The approval of the Ethereum ETF has been a monumental moment for the crypto industry, potentially signaling a new era of mainstream adoption and institutional investment. Analyst Virtual Bacon examines the implications of this landmark decision for Ethereum, Bitcoin, and the broader altcoin market.

What you'll learn 👉

Ethereum’s Regulatory Status and Market Confidence

One of the key aspects of the Ethereum ETF approval is its impact on Ethereum’s regulatory status. While Bitcoin has been confirmed as a commodity, Ethereum’s classification has remained unclear. The SEC’s stance on Ethereum has been ambiguous, with SEC Chair Gary Gensler avoiding clear statements on whether Ethereum is a commodity, security, or something else.

The approval of the Ethereum ETF will likely settle this debate, indicating that Ethereum is not considered a security. This clarity will boost confidence in the cryptocurrency and solidify its status in the US market, potentially leading to substantial institutional investment.

Recent Developments and Confusion

Recent developments have added to the confusion surrounding Ethereum’s regulatory status. A report showed that the SEC had viewed Ethereum as a security for over a year, and in March, the SEC targeted ConsenSys, MetaMask’s parent company, and other wallet providers for offering staking services, alleging they dealt with unregistered securities.

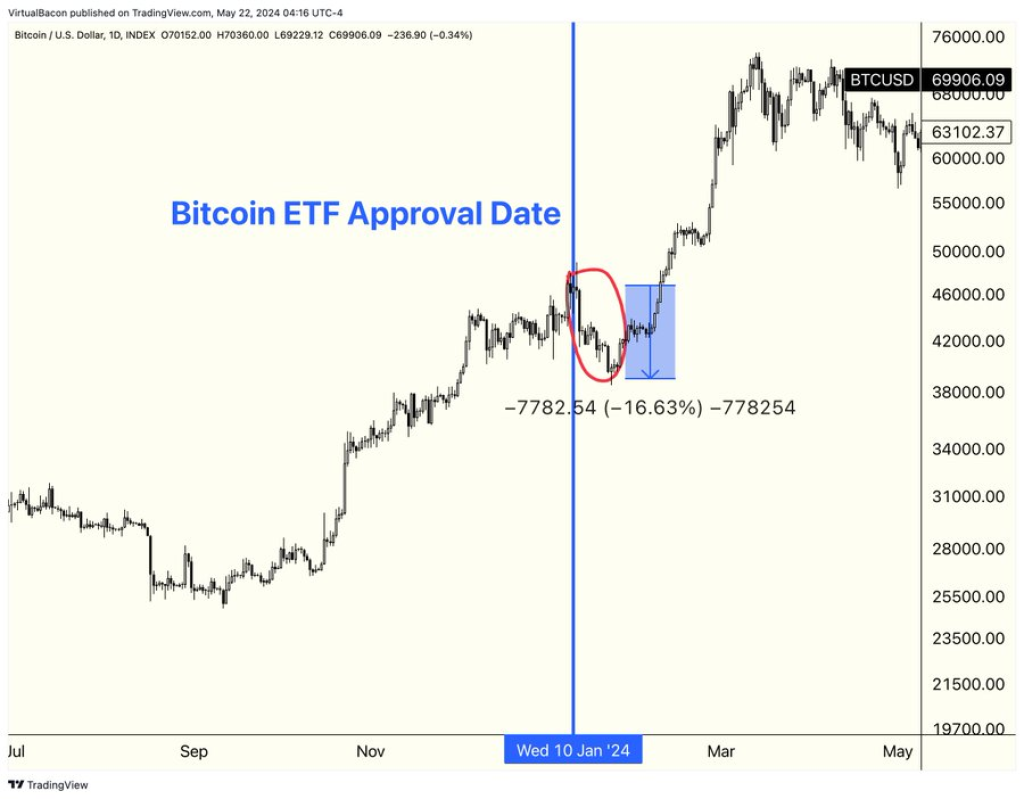

The Ethereum ETF approval will provide much-needed clarity and pave the way for significant market shifts, similar to those seen following the Bitcoin ETF approval.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Optimism and Market Indicators

Analyst Virtual Bacon had been optimistic about the Ethereum ETF getting approved mid-year, citing several key indicators. BlackRock, with a 99.8% approval rate for ETFs, had filed their Ethereum spot ETF. The Grayscale Ethereum Trust discount ratio had been closing, suggesting investor confidence. Additionally, the PolyMarket prediction for Ethereum ETF approval by May 31st had surged, with $11 million wagered on this outcome.

Ethereum Price Prediction and Market Volatility

Virtual Bacon expects major volatility in the upcoming weeks following the Ethereum ETF approval. Rather than betting on ETH long immediately, the analyst suggests waiting for a potential dip back to the $3,000 range, presenting a better entry point.

Reflecting on the Bitcoin ETF approval, institutions may take a few months to accumulate their positions, leading to gradual inflows. As a result, the analyst plans to hold their spot Ethereum position, awaiting a lower entry point around $3,000.

Long-Term Outlook and ETH/BTC Ratio

In the long term, Virtual Bacon believes we will see a reversal in Ethereum’s price relative to Bitcoin and the broader market. For a true bullish signal, the ETH/BTC ratio needs to break above the 0.055 resistance level. If this occurs, ETH could outpace BTC by 30-50% by year-end.

Based on Bitcoin reaching $100,000 and using a 1.3-1.5x multiplier, the analyst predicts Ethereum could reach at least $6,000 by year-end, representing a 60% increase from current levels.

The approval of the Ethereum ETF is a pivotal moment for the cryptocurrency market, promising to bring major institutional investment and propel Ethereum to new heights.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.