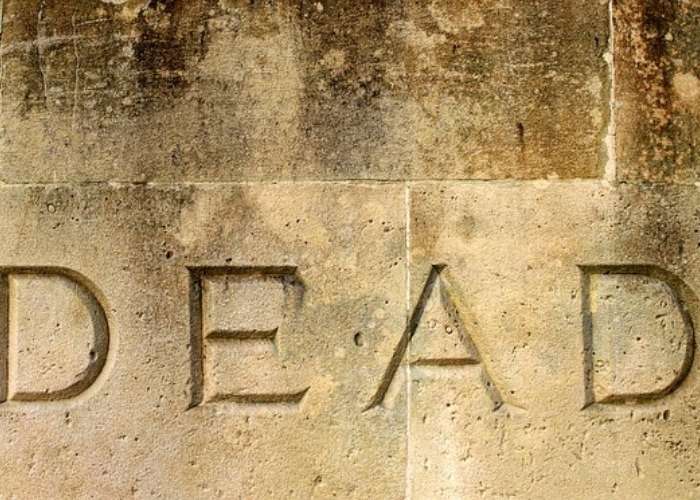

Marketwatch published an op-ed by Atulya Sarin, a professor of finance at Santa Clara University. In this biased and error-packed piece, professor Sarin bases his bitcoin is soon to be dead assumption on the decreased mining profitability.

As we can see from the reports of mining tracking websites, bitcoin hash power has dropped significantly in November.

Several reports and videos out of China over Thanksgiving weekend have shown large-scale shutdowns of bitcoin mining equipment, as the falling price of bitcoin made mining unprofitable. This prompted bitcoin objectors to pounce on this opportunity and to declare yet another bitcoin death.

Sarin writes:

What professor Sarin obviously is not familiar with is one ingenious feature Satoshi Nakamoto built into the bitcoin mining design. And that feature is difficulty adjustment. Thanks to this stroke of genius baked into its fundamental design, every time a mining rig is shut down, the bitcoin protocol increases the incentive for other miners to stay online.

Again, incorrect. If the price of bitcoin fell so hard as this professor wishes and predicts, professional miners would jump ship making way for ordinary users and small pools of enthusiasts to spin up their (old) rigs and start mining bitcoin again, liked they used to do back in the early days of bitcoin. This would actually make bitcoin more secure and stable since more small miners would mean more real decentralization.

Bitcoin proponents will argue that bitcoin’s price has dropped by large percentages before. Except this most recent decline is different in three significant ways. First, the magnitude of the recent decline dwarfs the magnitudes of past declines. Second, the losers in the recent decline are new investors who will likely retreat until there is more clarity around bitcoin’s use cases. Third, the futures markets have changed the game, enabling miners to estimate their mining losses and profits at the outset — if you can buy in a futures market at a price below my mining costs, why mine for a sure loss?

Another round of wishful thinking of a traditional bookworm professor with glaring lack of knowledge about how bitcoin works. There was enough people to mine bitcoin when it was worth $0 (kudos Satoshi and Hal) and there is certainly enough people when 1 BTC costs $3k+.

As breakermag aptly puts it:

“but it (difficulty adjustment) is the reason that bitcoin is nearly immune to true destruction, whether by state regulation or market fluctuations. It’s the reason bitcoin is superior to a centralized digital currency system like eGold, even if bitcoin is more expensive to run in aggregate. It’s what makes blockchains more persistently “real” than mere data saved to a hard drive, or even, arguably, to a Google cloud server farm.”