We predicted yesterday that Pi Coin might face downward pressure and test the $1.40 support level before consolidating between $1.40 and $1.50 throughout the day. A potential recovery toward $1.55 was also considered if market sentiment improved, though breaking above previous highs seemed unlikely.

Pi Coin price has since shown resilience, currently trading at $1.50 with a 3% increase for the day. However, trading volume has dropped by 44.38%, indicating reduced market activity. While buyers have managed to keep the price above key support levels, the decline in volume suggests uncertainty about sustained momentum.

What you'll learn 👉

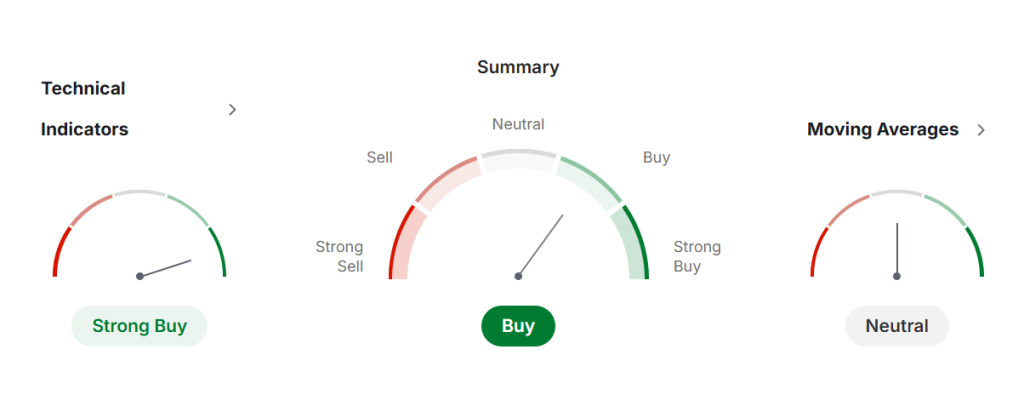

Technical Indicators Suggest Mixed Market Conditions

Pi Coin’s price is still holding above its upward support line, which has been key for keeping the price from falling too low. The coin has bounced off this line several times, showing how important it is. The $1.70-$1.80 range is still blocking the price from moving higher.

Per investing.com, market sentiment is cautious. Some indicators show a mild bullish trend while others remain neutral. The MACD (12,26) stands at 0.003, generating a buy signal, suggesting that there is some bullish momentum developing. However, the RSI at 53.86 remains neutral, indicating that the asset is neither overbought nor oversold, leaving room for movement in either direction.

The Ultimate Oscillator sits at 62.84, suggesting we should buy. This points to potential upward movement. The Rate of Change (ROC) is 3.473, also indicating a buy. This confirms the price is gaining strength and moving up. Despite these bullish indications, moving averages remain neutral, meaning there is no clear confirmation of a strong trend.

Pi Coin Price Outlook for Today

With the current market structure, Pi Coin’s price action will depend on whether buyers can sustain control at the $1.50 support level. If this level holds, a potential move toward the $1.70-$1.80 resistance zone could unfold in the short term. However, if selling pressure increases and the price falls below $1.50, a decline toward $1.30 could be the next scenario.

Traders should monitor volume trends closely. An uptick in trading activity could signal an attempt to break resistance, while continued low volume might lead to range-bound movement or further downside.

Read Also: Why is Toncoin Price Pumping? How High Can TON Go?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.