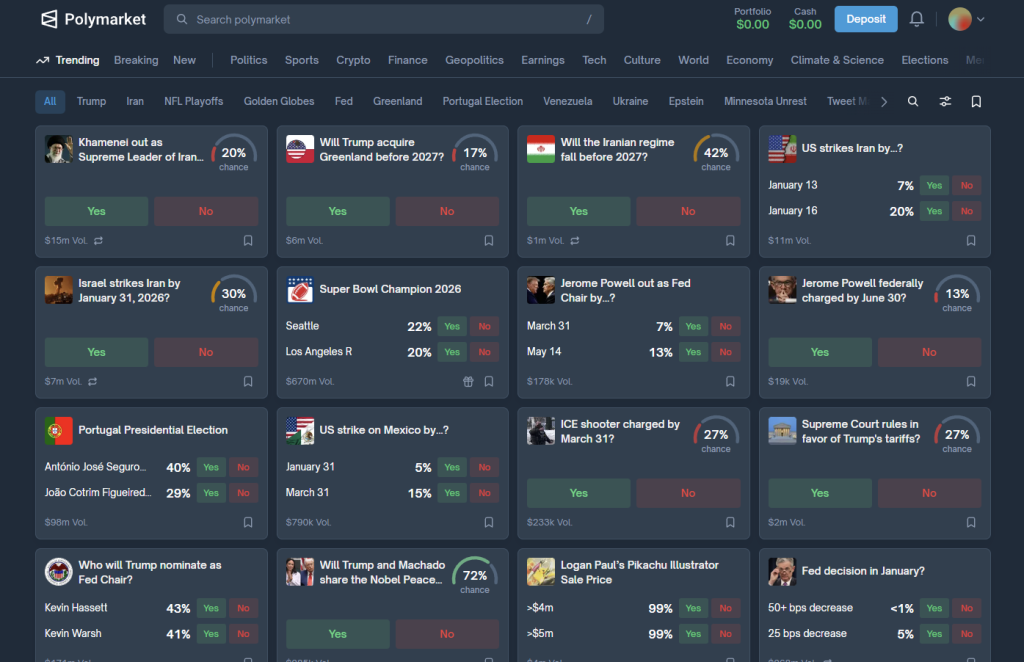

Polymarket looks simple on the surface. Buy “Yes” or “No,” wait for an outcome, collect profits. But anyone who has traded it seriously knows the truth. Polymarket is one of the fastest information prediction markets on the internet, and profits flow to traders who react first, analyze better, and execute faster than everyone else.

After weeks of hands-on research and real trading, one thing becomes clear. The difference between consistent winners and people who slowly bleed capital is not luck. It’s tooling.

This guide breaks down the best Polymarket tools in 2026, grouped into four clear categories that make the entire ecosystem easier to understand and far more profitable to navigate. These tools are used across politics, sports, crypto, and macro markets, and together they form a complete trading stack.

This is not financial advice. These are tools used for research, speed, and risk management.

What you'll learn 👉

Core Accounts Every Polymarket Trader Needs for Prediction Markets

Before AI, dashboards, or execution bots, Polymarket trading starts with information flow. Without the right core accounts, traders operate blind.

Polymarket

Everything starts here. This is where markets are created, trades are executed, and liquidity lives. Serious traders monitor platform updates, rule clarifications, and market changes directly from the source. Polymarket reacts to information instantly, and official updates often move odds before social media catches up.

PolymarketTrade

This tool tracks profitable wallets across Polymarket. Traders use it to study consistency, position sizing, and conviction rather than blindly copying trades. Watching where high-performing wallets deploy capital helps confirm sentiment and identify markets with informed participation.

PolymarketIntel

Polymarket moves faster than most financial markets. PolymarketIntel acts as a real-time news firehose, surfacing political headlines, macro developments, and breaking events the moment they hit. Traders who see news seconds earlier often enter at better prices.

PolymarketBuild

Many of the most powerful tools appear here first. PolymarketBuild is where community dashboards, experimental AI assistants, and new terminals are announced before broader adoption. Early access often means temporary edge.

AI Assistance: Speed Is the Real Alpha

AI tools don’t replace thinking. They compress time. In fast-moving markets, speed often matters more than perfect analysis.

