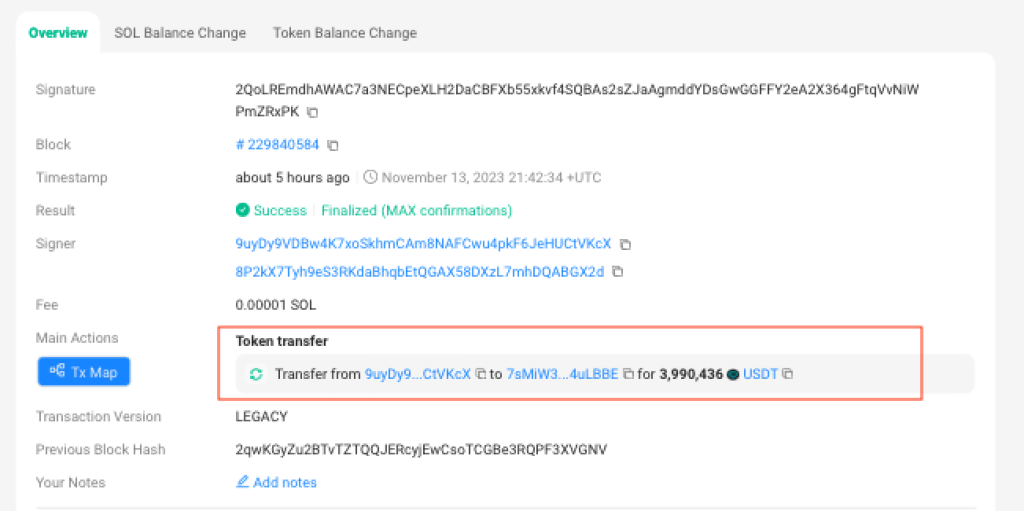

Wallets connected to the bankrupt FTX exchange have transferred over $13.5 million worth of Solana’s SOL token and $4 million in USDT stablecoins to crypto trading platforms, according to on-chain tracker PeckShield. The transfers likely signal further sales of SOL holdings related to FTX’s debtor proceedings.

SOL prices fell 6.7% over the past 24 hours amid a pause in the token’s monumental 145% monthly rally. The selloff comes a week after FTX wallets moved $30 million in SOL to exchanges Binance and Kraken. Ongoing sales have introduced pressures countering SOL’s meteoric 500% year-to-date gains.

A debtor group handling FTX’s bankruptcy controls these wallets which contain an estimated $1 billion in SOL acquired by Sam Bankman-Fried’s empire between 2020 and 2022. Mixed messages regarding plans for the holdings have created uncertainty. A surprising stake of over $120 million worth of SOL into staking in October temporarily eased concerns about a potential dump.

But continued transfers to exchanges point to steady liquidations to raise cash for FTX’s creditors. The solvency of FTX’s balance sheet remains in question as investigators untangle its financial wreckage. Ongoing SOL sales could weigh on prices as the token’s long-term fundamentals battle FTX overhang.

SOL has rallied this year largely on optimism for Solana’s potential as a fast and low-cost blockchain platform. But FTX’s collapse has underscored the systemic risks of centralized crypto intermediaries defaulting on obligations.

Read also:

- Tellor Whales Trigger 33% TRB Freefall: Who Dumped, and How Much Did They Make?

- Analyst Compares Kaspa to Cardano, Revealing His KAS Strategy While the Coin Trades in Red

- Uncovering Hidden Crypto Treasures: The Growth Potential of NEO, $RBLZ, and EGLD

For now, FTX’s massive crypto holdings represent a liability rather than productive staking contributing to Solana’s network. The debtor group’s liquidation moves will likely remain a primary price driver for SOL until the tokens are fully divested.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.