Pump.fun just dropped one of the most impressive fundamental updates in the meme coin space, and it’s not hype, screenshots, or “soon” promises. It’s math.

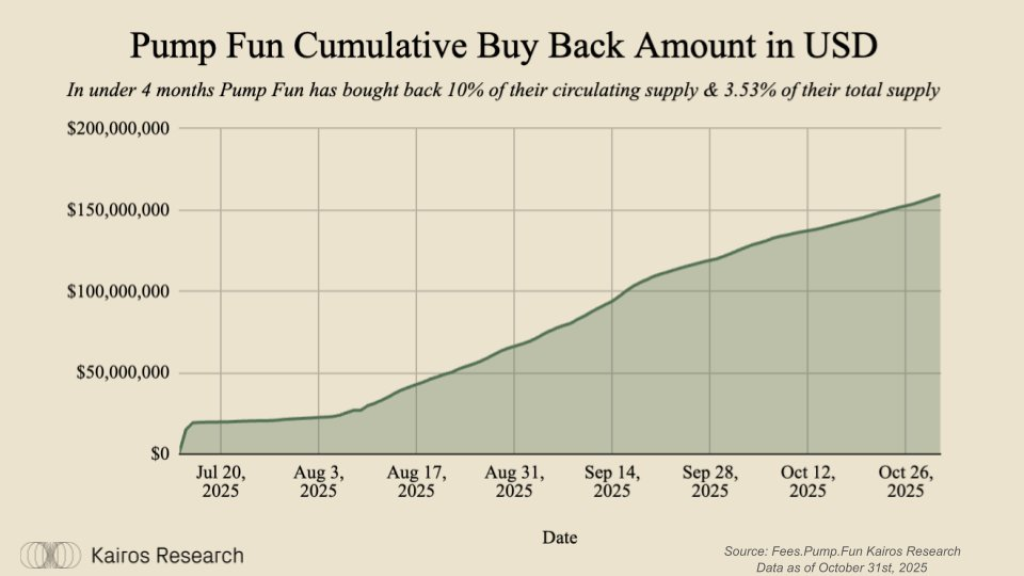

Analytics platform Kairos Research reported that Pump.fun has already bought back 10% of its circulating supply in less than four months. That equals 35.28 billion PUMP removed from the market, costing the protocol around $160 million. In total supply terms, they’ve already burned through 3.53% of all PUMP that will ever exist.

To put that into perspective: there is now more PUMP bought back than the entire PUMP liquidity sitting on Binance (3.29%, per Arkham). That shows exactly how aggressive the buy-side pressure has been.

What you'll learn 👉

The Chart Shows a Relentless Uptrend in Buybacks

The graph Kairos shared highlights something crucial:

• Rapid acceleration from early August

• A clean parabolic slope from September onward

• No slowdown despite market volatility

At the current pace, Pump.fun is on track to buy back about 33% of circulating supply every year, which would equate to 11.7% of total supply annually.

That’s real token-sink mechanics, not a marketing narrative.

So Why Did PUMP Crash 30%+ in October?

Even strong fundamentals can’t always save price action in a shaky market. the PUMP price dropped over 30% last month, entering a deeper correction mode while traders rotated into newer hype coins.

Market cap currently sits around $1.6 billion, placing PUMP well below its peak form.

But here’s the interesting part:

- The protocol’s fees and revenue didn’t slow down

- Buybacks kept growing

- The burn pressure continued removing supply

In other words: fundamentals improved while the chart cooled off.

This usually creates one of two outcomes:

1️⃣ Price eventually realigns upward

2️⃣ The market massively misprices value until a catalyst appears

Is a Comeback Setting Up for November–December?

PUMP is still more than 2x below its all-time high, and that’s not a wild target if the market turns bullish heading into year-end, especially with Bitcoin and major altcoins stabilized now after the recent October crashes.

Take the formula:

Strong revenue + constant buybacks + falling circulating supply

It builds a coiled-spring effect. All you need is a liquidity shift back into memes, and PUMP becomes one of the clearest narrative trades.

Pump.fun Holders Don’t Have a Reason to Worry

Pump.fun isn’t competing with Dogecoin-style meme culture alone anymore. It’s turned into a cash-flowing platform that directly converts hype into price support.

The slogan writes itself:

Trade memes → fund buybacks → reduce supply → repeat

After a tough October, PUMP isn’t dead, it might simply be loading for the next phase of the cycle.

A retest of the all-time high becomes a fair target if bullish sentiment continues into the final two months of 2025. And if buybacks keep climbing at this pace… the supply math starts doing the moon-talking for traders.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.