Polybro

Polybro builds structured probability reports from Polymarket links. It outlines scenarios, confidence scores, and reasoning paths. While it offers trade mirroring, many traders use it strictly for disciplined pre-trade analysis on larger positions.

Polysimplr

Polysimplr cleans up Polymarket’s interface and adds AI chat for plain-language explanations. It answers questions like why a market moved or what factors matter most. It’s beginner-friendly without sacrificing usefulness for experienced traders.

TradeFox

TradeFox feels more like a professional trading platform than a betting site. It offers limit orders, advanced filters, discovery tools, and volume-based rewards. Many traders prefer its layout for scanning and execution.

Data & Analytics: Where the Edge Is Built

AI helps with speed. Analytics help with clarity. These tools reveal behavior beneath surface-level odds.

Polysights

Polysights tracks volatility, trend shifts, catalysts, and over 30 custom indicators. Its alert system flags unusual behavior, helping traders avoid emotional decisions and react only to meaningful changes.

Hashdive

Hashdive ranks wallets by performance consistency and conviction. It highlights whale participation and offers market screeners based on liquidity, volume, and behavior. Traders who follow data over intuition rely heavily on this tool.

PredictFolio

PredictFolio tracks PnL, win rate, position size, and historical performance across wallets. It’s commonly used to compare personal performance against top traders and identify long-term winners versus short-term luck.

LayerHub

LayerHub focuses on large wallet activity. It flags significant capital inflows and sudden position changes, often signaling momentum before broader market reaction.

Dune Analytics (Polymarket Dashboards)

Community-built Dune dashboards track liquidity concentration, volume spikes, and wallet dominance. These dashboards help identify crowded trades and late-stage markets where risk increases.

Pentagon Pizza Watch

This unconventional indicator tracks pizza deliveries near the Pentagon, historically linked to heightened military activity. While not a primary signal, traders monitor it during sensitive geopolitical markets as contextual confirmation.

Trading & Execution Tools: Acting Faster Than the Crowd

Execution matters when information breaks.

Ostium

Ostium allows on-chain trading of macro assets with leverage. Traders use it to hedge Polymarket positions, especially when political or geopolitical outcomes affect currencies, commodities, or equities.

Bankr

Bankr allows Polymarket trading directly inside Telegram. During breaking news, this speed advantage can be decisive. It also supports watchlists and wallet tracking.

Read also: Did Polymarket Traders Front-Run a $1B Bitcoin Buy? Community Split After “Insider” Signals

Why Using Polymarket Tools Actually Matters in Prediction Markets

Polymarket markets do not move on opinions. They move on information, speed, and positioning. Traders who rely only on the default interface often react late, enter at worse prices, and exit under pressure. This is where Polymarket tools become useful.

Specialized tools help reduce reaction time. Real-time news feeds, AI summaries, and whale alerts allow traders to respond within seconds instead of minutes. In fast-moving political or macro markets, that time difference often determines whether a trade is profitable or not.

Polymarket tools also improve decision quality. Analytics platforms reveal who is entering a market, how concentrated liquidity is, and whether a move is driven by informed wallets or short-term speculation. This context helps traders avoid crowded positions and emotional trades based on noise rather than probability.

Another advantage is risk management. Tools that track historical wallet performance, volatility shifts, and late-stage market behavior help traders size positions more responsibly. Instead of guessing, decisions are based on patterns and data that repeat across markets.

Finally, Polymarket tools create consistency. Trading without structure often leads to impulsive decisions. A defined tool stack introduces routine: check information, confirm with data, execute with speed, and manage exposure. Over time, that process matters more than any single winning trade.

This is why experienced traders treat tools as part of their strategy, not an optional add-on. In a market where odds update instantly and competition grows every month, tooling is no longer a luxury. It is part of staying competitive.

Why These Are the Best Polymarket Tools in 2026

The Polymarket ecosystem has matured. Profitable trading now resembles professional markets, not gambling. Traders combine official sources, AI speed, behavioral analytics, and execution tools to stack small advantages.

Used together, these tools help traders:

Avoid emotional decisions

React faster to new information

Spot whale conviction early

Identify mispriced probabilities

Execute trades efficiently

That combination is what defines the best Polymarket tools in 2026.