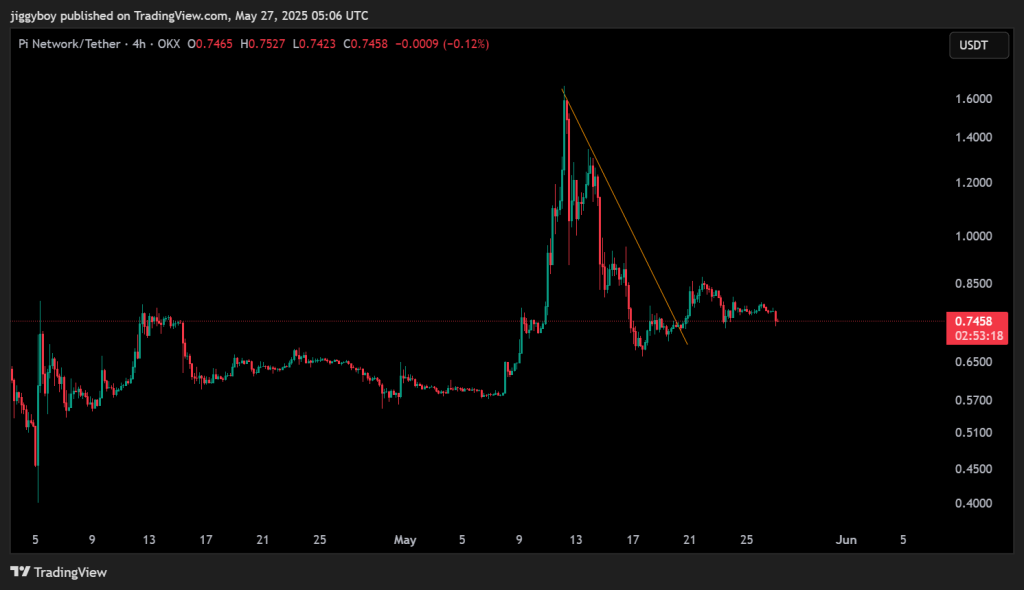

Pi Coin is facing renewed selling pressure after dropping nearly 5% in the past 24 hours. The token is now trading at $0.7453, with a noticeable rise in trading volume, up by 32.23%. This comes after a failed breakout attempt above $0.85 earlier this month, followed by a steady downtrend and a shift into range-bound price action.

Let’s break down today’s outlook.

What you'll learn 👉

📅 What We Got Right Yesterday

In yesterday’s forecast, the primary scenarios were laid out with a focus on the $0.73–$0.78 range. The Pi Coin price indeed stayed within this zone, confirming the neutral outlook. No breakout occurred above $0.78, and the $0.73 level has so far acted as temporary support.

The bearish scenario also remains valid as downside volume continues to increase. Although the price has not broken below $0.73 yet, momentum indicators suggested weakness, and that weakness carried into today’s early session. Our expectation of low volatility with a bearish tilt proved accurate as price action stayed muted and choppy within key range levels.

📊 Pi Coin Daily Overview (May 27)

- Current Price: $0.7453

- 24h Change: -4.92%

- 4H RSI: 39.35

- Volume: Up 32.23% compared to the previous day

Pi Coin price continues to consolidate between $0.70 and $0.80. The support zone at $0.70–$0.73 has been tested several times but is holding for now. Meanwhile, the resistance zone at $0.80–$0.85 remains untouched since the failed breakout earlier in the month. Short-bodied candles and low momentum show the market is indecisive.

🔍 What the Pi Coin Chart Is Showing

The 4H chart still reflects a distribution phase following the sharp rally that peaked near $1.75 in mid-May. After the price collapsed back down to the $0.70–$0.75 region, an attempt to reverse failed at $0.85. Since then, the chart has formed a sideways channel, and buyers have not stepped in with force.

Volume has picked up today, but it’s mostly red, indicating that sell orders are driving market activity. As long as the $0.70 level holds, the token may remain within the same range. A break below this zone, however, could shift momentum firmly back to the downside.

Read Also: Cardano Founder Reveals Talks to Bring RLUSD to ADA – But There’s a Catch

📈 Technical Indicators (Hourly Timeframe)

| Indicator | Value | Signal / Interpretation |

| RSI (14) | 31.07 | Approaching oversold, weak buyer momentum |

| ADX | 31.82 | Strong downtrend confirmed |

| MACD (12,26) | -0.006 | Bearish crossover, no sign of reversal |

| CCI (14) | -149.21 | Deep oversold territory |

| Ultimate Oscillator | 40.55 | Weak buying interest |

| ROC (Rate of Change) | -2.748 | Negative momentum |

| Bull/Bear Power (13) | -0.0285 | Slight bearish strength |

Summary: Every key hourly indicator shows bearish signals. While RSI and CCI indicate the asset is nearing oversold conditions, there is still no sign of reversal.

🔮 Pi Coin Price Prediction Scenarios

Bullish Scenario: If Pi Network breaks above $0.78 with a strong 4-hour close and increased volume, a move to $0.85 or higher may unfold.

Neutral Scenario: Pi Coin price remains trapped between $0.73 and $0.78 as market participants wait for a clear trigger.

Bearish Scenario: A breakdown below $0.73 could drag Pi Coin to $0.70. If that fails, $0.65 is the next support level to watch.

🧠 Wrapping Up

Pi Coin price remains in a holding pattern after a sharp decline from its early May highs. Despite oversold signals on the short-term chart, the bearish trend still dominates. Unless buyers reclaim $0.78 with strong momentum, continued sideways action or even a breakdown appears more likely in the short term.

Traders should closely monitor the $0.70 support and volume trends throughout the day. Any sustained move below that could shift the current consolidation phase into a new bearish leg.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.