As the crypto market enters 2024, on-chain data indicates a rotation of funds out of leading layer 1s Solana and Avalanche into Ethereum. According to analyst Metaquant, Ethereum looks poised to start its “on-chain season” after weeks of altcoin strength.

What you'll learn 👉

Solana and Avalanche Lose Steam After Explosive Runs

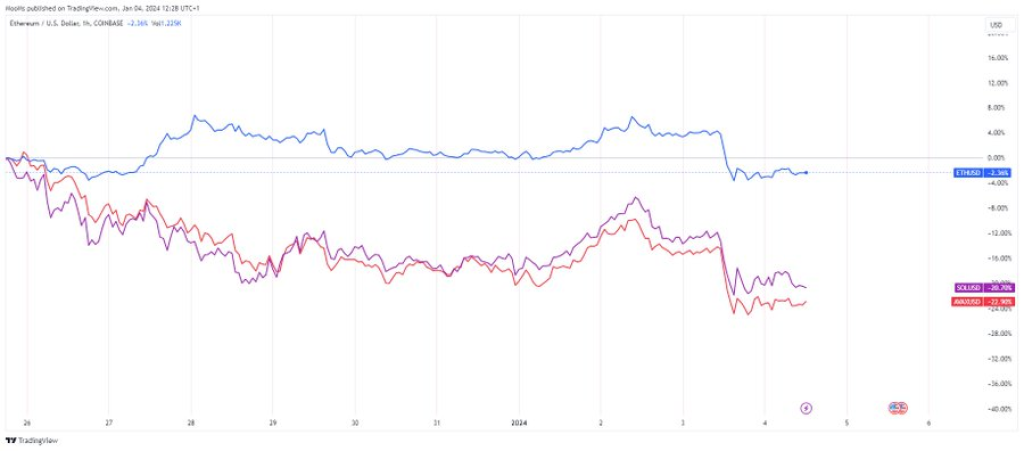

Both Solana and Avalanche saw their native tokens, SOL and AVAX, go on epic price runs in late 2023. However, Metaquant points out these layer 1 challengers have cooled significantly over the past ten days even as Ethereum moved sideways.

This loss of momentum for Solana and Avalanche has coincided with money flowing out from both ecosystems after accumulating heavily in previous weeks. At the same time, on-chain activity and funds entering Ethereum have ticked higher.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Signals Point to Imminent ‘ETH On-Chain Season’

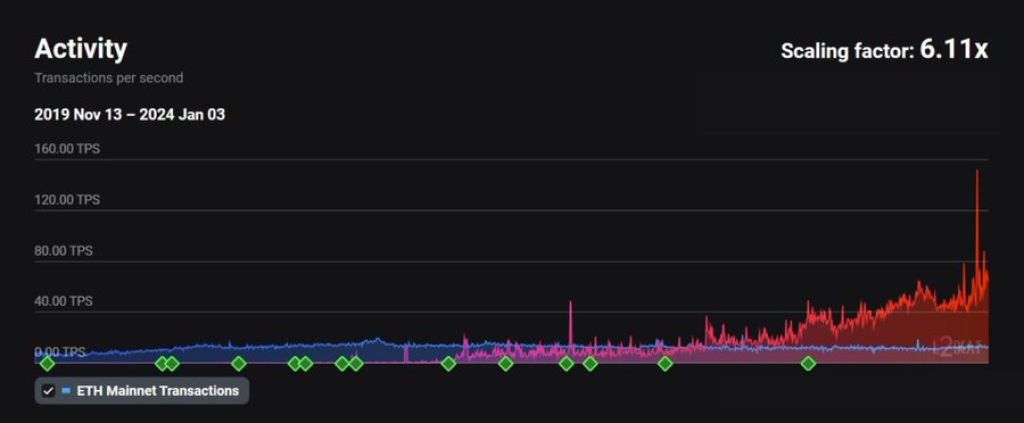

According to Metaquant, clear signals are flashing that Ethereum’s on-chain season is approaching. These include stablecoins and funds exiting centralized exchanges flowing into ETH, as well as climbing daily active addresses and on-chain volumes.

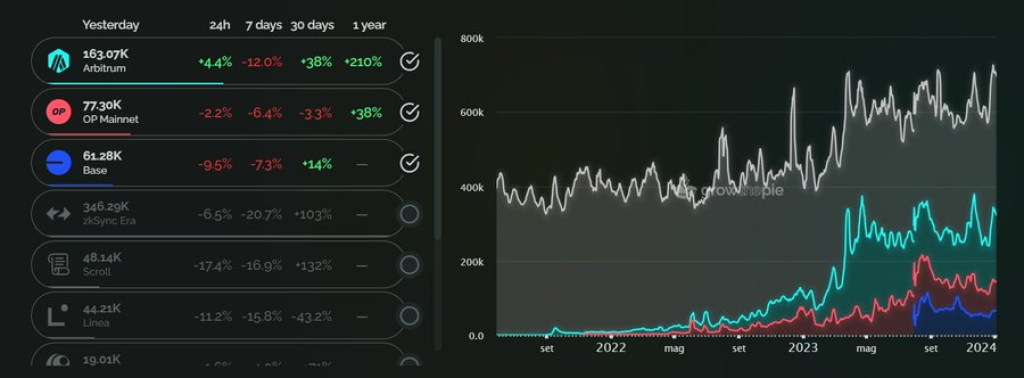

Layer 2 protocols built on Ethereum have also seen all-time highs recently across daily fees, total value locked, and stablecoin market capitalization. Still, Layer 1 Ethereum remains the primary hub of DeFi activity despite the growth of Layer 2s like Arbitrum and Optimism.

With so much fundamental activity happening across Ethereum and this not yet reflected in ETH’s price, Metaquant predicts a significant move is brewing. History shows crypto bull markets tend to align with on-chain spikes for Ethereum.

Quote: “On-chain summer was just a little taste of what is coming up on ETH”

One Solana co-founder even recently acknowledged Ethereum’s staying power, a sign of its enduring network effects. Metaquant believes the previous “on-chain summer” will pale in comparison to the Ethereum-fueled mania of this next rally.

Rotating From ‘Front-Running the Front-Runners’

Like in 2021, Metaquant notes that money first flowed into the hyped layer 1s before eventually finding its way back into the Ethereum ecosystem. He suggests this pattern of “front-running the front-runners” creates opportunities.

Once funds start accumulating in Ethereum amid improving on-chain signals, it tends to precede price runs across large caps, mid caps, and finally low caps. For those closely tracking fundamentals, this rotation back into ETH may signal the next major crypto market cycle is gearing up.

Riding these rotational waves by identifying where crowd activity clusters stands as a key skill in crypto investing. And all the on-chain data suggests Ethereum stands ready to absorb the next wave of capital inflows.

You may also be interested in:

- LINK Comes Back Fighting: Chainlink Technical Analysis Post Market Crisis

- Stratis’ Strax Surges Over 60% in Two Days Following This Key Announcement: Why The Move May Not Last

- Bitcoin Might Be Down, But $BTCMTX Continues Rising After Crossing $7.4 Million In Funding – Here’s Why

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.