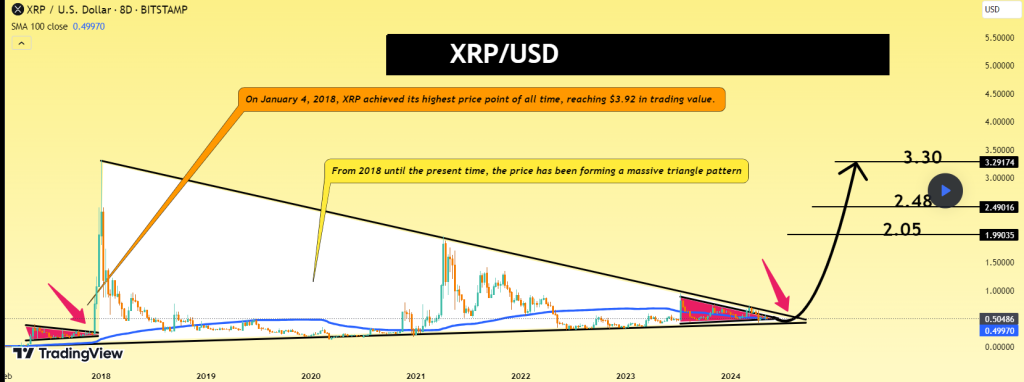

Ripple (XRP) has been forming a massive triangle pattern since 2018, according to an analysis shared by Kateryna, a TradingView analyst. This chart formation indicates a potential breakout to the upside, with targets ranging from $2 to $3. Holding Ripple in one’s portfolio could prove particularly relevant given this potential price movement.

The prolonged consolidation period reflected in Ripple’s price chart suggests a significant accumulation of market forces. A triangle pattern typically signifies a period of indecision, with buyers and sellers balancing each other out. However, as the pattern nears its apex, pressure builds, often resulting in a breakout. In Ripple’s case, a breakout to the upside is anticipated, given the historical bullish momentum of the cryptocurrency market and the positive sentiment surrounding Ripple’s technology and partnerships.

Examining Past Breakouts

To confirm the typical price movement of Ripple, Kateryna recommends examining the formations and breakouts from similar triangles in the past. For traders and investors, the breakout from this triangle pattern could present a lucrative opportunity. A decisive move above the upper trendline of the triangle, coupled with strong volume, would confirm the bullish bias. Traders may consider initiating long positions targeting the $2-3 range, while investors could view this as a validation of Ripple’s long-term potential and consider increasing their exposure to the cryptocurrency.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Ripple versus SEC Case: A Potential Catalyst

The ongoing Ripple versus SEC case is also expected to reach a conclusion soon. The outcome of this legal battle will likely have a significant impact on XRP’s price, either positively or negatively. A ruling in favor of Ripple could pave the way for a sustained rally, potentially aligning with the analyst’s prediction of a price surge. Conversely, an unfavorable ruling could lead to further price declines.

The Ripple versus SEC case has been a significant factor holding back XRP’s price for an extended period. Its resolution could serve as a defining moment for the cryptocurrency. If Ripple emerges victorious, it would likely provide a much-needed boost to investor confidence and adoption, potentially fueling a sustained upward trajectory. Conversely, an adverse ruling could further dampen sentiment and hinder Ripple’s growth prospects, at least in the short term.

Regardless of the outcome, the resolution of this legal battle is anticipated to bring clarity and potentially trigger significant price movements. Investors and traders alike will be closely monitoring the developments and their implications for Ripple’s future.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.