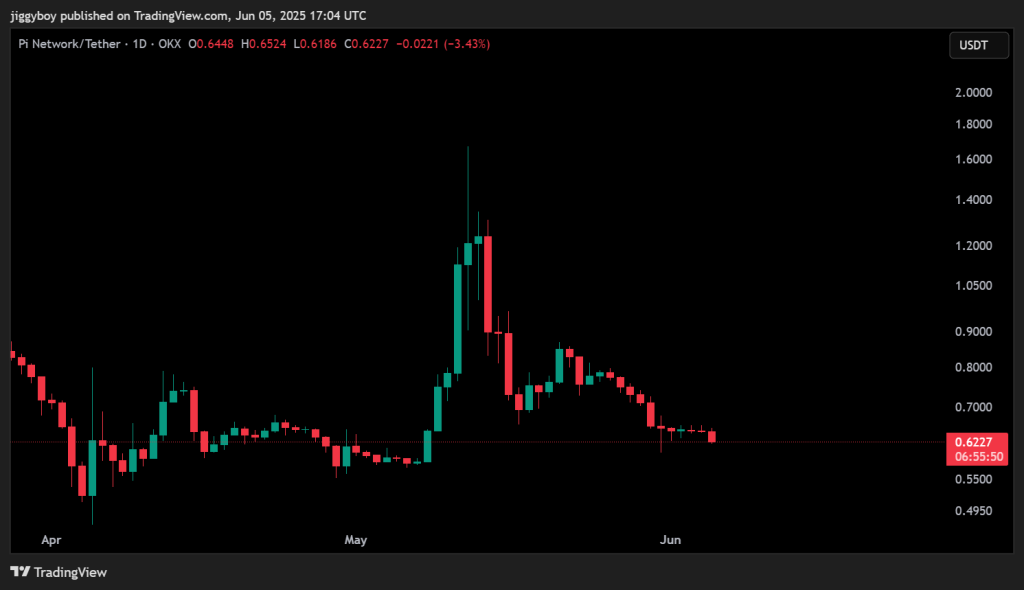

Pi Coin enters Friday trading below a key support level after extended selling pressure. Following a failed attempt to reclaim $0.66, the token is now hovering just above the $0.62 mark. With volume ticking higher but momentum fading, the path ahead remains unclear as bears continue to dominate most timeframes.

Let’s break down today’s outlook.

What you'll learn 👉

📅 What We Got Right Yesterday

In yesterday’s Pi Coin prediction, we outlined three possible scenarios, with the bearish outcome looking most likely. That has now played out. Pi Network failed to reclaim $0.66 and instead broke below $0.63. As anticipated, this triggered a move toward the lower support band near $0.62.

We also noted that technical indicators were firmly bearish, with no sign of momentum shifting back in favor of bulls. This remains true today. Price structure continues to make lower highs, and short-bodied candles reflect uncertainty and weak buying interest.

📊 Pi Coin Daily Overview (June 6)

- Current Price: $0.6243

- 24h Change: -4.90%

- Volume: +31.70%

- Trend: Bearish, with ongoing pressure near local support

Pi Coin price is now trading below the critical $0.63–$0.66 zone, which previously acted as short-term support. The chart shows a weak recovery attempt earlier in the session that was quickly rejected. With rising volume and falling price, selling pressure appears to be intensifying.

🔍 What the Pi Coin Chart Is Showing

The daily chart reflects a clean bearish structure. Since peaking above $1.80 in mid-May, the price has declined steadily, forming a clear pattern of lower highs and lower lows. The $0.60–$0.62 range is now being tested again, a level that previously served as a launchpad in April.

Several candles in the past week show long upper wicks, hinting at repeated rejection attempts. The market remains in a compression phase, and if the $0.61 zone fails to hold, a sharper decline could unfold toward $0.58 or $0.53 for Pi Coin price.

📈 Technical Indicators (Daily Timeframe)

| Indicator | Value | Signal / Interpretation |

| RSI (14) | 38.88 | Bearish momentum, not yet oversold |

| ADX | 47.24 | Strong trend strength, confirming current downtrend |

| MACD (12,26) | -0.03 | Bearish crossover, short-term momentum weaker |

| CCI (14) | -103.49 | Oversold territory, but no reversal yet |

| Ultimate Oscillator | 40.32 | Weak demand, sellers still in control |

| ROC (Rate of Change) | -24.73 | Strong negative momentum, trend accelerating downward |

| Bull/Bear Power (13) | -0.1176 | Bears maintain control near key support |

Summary: Every key indicator continues to point toward a bearish setup. Momentum, trend strength, and structure are all aligned with further downside risk unless a sharp reversal occurs.

🔮 Pi Coin Price Prediction Scenarios

Bullish Scenario: A clean break above $0.66 with volume may lead to recovery toward $0.70, but odds are currently low.

Neutral Scenario: Sideways movement between $0.61 and $0.63 may develop if selling pressure cools off.

Bearish Scenario: A confirmed breakdown below $0.61 opens the door to further losses toward $0.58 or even $0.53.

🧠 Wrapping Up

Pi Coin price remains locked in a clear downtrend, with every attempt at recovery facing rejection. While trading volume has picked up, it’s not translating into upside movement. Without a fundamental catalyst or trend reversal signal, bulls are struggling to defend key support.

The $0.61 level will be the most important price to watch today. A daily close below it could trigger another wave of selling. As it stands, momentum, structure, and technicals all support continued pressure in the short term.

Read Also: How High Can Dogecoin (DOGE) Price Rise This Cycle? This Chart Gives a Clue

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.