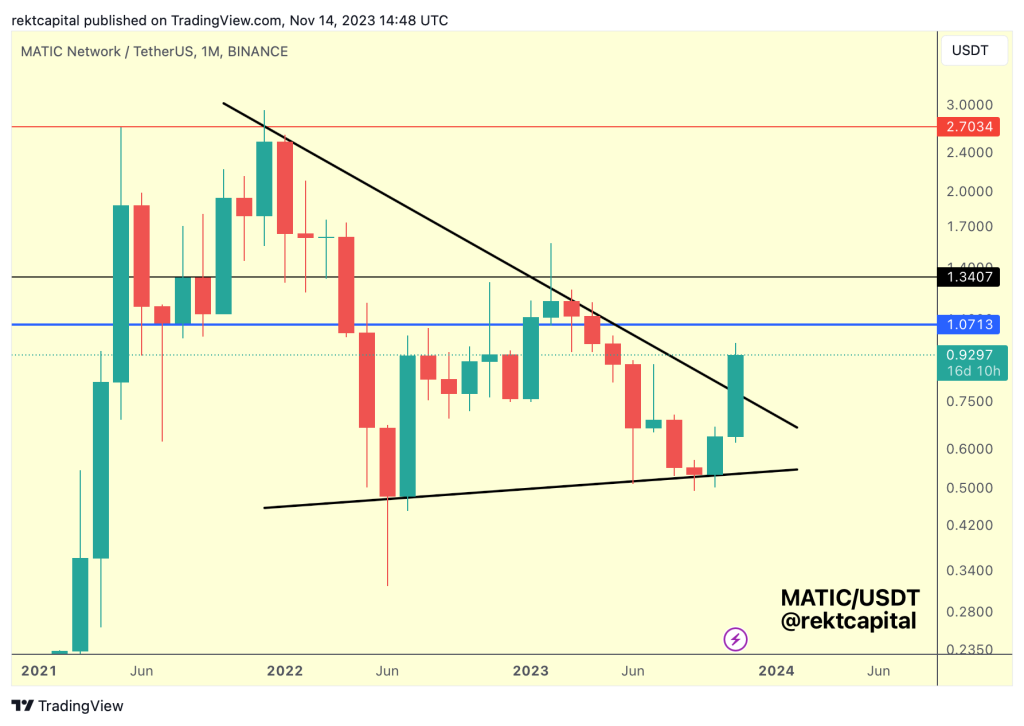

Polygon’s MATIC token saw a slight price bump earlier this week after exchange OKX launched a scaling solution built on Polygon’s technology. However, MATIC has been unable to maintain its momentum, now declining over 3% in the last 24 hours back to $0.91 from $0.98. According to leading analyst Rekt Capital, a key test is coming up for MATIC that will determine if its bullish breakout can continue.

What you'll learn 👉

Breaking Macro Downtrend

As Rekt Capital notes in a recent newsletter, MATIC recently broke out from the macro downtrend, around $0.75. The downward price structure has dictated its price pattern for the year.

Rekt Capital points out that a monthly close above this former downtrend would officially confirm the breakout. However, with many weeks left this month, MATIC’s stability ahead of the monthly close will be important.

Importance of Retest Support

Should MATIC dip in the coming weeks, Rekt Capital notes it is crucial for it to hold the broken downtrend line as support. Holding this zone on a retest would demonstrate strength and stability, increasing the odds MATIC can start a new sustained macro uptrend.

On the flip side, failing to hold support could invalidate the breakout and lead to more downside. MATIC has yet to retest the former descending resistance as support.

Bull Run Hinges on Retest

In conclusion, while MATIC’s breakout is an encouraging sign, Rekt Capital emphasizes the token isn’t out of the woods yet. For MATIC to kickstart a new bull market cycle, it must first retest and confirm its broken downtrend as support, according to Rekt Capital’s analysis.

Read also:

- Top Analyst Identifies a “Red Flag” in Bitcoin (BTC) On-Chain Indicators

- Bearish Market Drags Down Bitcoin and Ethereum While This Altcoin Shines

- Investor Alert: Cardano (ADA) and Meme Moguls (MGLS) Surge Amidst Market Volatility!

This retest will likely occur in the coming days and weeks ahead. MATIC holding up on this key test could pave the way for a sustained move back toward its all-time high near $1.5.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.