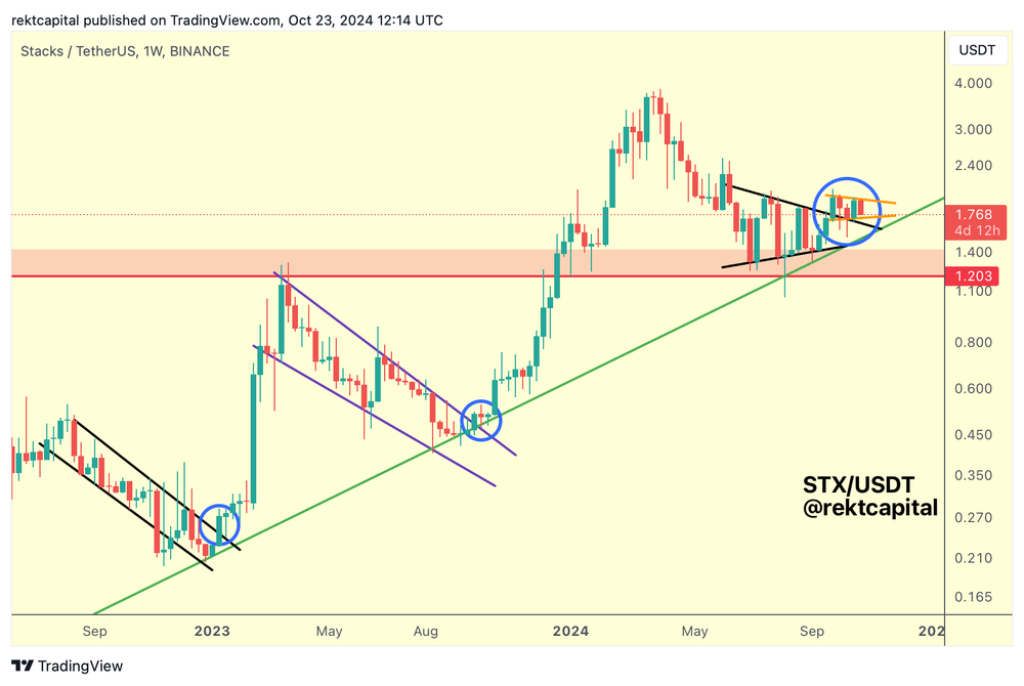

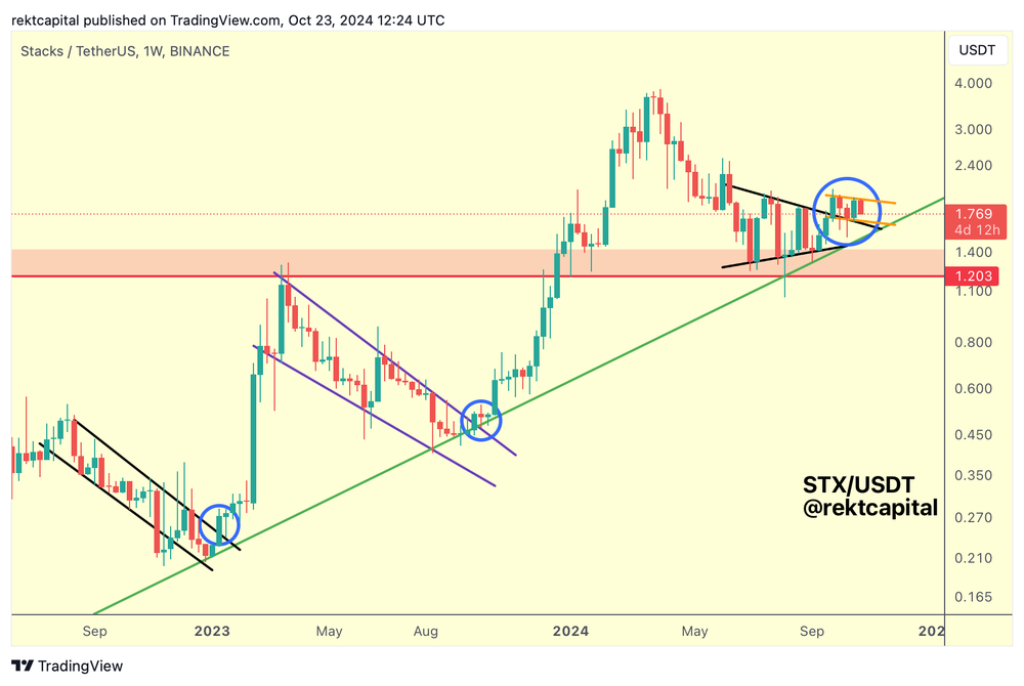

In the latest Rekt Capital newsletter, the expert analyzed the recent performance of Stacks (STX), noting that it has been repeating historical patterns. Currently, STX is forming a macro market structure near a macro Higher Low.

After breaking from this structure, it has been retesting the top, establishing new support. This breakout-retest-continuation process has historically varied in duration, taking two weeks in early 2023 and extending to three to four weeks later that year.

As of now, Stacks (STX) is in its fifth week of this process. The analyst pointed out that while the duration is increasing, the breakout-retest-continuation mechanism remains valid.

Read Also: Dogecoin Price Hits ‘Final Bottom’: Technical Analysis Suggests DOGE Could Surpass $10 This Cycle

Despite taking longer, STX continues to retest the top of the macro pattern as support, potentially leading to a multi-week re-accumulation structure.

A new Lower High has emerged for STX, prompting the need to watch for the formation of a new Higher Low, which could signal continuation on the macro wedge. The provisional structure identified by the expert indicates that while a new Lower High is confirmed, the exact position of the bottom remains uncertain, although a new Higher Low is suspected.

The top of the macro wedging structure is anticipated to serve as crucial support, with technical potential for this support to align with a Falling Wedge bottom.

The analyst will continue to monitor this emerging structure, indicating that STX is forming a new continuation pattern above the macro wedging structure as part of its post-breakout retesting phase.

Read Also: Analyst Skeptical Sui is a ‘Solana Killer’ – Here’s What Needs to Happen for SUI to Flip SOL

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Bittensor (TAO) Could Continue Downside

