SatoshiVM saw its native governance token SAVM abruptly spike by 58% after influential exchange KuCoin announced plans to list the asset.

The sudden explosion in price and volume raises questions about the motivations of different actors within the young SatoshiVM ecosystem.

What you'll learn 👉

Announcement Sparks Buying Frenzy

As analytics platform SpotOnChain revealed, the root catalyst behind SAVM’s massive single day surge was KuCoin confirming they would open SAVM trading on their exchange at 9:00 UTC on February 26.

“The $SAVM price surged up to 58% in the past 24 hours after KuCoin announced to list the token at 9:00 on Feb-26-24 (UTC)!” the on-chain analyst tweeted.

But curiously, further inspection shows that one whale may have aggressively accumulated SAVM tokens right before the listing at a significant discount to soon-after prices.

Whale Snaps Up Tokens Before Announcement

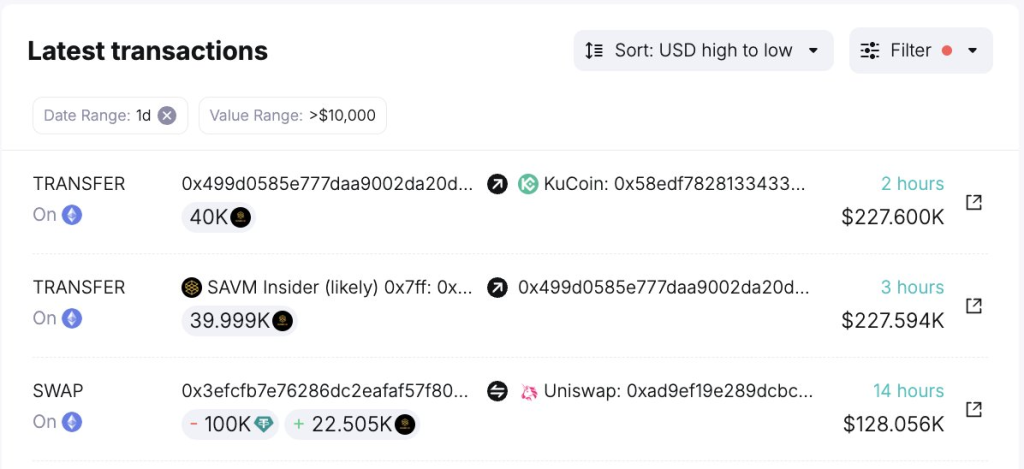

SpotOnChain’s blockchain analysis uncovered that the 5th largest SAVM holder managed to acquire 22,500 additional tokens, worth around $100,000 – at a per-token rate of only $4.44. This occurred just 14 hours prior to KuCoin’s announcement.

Thanks to the ensuing 50% overnight price spike following the news, this whale now holds over $2 million worth of SAVM – having scored an “unrealized profit of $922K (+72.5%),” per SpotOnChain.

The fortuitous timing and buying activity raises questions around whether this investor had advanced notice of exchange listing plans to capture outsized gains.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Team-Linked Wallet Deposit Sparks Dump Speculation

But perhaps more interestingly, SpotOnChain then notes that their tools also flagged a suspicious SAVM wallet movement by an address that looks to be closely affiliated with the SatoshiVM team itself:

“A likely SatoshiVM team-linked wallet deposited 40K $SAVM ($221K) to #KuCoin ~2hrs ago. Is this to supply liquidity or to sell the tokens after listing?”

This observation introduces concerns about the project creators themselves potentially aiming to immediately distribute tokens, risking crashing the price. Considerable on-chain evidence of this kind of behavior exists across other altcoin projects.

Thus, between opportunistic whales and insiders prepping liquidity, retail traders must exercise caution when chasing markers like SAVM on rapid listing spikes, as easy come can mean easy go if the result proves a bull trap.

You may also be interested in:

- JasmyCoin (JASMY) Bull Flag Breakout Finally Complete; Price Must Now Break These Levels for Bullish Continuation

- Kaspa Analyst Reveals What KAS Will Be Worth by April 2024

- Why Binance Coin (BNB) Influences Ethereum (ETH) and How Does DeeStream (DST) Make 20X in Just Months?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.