The price of Pi (PI/USDT) has been moving in a well-defined upward trend since the start of April. On the 4-hour chart, this uptrend is supported by a rising trendline that has acted as a consistent base during multiple price dips.

Each time PI has come close to this trendline, it has bounced back — a sign that buyers are still defending this level and that sentiment remains cautiously bullish.

Just yesterday, we saw the fifth bounce from this line, which sparked a small rally. PI gained around 2.8% shortly after the bounce, but then retraced a bit, now sitting about 1.9% higher than the support zone.

At the time of writing, Pi Network’s price is hovering near $0.6391. This level is still within the broader consolidation range of $0.60 to $0.66, where the coin has been trading for the past several days.

Despite minor fluctuations, the structure remains bullish as long as the price stays above that rising trendline.

What you'll learn 👉

Where Could Pi Network Price Go Next?

If PI continues to respect the current trendline support, there’s a good chance we’ll see another push toward the $0.66 resistance — a price level it tested some days. A clean breakout above this level could bring more bullish momentum and potentially set the tone for a move toward new short-term highs.

However, if Pi Coin breaks below the ascending trendline with strong selling volume, the setup could shift. In that case, the market might enter a lower range or even start forming a downtrend. For now, though, the chart suggests buyers are still in control — cautiously but steadily.

What Technical Indicators Say About Pi Coin

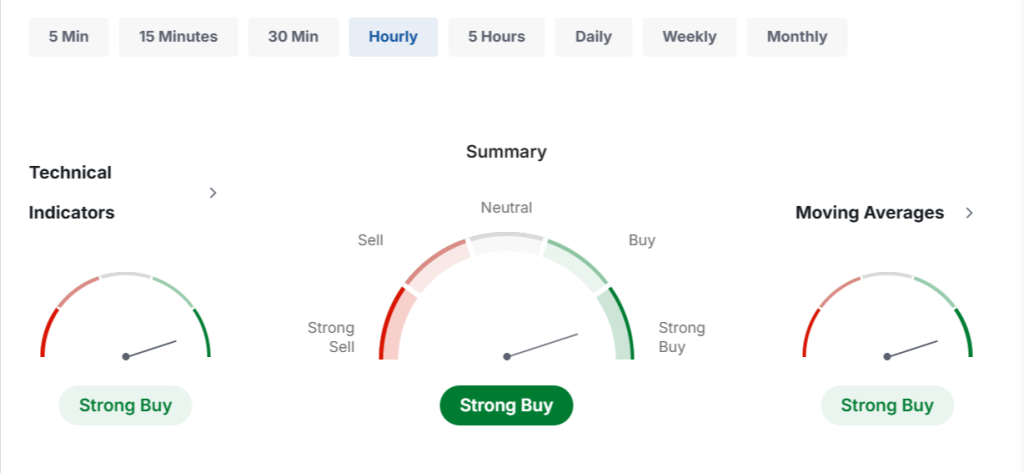

On the 1-hour timeframe as revealed on investing.com, the technical indicators are painting a mildly bullish picture for PI price today:

- RSI (Relative Strength Index) is currently at 56.2, which is in the neutral-to-bullish zone. It means the asset isn’t overbought or oversold, but there’s slight upward momentum. Traders typically view RSI readings above 50 as a sign of buying interest.

- MACD (Moving Average Convergence Divergence) is showing a value of 0.001, accompanied by a “Buy” signal. This indicates that the short-term momentum is stronger than the long-term momentum, which usually precedes upward movement if sustained.

- ATR (Average True Range) sits at 0.0037, showing relatively low volatility. That means there aren’t big price swings, which often suggests stable consolidation before a larger move.

- ROC (Rate of Change) is at 1.365, also indicating a “Buy” signal. It shows that the price has increased over the last period, confirming the slow upward drift we’ve seen.

Together, these indicators suggest there’s room for more upside today — especially if volume increases during the next leg up. The lack of extreme volatility also means the price is not being pulled erratically in either direction, which favors trend-following strategies like the current bounce-based structure.

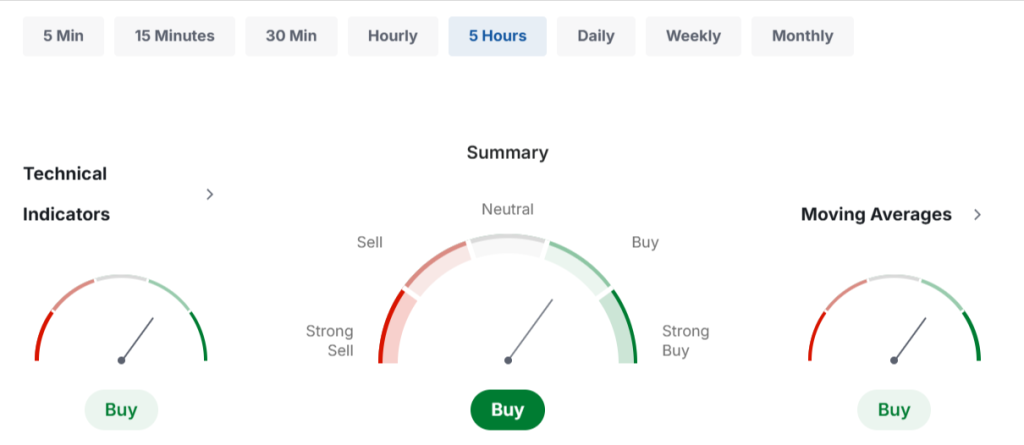

Midday Momentum: 5-Hour Indicator Also Flashes Buy

Looking at the broader 5-hour chart on investing.com, we see a continuation of bullish signs. The 5-hour indicators also support a buying stance for Pi Coin, adding more confidence to the current setup.

When multiple timeframes align like this, it often strengthens the case for a move in that direction — in this case, upward.

Read Also: HBAR Just Broke Out — Here’s Why Hedera Might Lead the Next Crypto Rally

Pi Price Prediction for April 23

Based on the current trendline structure, indicator readings, and price behavior, the most likely scenario for Pi today is another attempt to reach the $0.66 resistance zone. If that level is broken with strong volume, we could see short-term gains pushing the PI price toward $0.68 and beyond.

On the flip side, if the trendline breaks down with noticeable selling pressure, Pi might retreat toward the $0.60–$0.58 range.

But as of now, the market is still leaning bullish, and unless the structure breaks, the trend favors the bulls — slowly but surely.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.