Debanking fears are back in the spotlight after JPMorgan CEO, Jamie Dimon, pushed back against claims that banks are targeting crypto users for political reasons. The comments follow fresh accusations from crypto executives whose accounts were abruptly closed, reviving concerns of a new “Operation Chokepoint” era for digital assets. As trust in traditional banking wobbles, traders are once again reassessing where capital may flow next.

That capital appears to be flooding straight into the small handful of altcoins preparing to go 100x or more in 2026. In this article, we’ll explore three with the strongest potential: DeepSnitch AI, Firo, and our Solana price prediction. Of the three, DeepSnitch AI appears to have the most potential, priced at just $0.02682 with over $711,000 raised so far.

What you'll learn 👉

Solana price forecast firms as JPMorgan debanking row reignites crypto distrust

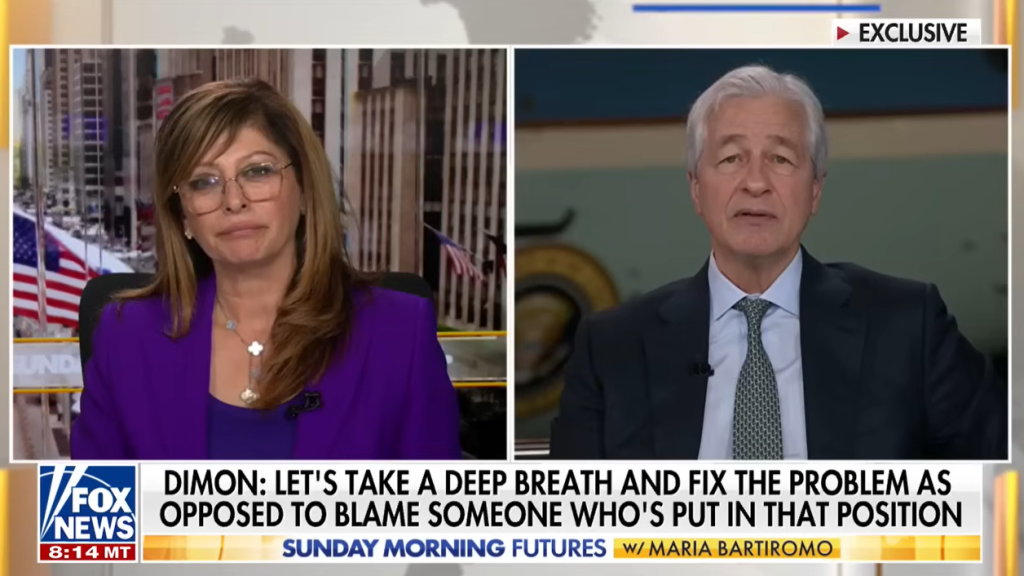

JPMorgan CEO Jamie Dimon pushed back this week against claims that the banking giant is targeting crypto users based on politics, following fresh debanking allegations from industry leaders.

During an interview on Fox News’ Sunday Morning Futures, Dimon denied the accusations, saying, “We do not debank people for religious or political affiliations… We debank Democrats. We debank Republicans.”

The comments came after Jack Mallers, CEO of Bitcoin payments firm Strike, said JPMorgan abruptly closed his personal accounts last month, raising fears of a renewed Operation Chokepoint 2.0 targeting crypto firms. Trump Media CEO Devin Nunes also alleged JPMorgan severed ties with the company amid a wider probe involving over 400 Trump-linked individuals.

Dimon admitted that debanking rules are flawed and said he has pushed for reform for over 15 years, calling the current framework “customer unfriendly.” For crypto investors, the saga reinforces why decentralized assets continue attracting capital as trust in traditional finance erodes. And with 2026 right around the corner, here are 3 altcoins we think could go furthest:

- DeepSnitch AI (DSNT): Live intelligence agents meet early-stage upside at $0.02682

DeepSnitch AI is positioning itself at the intersection of real-time crypto intelligence and early-stage investing. Built around five autonomous AI agents, the platform continuously scans on-chain data, smart contract behavior, liquidity movements, developer activity, and whale wallets. Three of these agents are already live inside the public dashboard, giving users immediate insight into market risks and opportunities before they affect the markets.

In a market where debanking fears and regulatory pressure continue to hit centralized players, tools like DeepSnitch AI that offer transparency and independence are becoming increasingly valuable.

That’s partly where a lot of the momentum behind DeepSnitch AI lies. Stage 3 fundraising has now passed $711,000, with the token priced at $0.02682, up 77% from its initial $0.01510 entry. And with bonus Christmas codes DSNTVIP50 and DSNTVIP100 also active until January 1, there’s never been a better time to jump in ahead of the January 2026 launch.

- Firo: Privacy coin sees surge in momentum

Firo traded around $2.20 on December 8th after posting an 8.6% gain over the past seven days and a 12.1% rise over 30 days, following a powerful momentum burst in November when FIRO surged more than 300% and briefly pushed above $5.

The rally was driven by renewed interest in privacy assets and anticipation around Firo’s Spark hard fork, which enables tradable Spark Names. Despite the rebound, FIRO still sits 98% below its $139.77 all-time high, keeping longer-term sentiment mixed. Most short-term FIRO price forecasts now cluster in the $2.50 – $3.20 range if volume expansion continues.

- Solana price prediction: SOL long-term outlook steadies as network activity and treasuries expand

The Solana price prediction turned cautiously bullish on December 8th after SOL traded around $135 following a 6.3% weekly rise and a 17% loss over the past 30 days. Trading volume recently surged past $4.7 billion, signaling renewed speculative demand.

The token still remains about 54% below its $293 all-time high, set in January 2025. With multiple treasury entities continuing to accumulate SOL and ecosystem activity picking up around meme trading and DePin networks, the Solana price prediction now clusters between $165 – $190 if current momentum holds.

Still, from a pure upside perspective, the Solana price prediction remains structurally capped versus early-stage tokens.

What’s the verdict?

The Solana price prediction remains positive as network activity grows and institutional treasuries quietly add exposure, but at a $75B market cap, the explosive upside many investors crave is simply harder to unlock.

That’s where early-stage asymmetric plays step in. With DeepSnitch AI still priced at $0.02682, already up 77%, and over $711,000 raised, the risk-reward profile looks very different. Add in the limited-time Christmas bonus codes DSNTVIP50 and DSNTVIP100 before the January 1 expiry, and the window for early positioning is narrowing fast.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

How high will Solana go in 2025?

The Solana price prediction for 2025 generally clusters in the $165 – $200 range if network growth, treasury buying, and broader market strength continue.

Can SOL reach $1000?

A Solana price prediction of $1000 would require an enormous expansion in adoption, liquidity, and total market capitalization, making it a highly unlikely scenario in the near term.

Is Solana worth buying?

From a Solana price prediction standpoint, SOL remains a solid large-cap Layer 1, though its upside is more limited compared to early-stage presales like DeepSnitch AI.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.