CaptainAltcoin’S YouTube channel, best known for covering Bitcoin, Ethereum, XRP, and broader crypto market trends on YouTube, recently stepped outside his usual lane to break down one market many viewers kept asking about: silver. In a dedicated video on the CaptainAltcoin YouTube channel, he shared a detailed silver price outlook for 2026 through 2030, combining long-term chart structure with macroeconomic and industrial demand factors.

Rather than treating silver as a simple “cheaper gold,” the analysis frames it as a hybrid asset—part safe haven, part industrial commodity. That dual role is what makes silver behave differently from gold, especially during periods when monetary policy, inflation, and real-world demand start pulling in the same direction.

What you'll learn 👉

Silver’s Breakout Changed the Long-Term Picture

Silver enters 2026 after a powerful move in 2025, breaking above price levels that had capped it for decades. According to CaptainAltcoin, moves of that scale usually signal more than short-term speculation. Either the market ran too far, too fast, or it is beginning to price in a structural shift that is still underappreciated.

The key technical level to watch is the $50 zone. Silver failed to hold above that level in both 1980 and 2011, making it one of the most important resistance areas in the metal’s history. This time, silver did not simply test it—it broke through and continued higher. When a multi-decade resistance level flips, it often becomes major long-term support. How silver behaves if it ever revisits that area will be critical.

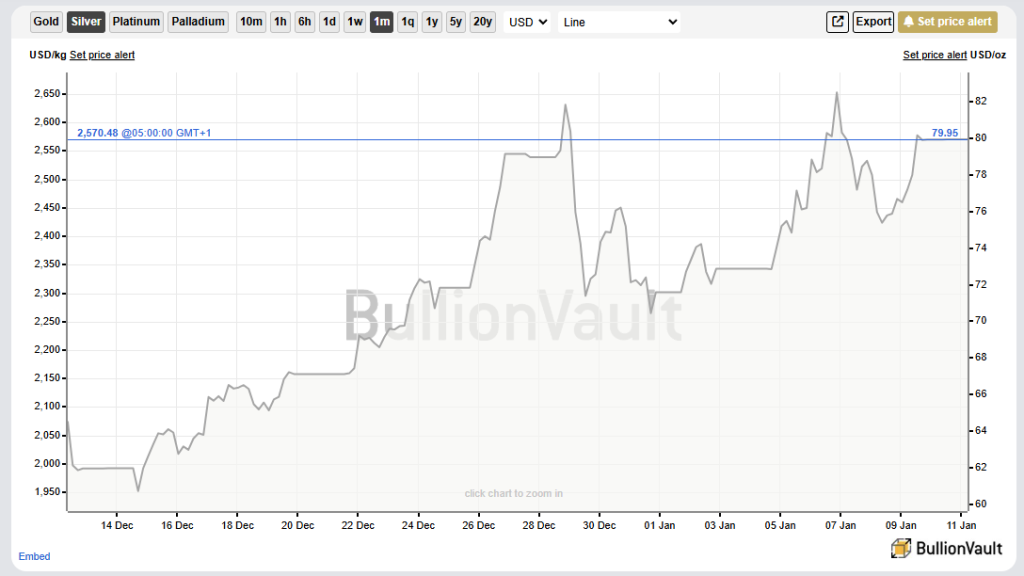

Above current prices, CaptainAltcoin highlights $80 as an important zone, roughly aligned with recent highs. Holding above that level while forming higher lows would keep the bullish structure intact. Beyond that sits the psychological $100 level. While silver does not need to reach $100 to remain bullish, round numbers tend to attract attention, liquidity, and momentum once price gets close.

Macro Conditions That Could Drive Silver

On the macro side, silver remains highly sensitive to real interest rates. When inflation stays elevated while central banks begin easing, real yields decline, making precious metals more attractive. CaptainAltcoin notes that the key question for 2026 is not simply whether rate cuts arrive, but whether inflation allows those cuts without destabilizing confidence.

The U.S. dollar also plays a major role. Because silver is priced globally in dollars, a weaker dollar typically acts as a tailwind, while a strong dollar can cap upside. Watching the DXY alongside silver price action remains a critical part of the broader setup.

Industrial Demand Is the Long-Term Wildcard

What separates silver from gold is consumption. Silver is not just stored—it is used. Solar panels, electric vehicles, electronics, grid upgrades, charging infrastructure, and data centers all rely on silver’s conductivity. Even if manufacturers reduce silver per unit, rising production volumes can still push total demand higher.

CaptainAltcoin emphasizes that this is not a short-term narrative. The electrification and energy transition trends extend well into the late 2020s, supporting steady demand growth rather than speculative spikes.

Supply Constraints Add Structural Pressure

Silver supply does not respond quickly to rising prices. Much of global silver production is a byproduct of mining for other metals such as copper, zinc, and lead. That makes supply relatively inelastic. Higher silver prices alone do not instantly create new production.

At the same time, mining faces declining ore grades, higher costs, stricter regulations, and long project timelines. These factors make persistent supply deficits more likely, especially if industrial demand continues to grow.

The Gold-to-Silver Ratio Still Matters

The gold-to-silver ratio offers another lens into silver’s relative value. When the ratio is high, silver is historically undervalued compared to gold. When it compresses, silver tends to outperform—but with increased volatility.

Recent compression suggests silver is no longer ignored, but it also means sharper price swings should be expected as capital rotates more aggressively.

Risks to the Outlook

Despite the bullish bias, CaptainAltcoin highlights several risks. A deep global recession could temporarily weaken industrial demand, causing silver to fall harder than gold. Substitution risk also exists if industries successfully scale alternative materials. Finally, unexpected central bank policy shifts that keep rates higher for longer could slow momentum.

Silver Price Prediction for 2026

After a breakout year, markets often consolidate or correct before resuming trend. CaptainAltcoin’s base case for 2026 is a volatile consolidation phase rather than a straight-line rally. Pullbacks may shake out weaker hands, followed by renewed upside.

His personal end-of-2026 target range sits between $85 and $95, with a realistic chance of silver testing $100 if macro conditions align. That level is viewed as a magnet, not a guarantee.

Silver Price Outlook Through 2030

Looking beyond 2026, the longer-term outlook turns more constructive. In 2027, silver may spend time adjusting to a new price regime, where levels that once seemed extreme become normal. Holding above $70 becomes plausible, with continued attempts to challenge $100.

By 2028, the probability of sustained trading above $100 increases if supply deficits persist and industrial demand remains strong. At that stage, $100 could shift from a target to a base.

In 2029, momentum and positioning may push silver toward higher psychological zones such as $120 or even $150. Once prices enter triple digits, overshooting becomes more common.

By 2030, CaptainAltcoin’s base-case target range for silver stands between $120 and $150 per ounce, driven by long-term demand trends, constrained supply, and recurring macro tailwinds.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.