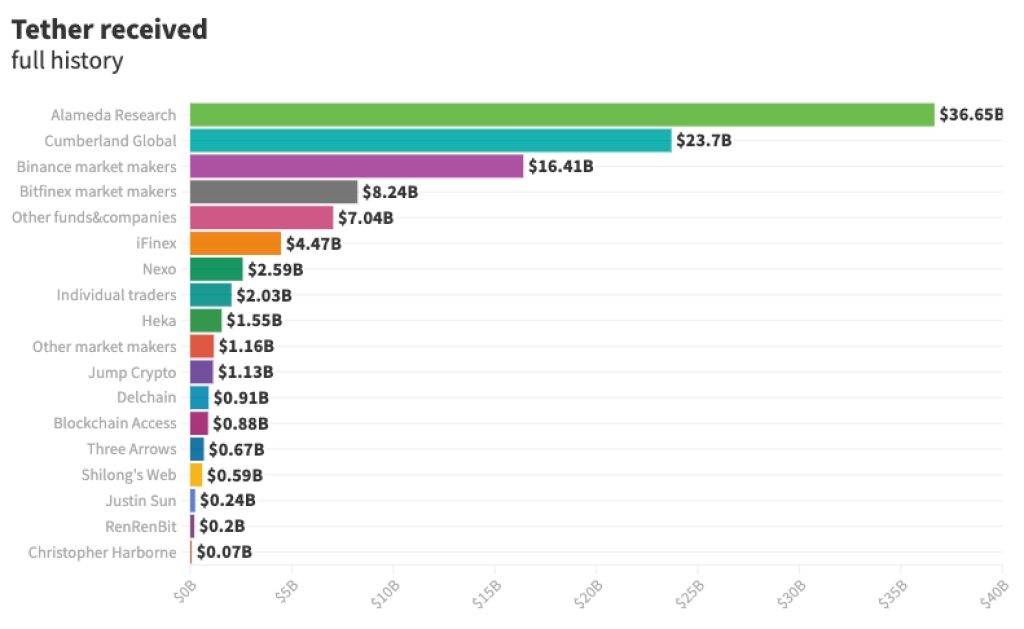

New analysis by crypto analyst Dylan LeClair is raising questions about the stablecoin activities of Alameda Research, the trading firm founded by Sam Bankman-Fried.

According to LeClair, data shows that Alameda minted over 36 billion USDT tokens from Tether, but only ever redeemed around 4 billion USDT. This leaves a difference of over 30 billion USDT that was minted but never redeemed by Alameda.

Normally, USDT is minted when dollars are deposited with Tether as reserves to back the stablecoin 1:1. The lack of redemptions suggests Alameda may not have deposited sufficient dollars to back the huge amount of USDT they received.

LeClair points out that the magnitude of USDT minting by Alameda is unprecedented and suspicious given their lack of redemptions. He speculates that either Alameda was serving as a “bank mule” for other entities to obtain USDT, or that the stablecoins were improperly minted without sufficient reserves.

So far in the FTX bankruptcy case, there has been no mention of Alameda wiring billions of dollars to Tether to support its USDT minting. The only reference to stablecoin activity was FTX co-founder Caroline Ellison admitting to converting $2 billion of FTX funds into USDC.

LeClair argues that the lack of transparency around Alameda’s USDT transactions raises concerns. He also highlights that FTX valued USDT lower than other stablecoins, hinting they may have known reserves were questionable.

The allegations around Alameda’s USDT dealings open new questions in the ongoing FTX collapse saga. As investigations continue, regulators will likely be scrutinizing the reserves and issuance of Tether’s stablecoin and its relationship to Alameda.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.