs after these zones rejected its rip higher.

Both areas represent key historical price hurdles that thwarted previous Solana spikes over the past year. The inability to conquer them after SOL’s latest push hints bullish momentum is fizzling.

Especially with the monthly close looming within the week, failure to reclaim lost support paints a vulnerable tapestry. Rekt Capital indicates SOL could be primed to revisit its multi-month lows in early November if selling pressure persists.

Read also:

- Solana (SOL) Price Takes A Well-Deserved Breather After Explosive 200% Rally, But Bulls Remain In Control

- Binance’s Implosion Proves Decentralized is Safer as FTX Collapse is Happening Again

- The Battle of Memes: Wall Street, Doge Killer, and the GameStop Memes

The coming days should determine whether Solana’s rally was a head-fake or a legitimate trend change. For now, the technical guardrails are weakening despite SOL’s temporary defiance of the broader market slide. Its resolve finally appears to be cracking as old barriers again repel its advance.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.