The price of Polygon (POL) might be about to see some bearish movement following the recent bullish rally it had. The price has seen more than a 20% spike in the last four days.

A look at the 4-hour chart shows that the price has been bouncing off a trendline that started on November 4. This trendline acted as support on November 15, and with the price moving up after this, we could see a retracement back to this trend line before a bullish continuation.

With the bullish move slowing down, the price might be ready for a pullback, which could occur in the next few days.

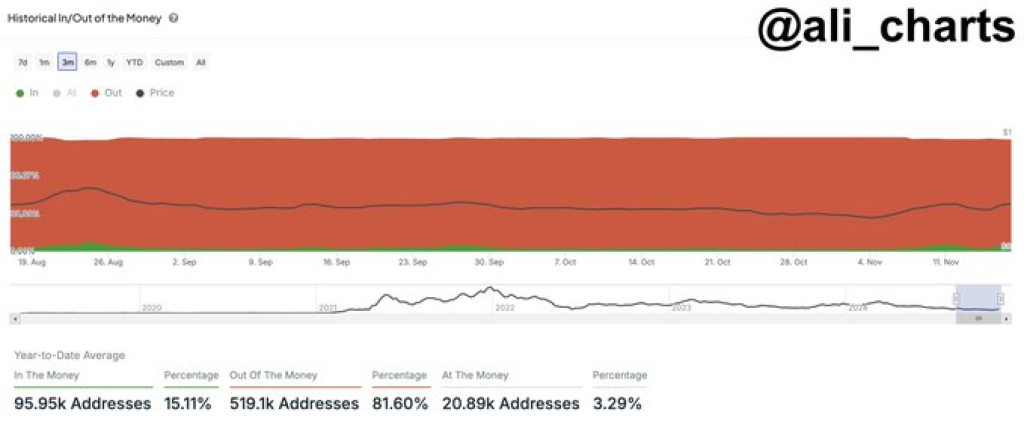

Supporting the bearish outlook is a post by analyst Ali Chart. He noted that 81.6% of Polygon holders are already out of money.

Read Also: Traders, Be Careful! Large Token Unlocks Coming for SOL, DOGE, SUI, and Other Cryptos

The analyst shows metrics that reveal the high level of skepticism surrounding the POL coin. This disbelief and lack of enthusiasm to hold onto the coin could lead to more bearish moves for the token.

However, some other metrics give some hope. Ali also posted that Polygon has seen some spikes in daily active addresses, transaction volume, and whale activities.

This could indicate increasing interest and market participation. This contrasts with the earlier metrics, which show a lack of enthusiasm around the token.

These mixed signals make it hard to determine how the on-chain metrics could influence the price. However, if the price continues to be bearish, traders will look to the trend line for an opportunity for a price spike.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.