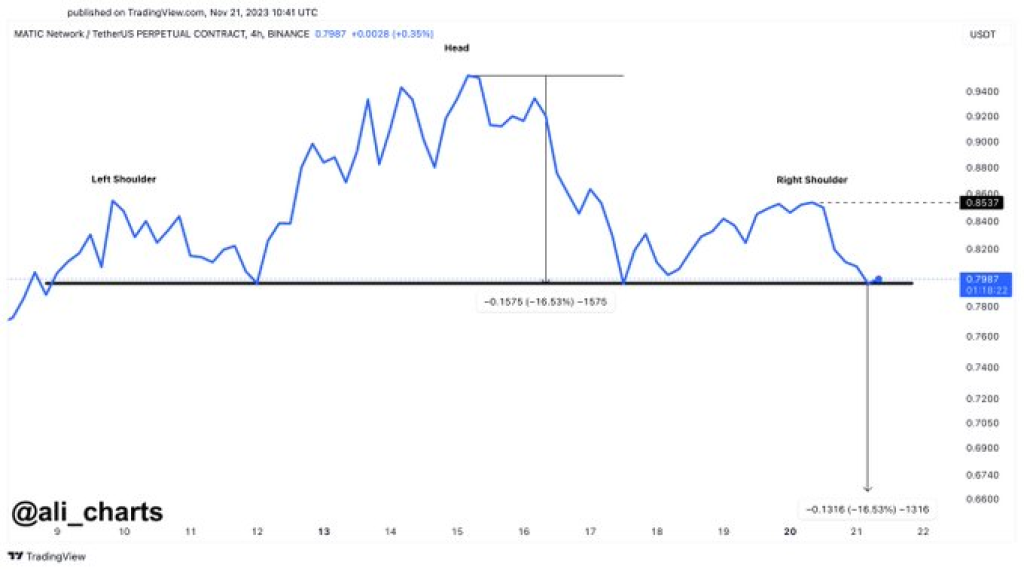

According to technical analyst Ali, Polygon (MATIC) faces downside risk after forming a bearish head-and-shoulders chart pattern on its 4-hour timeframe.

Ali highlights how MATIC recently forged the right shoulder of this reversal formation, with the neckline support at $0.79. He notes that if MATIC closes decisively below $0.79 on a sustained timeframe, the head-and-shoulders target projects a 16% sell-off towards the $0.67 level.

Traders should watch $0.79 closely as a trigger point for possible MATIC weakness ahead. According to Ali, invalidation of the bearish thesis only comes if MATIC reclaims the recent right shoulder high around $0.86, signaling bulls have re-established control.

If bears do force a neckline breakdown, the crowd psychology driving head-and-shoulders patterns suggests many nervous MATIC longs would likely cut losses and accelerate selling pressure around $0.67.

Read also:

- Litecoin Whale Activity Could Foreshadow Next Bull Run While Solana Flashes Sell Signal

- Shiba Inu Magazine Highlights Welly’s Commitment to Shibarium Blockchain

- Benjamin Cowen Predicts Bitcoin’s Rise to $100K by 2025; InQubeta Celebrates $5M Presale Triumph

In summary, while no outcome is guaranteed, Ali illustrates an emerging risk for MATIC holders from a technical perspective. MATIC’s recent rally appears exhausted, and failure to reclaim $0.86 could open the door to significant downside. Traders should plan risk management around the make-or-break $0.79 level during coming days.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.