In recent weeks, Rekt Capital has also provided detailed insights into Bittensor (TAO). Earlier this month, the analyst noted that TAO was positioned just below significant Range High resistance, grappling with a Bearish Divergence on the daily chart.

This divergence began to manifest last week, leading to expectations of a price drop towards the blue $521 Range Low support.

Indeed, TAO has since declined to this Range Low support on the weekly timeframe. The daily Bearish Divergence remains strong, with the RSI continuing to trend downward.

The expert emphasized that for TAO to reverse its price trajectory, it must break this RSI Downtrend. Until such a break occurs, maintaining the Weekly Range may prove challenging.

The analyst highlighted the importance of TAO closing above the $521 Range Low to sustain its position. There exists a real possibility of TAO downside wicking below this level, reminiscent of previous volatility. The last significant downside wick occurred when TAO dropped to $473 before closing above the $521 mark.

Should TAO experience a downside wick this week, the price must still close above $521 to uphold this support. The expert suggested that a temporary drop into the high $400s could potentially facilitate a break in the RSI Downtrend.

Read Also: How Much Will Solana (SOL) Be Worth at the Peak of the Bull Run?

Ultimately, bullish investors are cautioned against bearish confirmation, which would entail a Weekly Close below $521, followed by a wick back into that level, potentially flipping it into resistance and triggering further downside.

To avert this scenario, TAO needs to maintain the Weekly $521 support, possibly allowing for a volatile retest while working to invalidate the ongoing Daily RSI Downtrend, thereby building strength at the $521 level.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.