Bitcoin went through two major crashes in August, and this could have raised questions about its next price direction.

To answer this, Lookonchain, a crypto analytics firm used five indicators to determine whether the price has reached its top, which would make now a time for Bitcoin to decline.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So the question is, will BTC drop or bounce back?

5 Indicators Show Whether the Top is Here or Not

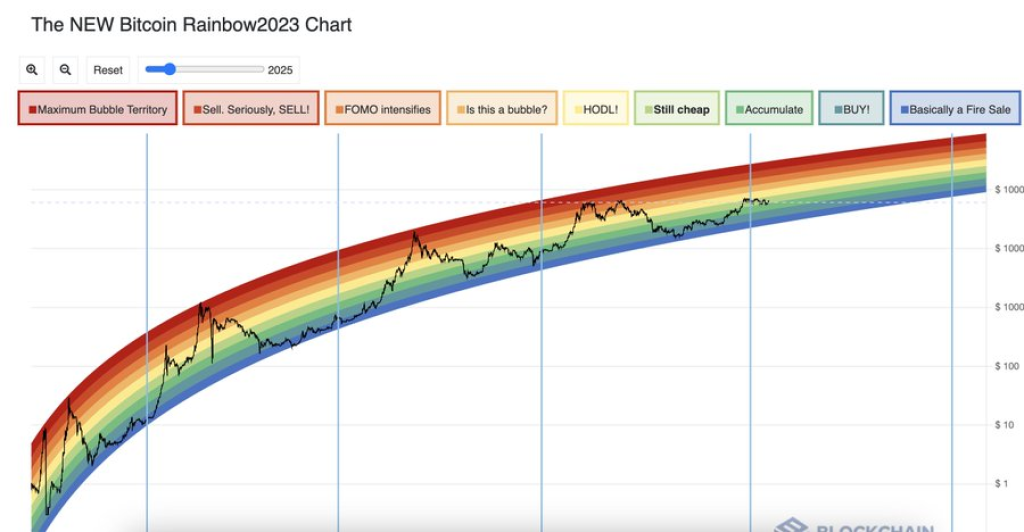

Rainbow Chart

The first indicator is the Rainbow Chart, which is a long-term valuation tool that uses a logarithmic growth curve to predict the future price of Bitcoin.

For now, the NEW Bitcoin Rainbow2023 chart shows that bitcoin is still cheap and there is a lot of room for price growth.

Relative Strength Index

When the RSI is above 70, it is interpreted as an overbought level, while a reading below 30 is oversold.

The RSI by the time of the analysis was at 61.87, and compared with the previous data, it could be interpreted as Bitcoin is not yet overbought and a peak may not be here yet.

200 Week Moving Average Heatmap

The 200-week moving average heatmap also shows that the price is not yet at the top. The current price is blue, and it is a sign that traders can still buy a hold for a price increase.

Cumulative Value Coin Days Destroyed (CVDD)

When the price of Bitcoin touches the CVDD green line on this chart, it shows that BTC price is undervalued and it could be a good buying opportunity.

The current chart also shows that the top has not yet been reached and there could be room for further price growth.

2-Year MA multiplier

The 2-year MA multiplier also shows that the price of Bitcoin is between the red and green lines. Since it has not yet gotten into the red light, the top is not yet here.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.