In a concerning development for investors, recent on-chain analysis by SpotOnChain revealed that major Render Network (RNDR) institutional backer Kenetic Capital has exited its position by moving all of its holdings to exchanges.

What you'll learn 👉

Largest Institutional RNDR holder offloads all tokens

According to tweets by SpotOnChain, Kenetic Capital’s wallet address, 0xf26 was the largest institutional holder of RNDR tokens prior to withdrawing all 6.6 million tokens worth $32.5 million to Binance since December 24th, 2023. The VC firm is estimated to have profited $15.95 million from offloading all its RNDR a few hours ago.

This exit comes after Kenetic Capital already deposited another 1 million RNDR tokens worth $4.86 million to Binance on February 5th. In total, since December 24th, the firm has moved 2.5 million tokens to Binance at approximately $4.83 each, totaling $12.06 million.

The unloading of its full RNDR position signals a clear lack of long-term confidence in the project by a formerly major institutional backer. This will likely negatively impact broader market sentiment and risk further selling pressure.

The price of RNDR witnessed a 1.5% drop in the last 24 hours following the institutional offloading. RNDR had put up a nice surge in the last 30 days, with its token up by almost 28%.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Polygon Foundation offloads MATIC

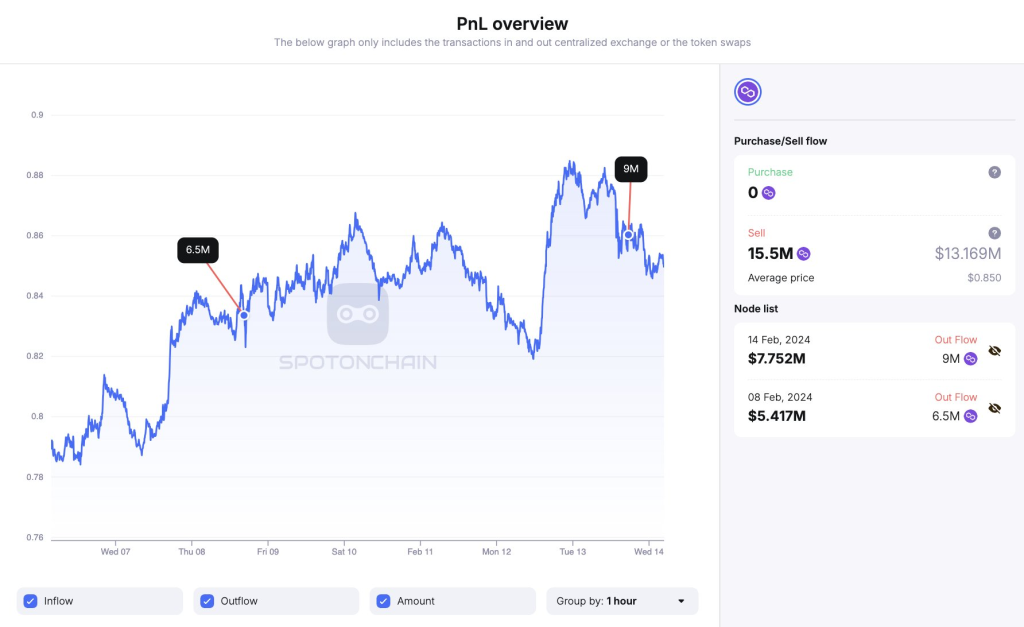

Notably, Kenetic Capital isn’t the only major crypto investor recently moving holdings to exchanges. According to another SpotOnChain tweet, wallet address 0x57f linked to the Polygon Foundation deposited 9 million MATIC tokens worth $7.75 million to Binance around 11 hours beforehand.

Overall, there have been two Polygon Foundation connected wallets depositing 15.5 million MATIC to Binance over the past 5 days, for a total of $13.2 million. The price of MATIC has slightly dipped after each large deposit.

This pattern of major project backers unloading tokens to exchanges is concerning for holders. It suggests decreased confidence even among core team members and backers, as they lock in profits regardless of how it may negatively impact rank-and-file investors.

The crypto markets remain fragile as years of loose monetary policy unwind. For RNDR in particular, the loss of a major backer like Kenetic Capital has severely damaged confidence. Unless new long-term buyers emerge, further declines could be in store. Investors would be wise to observe on-chain activity for signals about when insiders are losing faith.

You may also be interested in:

- When Will Kaspa (KAS) Hit $1?

- Bitcoin Pre-Halving Rally ‘Has Begun,’ but Ethereum and Altcoins Will Follow BTC – Here’s Why

- Best Altcoins to Collect Before the Bitcoin Halving: Which of These Altcoins Could Surge in 2024?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.