The ongoing legal case between Ripple Labs Inc. and the U.S. The Securities and Exchange Commission (SEC) may be approaching a final resolution.

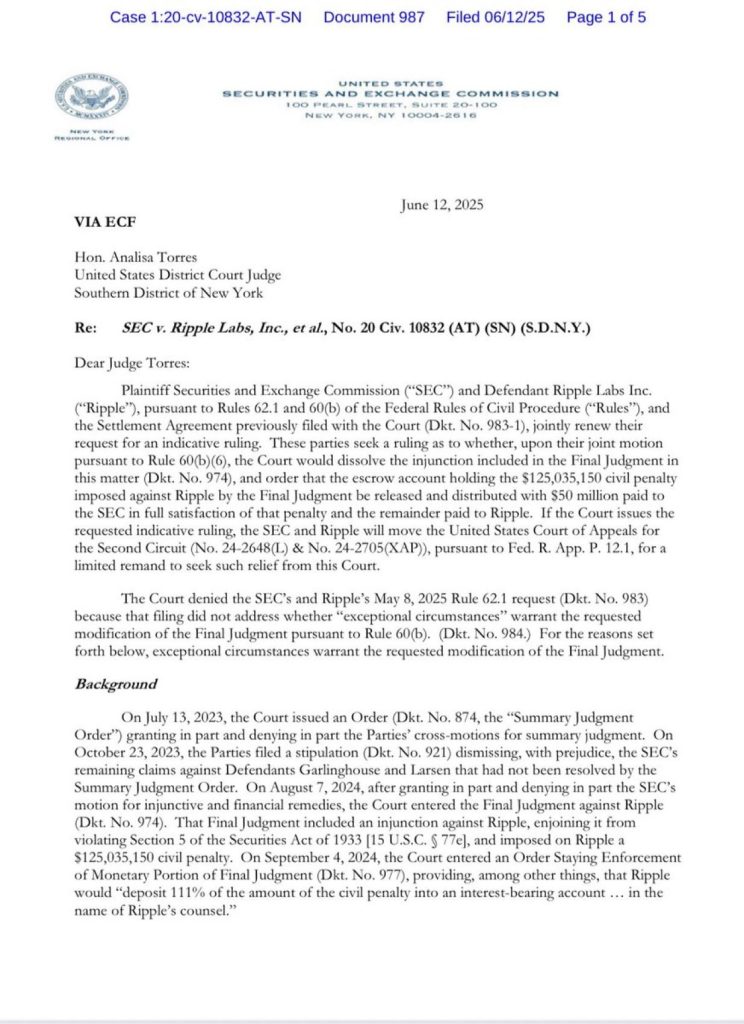

On June 12, 2025, Ripple and the SEC teamed up and submitted a request to Judge Analisa Torres in New York’s Southern District Court.

The new motion seeks to end the legal battle by modifying the terms of a previously issued final judgment.

BrettCrypto posted on X (Formerly Twitter) about the filing, while calling it a “bombshell” and suggesting that both sides want to end the fight.

According to the tweet, Ripple would pay $50 million, retain the remainder of the escrowed funds, and move forward with no further appeals.

This interpretation reflects the general direction of the filing, though the court has not yet ruled on the request.

What you'll learn 👉

Filing Requests Court to Dissolve Injunction and Release Funds

According to the five-page court document, Ripple and the SEC are requesting an indicative ruling that would allow the court to dissolve the existing injunction against Ripple.

The parties are asking that the $125 million civil penalty be released from escrow. The motion is based on Rules 60(b) and 62.1 of the Federal Rules of Civil Procedure.

If the proposed terms go through, $50 million would be paid to the SEC as full satisfaction of the penalty, while the rest would be returned to Ripple.

The filing argues that exceptional circumstances now exist to warrant a modification of the court’s previous order. If approved, the penalty would be reduced, and the case would not proceed to further appeals.

Background of the Long-Running Dispute

The court originally issued a summary judgment in July 2023, finding that Ripple had violated Section 5 of the Securities Act.

A final judgment was entered in August 2024, which imposed a $125 million penalty and a permanent injunction. Ripple was ordered to deposit the full penalty amount into an interest-bearing escrow account.

In May 2025, a previous request for relief under Rule 62.1 was denied due to insufficient justification. The new filing responds to that denial by providing further explanation and context to support the proposed modification.

Read Also: Ripple Price Warning: Analyst Says This Metric Could Trigger Sharp XRP Dip

Outcome Depends on Court Ruling

While the tweet from BrettCrypto suggests that the case is nearing a close, Judge Torres has not issued a ruling yet.

If the request is approved, both parties would move to dismiss pending appeals in the Second Circuit. If denied, the legal proceedings would continue under the original terms.

The court’s decision will determine whether this filing marks the final step in a legal case that has influenced XRP regulatory status since 2020.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.