Pyth Network is showing fresh signs of life. The token is up more than 5% today, trading around $0.1651, while trading volume has jumped over 50%.

After months of consolidation, PYTH price has finally broken out of its long-term downtrend, and traders are starting to ask: could this be the beginning of a bigger move in 2025?

One of the biggest reasons behind PYTH comeback is the wave of institutional adoption. Back in late August, PYTH exploded by more than 90% after the U.S. Department of Commerce announced it would publish GDP and economic data on-chain using Pyth.

That single move validated the network’s role as more than just another DeFi oracle, it positioned Pyth as critical infrastructure for programmable finance.

Since then, big money has been flowing in. VanEck rolled out a PYTH-based ETN, and Grayscale launched a PYTH Trust, with both products together pulling in over $1.2 billion in assets.

This kind of institutional demand doesn’t just drive awareness, it also creates steady token demand through subscriptions and revenue-sharing models, which can tighten supply over time.

What you'll learn 👉

PYTH Ecosystem Growth & Partnerships

On the ecosystem side, Pyth network continues to expand its footprint. The network now powers over 1,900 real-time data feeds across more than 100 blockchains. Recent partnerships with RHEA Finance and xStocks Alliance highlight how Pyth is becoming a go-to data source.

RHEA is using Pyth’s data to run AI-optimized yield strategies in DeFi lending, while xStocks taps Pyth to power tokenized equities.

Each new integration adds utility for the PYTH token itself, whether as governance, payment, or staking collateral. That growing utility is one of the clearest reasons why demand for PYTH could keep rising.

Pyth Network Chart Analysis

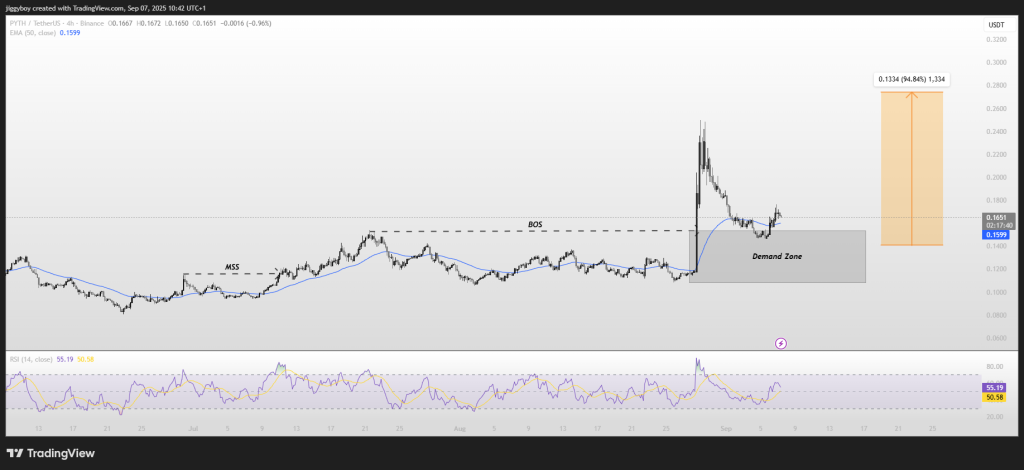

The technical picture has finally turned bullish. On the 4-hour chart, PYTH price bounced strongly from the $0.14–$0.15 demand zone and is now trading above the 50 EMA at $0.159.

That zone has flipped into solid support, showing that buyers are back in control. RSI is sitting just above 55, pointing to recovering momentum. The first big resistance lies at $0.18, with upside potential stretching toward $0.25–$0.28 if bulls stay in charge.

Read Also: Kaspa (KAS) Price Prediction for the Week

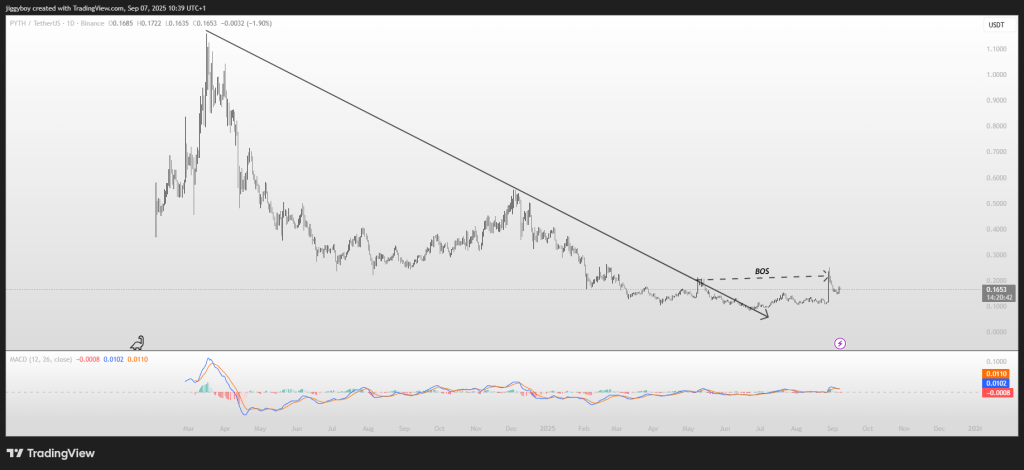

Zooming out to the daily chart, PYTH price has officially broken a long-term descending trendline. That’s a major structural shift, especially since it happened right after a clean break of structure (BOS) and retest. The MACD is also leaning bullish, suggesting momentum could build as the breakout plays out.

A measured move from the demand zone points toward a possible 90% rally, putting the $0.28 level firmly in sight if the current trend continues.

PYTH Price Outlook For 2025

Between institutional adoption, new partnerships, and a clean technical breakout, the bullish case for Pyth Network in 2025 is stronger than ever.

Of course, traders should keep an eye on key levels, $0.15 remains the line in the sand for support, while $0.18 is the resistance to beat.

If momentum holds, PYTH price could be setting itself up for a run toward $0.25–$0.28 in the months ahead. For now, breaking the trendline may just be the start of a much bigger story.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.