Polygon’s POL token is showing signs of life again. After a strong 7% move up today, some key daily technical indicators are starting to turn positive, hinting that buyers may be gaining momentum. But while the chart looks more bullish than it has in weeks, there are still a few hurdles to clear.

The Relative Strength Index (RSI) is currently around 58 on the daily timeframe. That’s still below the 70 level, so it hasn’t entered the overbought zone yet. This means there’s still room for POL to move higher before the rally becomes overheated.

The Moving Average Convergence Divergence (MACD) remains just below the zero line at -0.004. That normally signals a bearish bias. However, the gap between the MACD line and its signal line is shrinking, which could mean a bullish crossover is on the way if price keeps rising.

What you'll learn 👉

Buying Pressure Is Increasing

The Commodity Channel Index (CCI) has moved up to 106, putting it firmly into bullish territory. This suggests growing demand for POL at current levels. The Bull Power indicator also flipped positive at 0.0158, which tells us buyers are currently in control over sellers.

Meanwhile, the Rate of Change (ROC) is sitting just under 11. That’s a clear sign that today’s price move has real momentum behind it. When ROC spikes like this, it often signals that something has shifted in the short-term trend.

Despite these encouraging signs, not everything is signaling a full recovery just yet. The Ultimate Oscillator, which looks at momentum across different timeframes, is still quite low at 24.6. That suggests the bigger picture trend is still lacking strength.

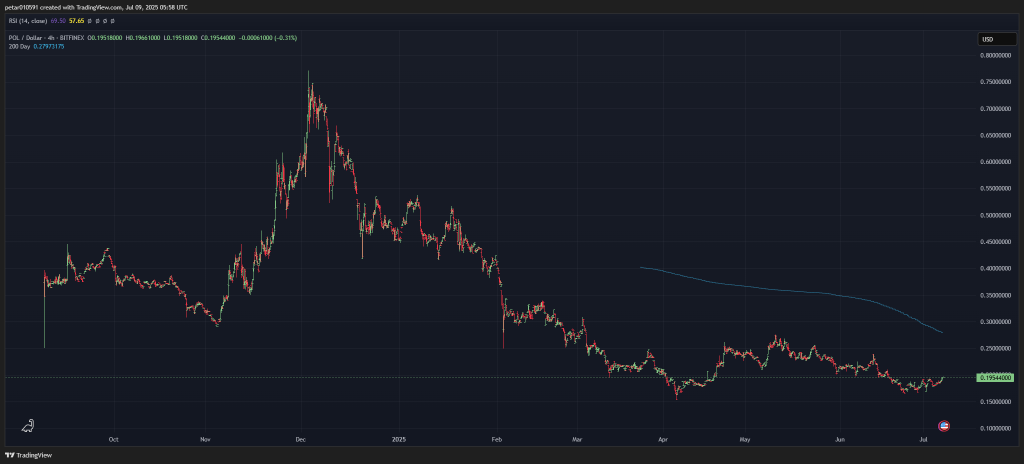

Another concern is the 200-day moving average, which currently sits around $0.28. POL remains well below this level. Until price can reclaim that zone, the longer-term trend will stay neutral to bearish.

Also worth noting is the Average True Range (ATR), which is now at 0.0159. That indicates there’s still a fair bit of volatility in play. So even as momentum builds, traders should be ready for short-term price swings in both directions.

Key Levels to Watch

From a chart perspective, POL is starting to form a short-term base. If it can push above the $0.20 resistance level and close there on the daily chart, it may open the door to further upside. A move toward $0.23 could follow, and if momentum continues, the next major test would be near $0.26. That’s where the descending trendline from late 2024 still looms overhead.

On the flip side, if POL drops back below $0.18 and stays there, this bullish setup could fade. That level has acted as a floor during recent dips, so bulls will want to keep price above it to maintain momentum.

Read also: Hedera Price Surges as Falling Wedge Breakout Triggers Bullish Targets

POL Price Forecast

In the near term, POL looks like it’s trying to turn the corner. Daily indicators are improving, and price is attempting to break out of its recent range. The $0.20 mark is shaping up to be a key level for the next move. If buyers step in with volume and push through that resistance, the path toward $0.23 and $0.26 opens up.

While it’s too early to call this a full trend reversal, the signs are promising. If POL can keep building on this momentum, especially with broader market support, this could be the start of a larger recovery.

Read also: ADA Whale Activity Surges as Big Wallets Re-Enter – Is It Time to Watch Cardano?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.