There are several indicators used by BTC traders to determine whether the price is moving up, down, sideways, and how strong the move is. According to Cihan Türkmen, a crypto analyst on X, one of the most reliable indicators is the Pi Cycle Top, and its structure makes it stand out during every Bitcoin cycle.

Cihan Türkmen explains how this indicator behaves during major Bitcoin movements, and his breakdown has become especially relevant now that the Bitcoin price trades around $92,283.

What you'll learn 👉

How Pi Cycle Top Chart Explains Bitcoin Price Momentum

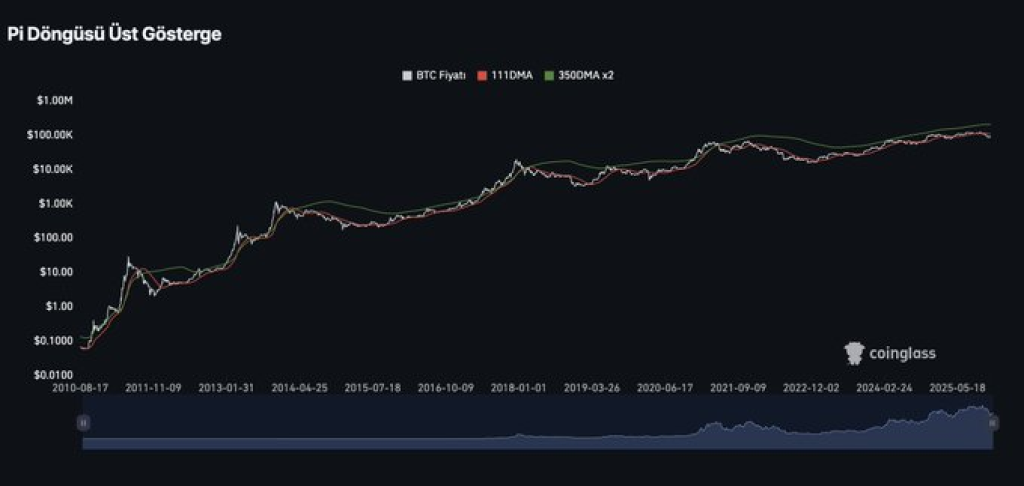

Cihan Türkmen noted the Pi Cycle Top as a tool that has accurately predicted almost every major Bitcoin price peak. The chart shows three lines: BTC price, 111-day moving average, and 350-day moving average ×2. Historically, when the red 111-day moving average crosses the green 350-day ×2 line, Bitcoin token has marked a cycle peak.

Looking at the attached chart, BTC price remains well below the point where these averages intersect. The red and green lines are still far apart, showing that the market is far from the euphoria stage that precedes a top. This gap indicates a mid-cycle accumulation phase. Investors might see the pattern as BTC token building momentum, with significant upward potential before the averages cross.

The chart’s historical perspective is striking. Every previous cycle peak aligns closely with a crossover of these lines, confirming the indicator’s reliability. Current separation suggests that BTC price could continue climbing, potentially aiming for levels that some market participants project around $180k.

BTC Poised for a Breakout in Early 2026

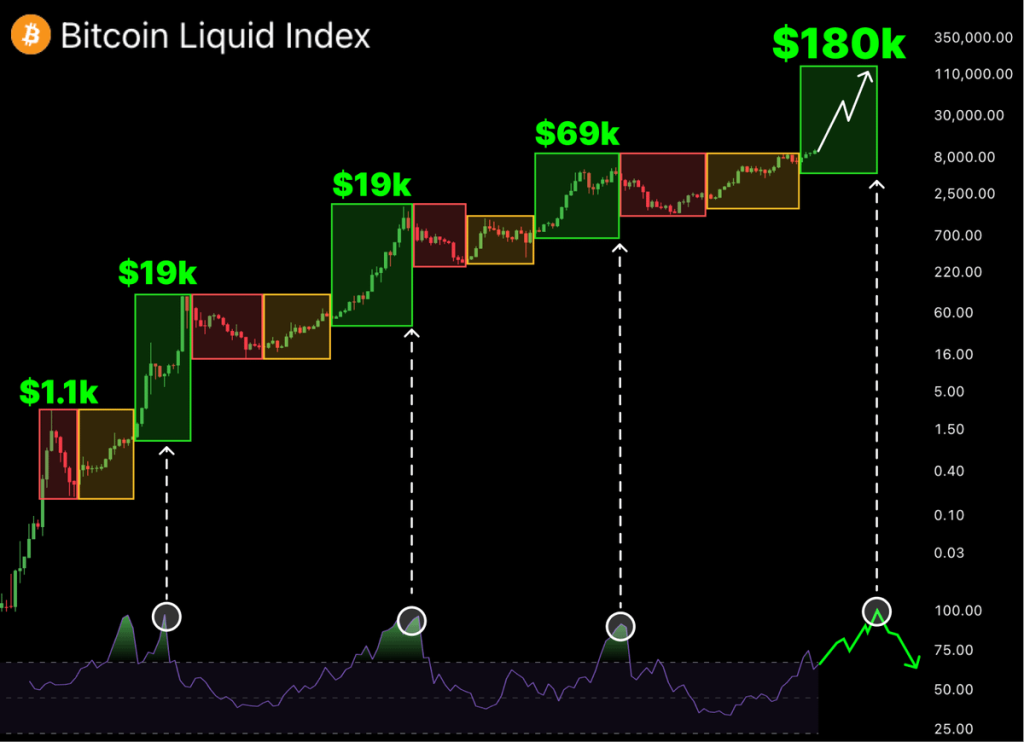

According to a web3 researcher on X called Klark, he sees conditions setting up for a breakout in early 2026. He points to macroeconomic and on-chain signals supporting this view. Fed rate cuts and potential quantitative easing at the start of 2026 could create a favorable backdrop for BTC. Whales accumulating Bitcoin token reduce available supply and indicate confidence, while RSI readings show BTC is oversold, often interpreted as a setup for a rebound.

Klark’s framework suggests a buildup phase where both market behavior and external conditions line up for a meaningful move. The combination of these signals with insights from the Pi Cycle Top creates a cohesive narrative of continued growth rather than an imminent peak.

What the Chart and Signals Mean for Bitcoin Token

Chart patterns and macro signals together indicate that BTC price top has not arrived yet. The Pi Cycle Top line separation, macro shifts, and accumulation trends suggest Bitcoin token may still have significant room to grow. Observing these moving averages and large holder activity provides a roadmap for potential future BTC price movements.

Read Also: Could This Be Why Shiba Inu (SHIB) Is Dying as a Key Partner Questions Team Commitment?

Current BTC price behavior, coupled with insights from both Cihan Türkmen and Klark, reinforces the idea that we are still in a phase where accumulation dominates, and the next significant surge may be ahead. $180k remains a realistic projection if the historical pattern repeats and macro conditions align.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.