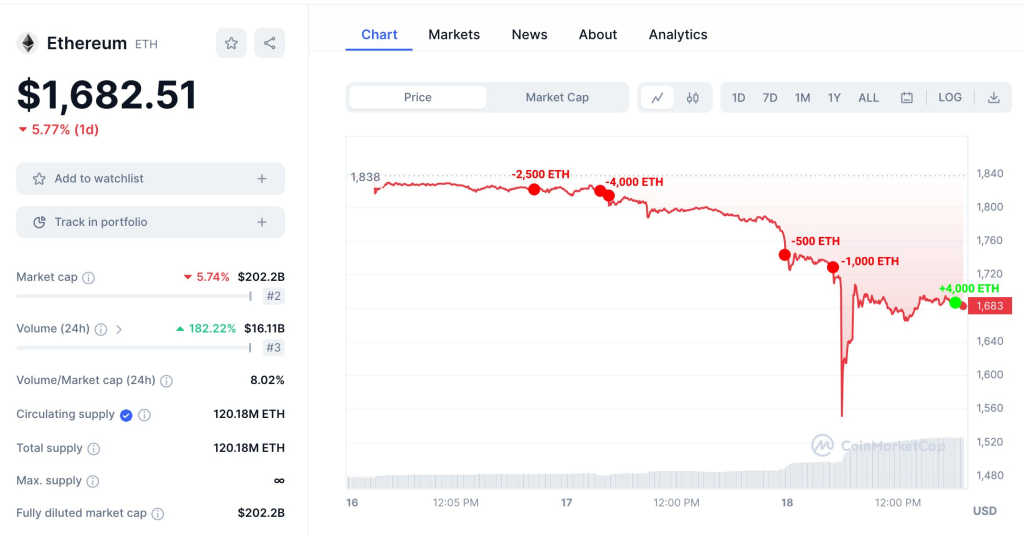

In a related development shared by on-chain analyst Lookonchain, some sources suggest that Cumberland made a strategic move by offloading 8K $ETH, valued at approximately $14.4M, prior to the market downturn. Additionally, a withdrawal of 4K $ETH, equivalent to $6.72M, was noted from Binance recently.

The cryptocurrency community remains vigilant, with many closely monitoring the market’s movements and potential implications.

By exiting minutes before the plunge, Cumberland sidestepped what could have been significant paper losses had they maintained the position. Instead, the firm banked substantial gains and conserved capital to deploy later.

Many laud Cumberland’s prescience, or at least situational awareness, amid such a violent reversal. While unlikely orchestrators of the crash, their maneuvering suggests Cumberland interpreted warning signs before the worst materialized.

The cryptocurrency markets have seen a lot of instability, with large asset and exchange liquidations. These liquidations had a stunning total value of close to $1 billion.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Interestingly, amidst this financial storm, both Bitcoin and Ethereum demonstrated resilience. Bitcoin managed to recover from its lows, hovering around the $26,000 mark, thereby safeguarding the vital support zone that lies between $25,000 and $26,000. Ethereum, on the other hand, managed to stay above the $1,600 support level, even after briefly dropping below $1,700.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.