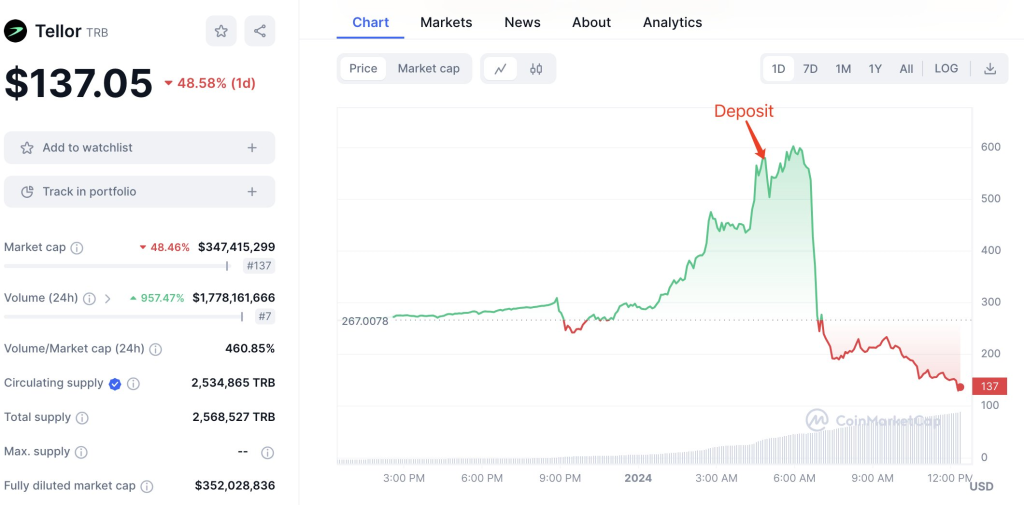

Popular oracle token Tellor (TRB) experienced a wild price swing over the past 24 hours, soaring to over $600 before crashing back down below $200. According to on-chain analytics account on Twitter LookOnChain, more than $68 million worth of TRB positions were liquidated during this pump and dump event.

LookOnChain reported that the price of TRB skyrocketed to $600 briefly yesterday before plummeting to $137 within hours. This extreme volatility led to TRB becoming the most liquidated token over that period.

Specifically, LookOnChain noticed that the Tellor team deposited 4,211 TRB (worth $2.4 million at peak prices) into their treasury wallet shortly after the TRB price spike. This has caused speculation that the Tellor team may have perpetrated or been complicit in manipulating the price higher before dumping their own tokens.

At the time of writing, TRB is trading around $191, having stabilized after the shocking price swing. However, traders remain rattled by the incident which wiped out many leveraged positions. Questions linger over whether the price action was a coordinated pump and dump scheme or the result of overheated speculation.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Tellor oracle system is designed to provide reliable real-world data to DeFi platforms. As an oracle token, extreme price volatility undermines trust in Tellor’s ability to function as a stable value reference. The community is now calling for more transparency from the Tellor team over the circumstances surrounding this price crash event. Until then, uncertainty persists around TRB in the aftermath of its parabolic rise and fall over the past day.

You may also be interested in:

- Litecoin (LTC) Expected to Spike 200% in January If This Happens

- Weekly Analysis of MemeCoins: PEPE vs. Rebel Satoshi vs. Dogecoin

- Arbitrum’s ARB Silence Finally Coming to an End but Breakout of This Zone Is Crucial to Major Price Increase

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.