In a short period since the mainnet launch, Pi Network managed to create one of the strongest communities in crypto. This is why whenever we post something negative about the Pi Coin price, we get attacked by their community and we are fine with that.

Unfortunately, crypto prices go down more often than not this year and Pi Coin got hit heavily. Numbers don’t lie – Pi Coin is right now trading 75% below its all-time high of $2.98.

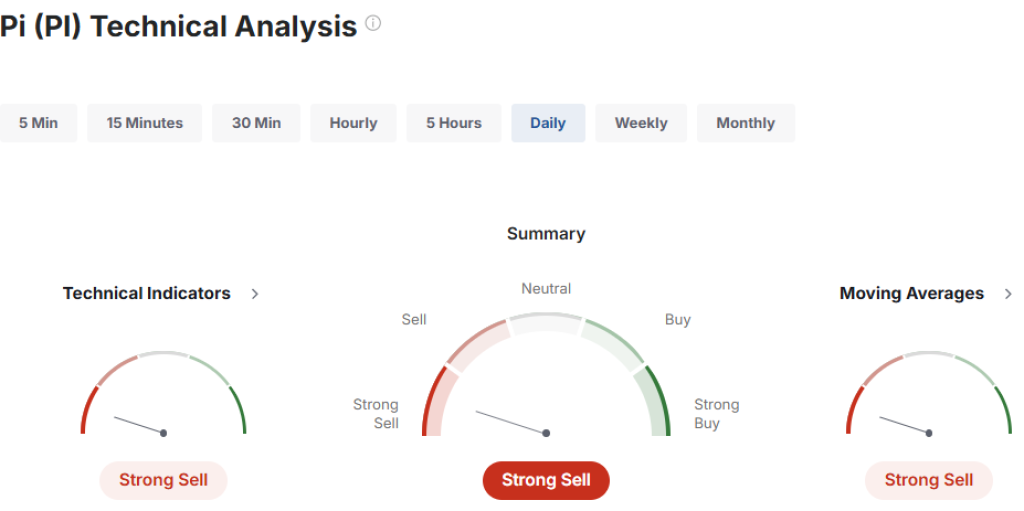

We have been working on daily Pi Coin price predictions for weeks now and just by looking at technicals on a daily timeframe, it was clear the situation is not good and more downside is likely possible.

Here are 3 possible reasons to sell your Pi Coins now, even at $0.70 current price.

What you'll learn 👉

Reason 1: Lost Hype

In crypto, when there’s a strong hype around the project, post-launch rallies are super strong. This happened with Trump’s meme coin in January and then with Pi Coin in February as well.

However, when that hype fades, crypto investors are impatient and they continue to sell. This is why TRUMP and Pi Coin are now trading way below their respective all-time highs hit not so long ago.

For now, Pi Coin seems to have lost that hype and strong catalysts that can hold the price above crucial support levels and eventually make a bounce.

Reason 2: Poor Technical Indicators

As mentioned, just by looking at daily timeframe technicals, we can see that:

RSI is 25.403 – The Relative Strength Index has fallen into deeply oversold territory. While this sometimes signals a potential bounce, it also confirms the strong downward momentum and selling pressure Pi Coin is experiencing.

CCI is -138.0935 – The Commodity Channel Index is showing an extremely bearish reading, indicating that prices are unusually low compared to their average. This suggests the downtrend is strong and could continue.

Highs/Lows is -0.1827 – The negative Highs/Lows indicator reveals that recent price lows are dominating over highs, confirming a bearish trend where sellers are in control of the market.

Ultimate Oscillator is 31.873 – This reading is well below the 50 neutral line, showing bearish pressure across multiple timeframes. The market lacks buying momentum needed for a sustainable recovery.

ROC is -48.232 – The Rate of Change indicator shows Pi Coin has lost nearly half its value in the measured period. This steep decline signals that selling pressure remains intense.

Bull/Bear Power is -0.4081 – The negative reading indicates bears are in control of the market. The selling force currently outweighs buying interest, making price recovery difficult.

Read also: We Asked AI to Predict Pi Coin Price in April

Reason 3: Scammer Infiltration

Crypto developer that goes by the name ‘Satoshi Nakamoto’ pointed out an ongoing scam targeting the Pi Network community.

After investigating numerous reports, this developer discovered a dangerous pattern: scammers are actively monitoring Pi-related social media posts to find potential victims. They approach Pi holders with tempting offers to buy coins directly from wallets at inflated prices of $15, $30, or even $50 per coin.

I have not been very active over the past few days because I was conducting extensive research. I had been receiving numerous messages from the community reporting that individual accounts were offering to buy Pi Coins at $15, $30, or even $50 per coin. I thoroughly investigated…

— Satoshi Nakamoto (@s_nakotomo) March 31, 2025

The scammers then request screenshots of wallet balances and send users to fake Pi Network wallet portals. These fraudulent websites contain keyloggers and malicious software designed to steal recovery phrases and private keys. Once users enter their wallet information on these sites, their funds are immediately compromised and stolen.

This growing threat represents another reason for caution. The presence of such sophisticated scams targeting the Pi community suggests the ecosystem may not yet have the security infrastructure and awareness needed to protect all users adequately.

Community vigilance remains the strongest defense against these attacks, but for some investors, the increasing fraud risks might be reason enough to reconsider their positions until better security measures are established.

Wrapping Up

All these bearish reasons could become irrelevant if Pi Coin stages a strong bounce in the coming days. A price recovery could quickly restore market confidence and attract fresh buying interest, and reverse the current downtrend.

For investors still interested in Pi Coin, we see the $0.40-$0.50 range as a potential buy zone where risk-reward becomes more favorable. However, we recommend waiting for clear signs of price stabilization before entering positions.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.