Memecoins feel abandoned again. Liquidity is thin. Volumes are quiet. Most charts look broken. Many tokens are down 80% to 99% from their highs, and sentiment across the sector feels worse than it did during large parts of the 2022–2023 bear market.

That kind of mood usually marks the end of interest, not the start of a rally. But history shows memecoins don’t move when confidence is high. They move when nobody wants to touch them.

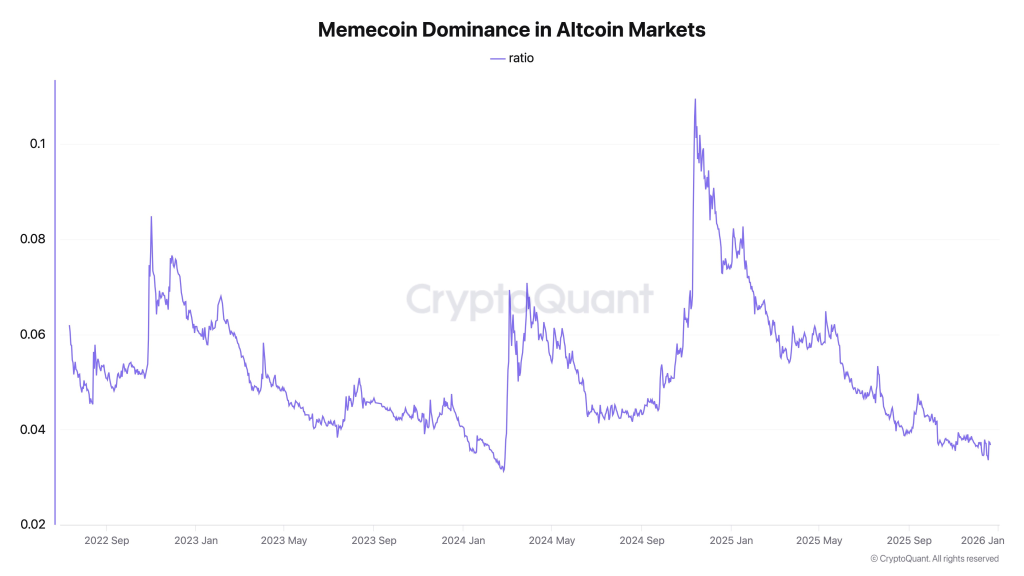

Unipcs highlighted this disconnect in a recent X post, sharing a CryptoQuant chart that tracks memecoin dominance across the altcoin market. The data paints a clear picture. Memecoin dominance has collapsed to levels rarely seen over the past few years. In fact, it is now sitting near the same zone that preceded some of the largest memecoin rallies of the cycle.

The last time dominance fell this low was in February 2024. At the time, sentiment looked almost identical. Traders declared memecoins finished. Liquidity rotated elsewhere. Social engagement dropped off a cliff. Then the market flipped.

PEPE rallied roughly 2,500% in the months that followed. WIF surged around 1,600%. FLOKI gained close to 1,000%. BONK added more than 400%. None of those moves started from optimism. They started from exhaustion.

The chart shared by Unipcs shows why this matters. Memecoin dominance tends to move in cycles, not trends. When dominance spikes, capital is crowded and upside becomes limited. When dominance collapses, capital dries up and expectations reset. That’s where asymmetric moves tend to form.

Right now, dominance is hovering near historical lows, even lower than many points during the 2022–2023 bear market. That matters because back then, the broader market was weak. Today, the broader crypto market is far more developed, liquid, and reactive. Yet memecoins are priced as if they are irrelevant.

PEPE sits right in the middle of that disconnect. Price action looks dead. Volatility is compressed. Attention has moved elsewhere. But structurally, this is the same environment where PEPE previously transitioned from being ignored to becoming the focal point of the entire sector.

This does not mean a rally starts tomorrow. Memecoin bottoms are rarely clean. They form through boredom, frustration, and disbelief. What matters is positioning. When dominance is low and sentiment is worse, it takes far less capital to trigger a violent repricing.

The setup today mirrors that earlier period closely. Capital has left the sector. Weak hands are gone. Survivors are exhausted. That is usually when memecoins stop trending lower and start surprising traders on the upside.

PEPE and the broader memecoin market are back in a zone most participants associate with failure. History shows those zones have often marked the beginning, not the end, of explosive moves.

When memecoins feel completely finished, they are often closer to waking up than disappearing.

Read also: What Could 2026 Bring for the Shiba Inu Price After a Brutal 2025?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.