Inflation fears are in focus for the past few years. Gold gets the stage. Silver gets a mention. Then the discussion usually stops. Analyst Alex Mason is arguing that this framing misses the real trade entirely.

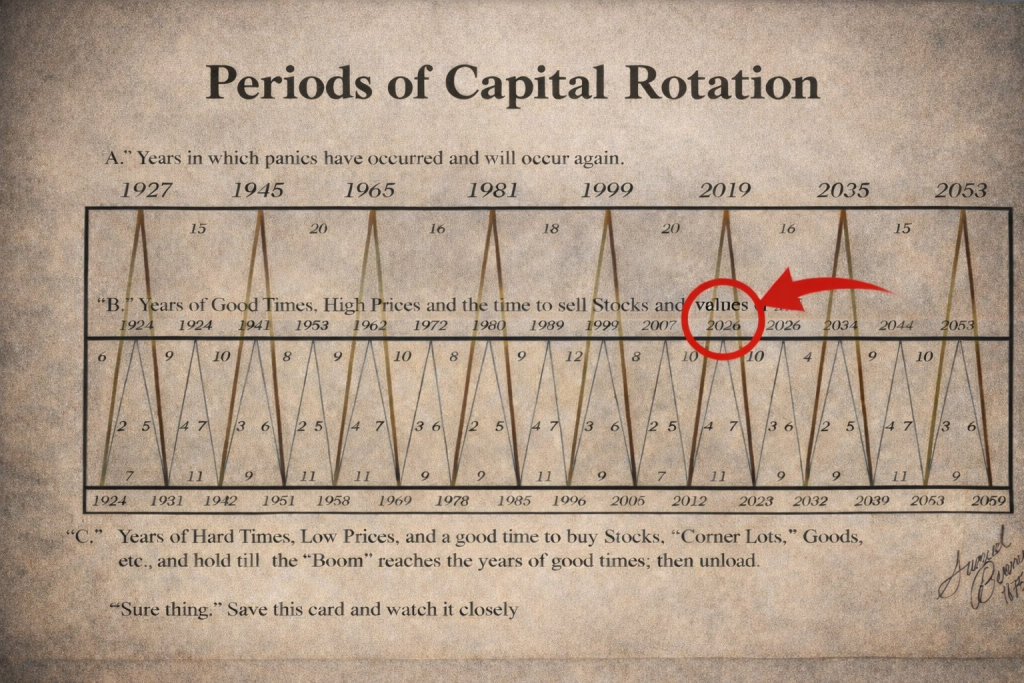

In his recent post, Mason laid out a broader view of inflation protection, backed by a long-term chart on periods of capital rotation. His core message is clear: inflation does not just hit prices, it stresses systems. And capital tends to rotate toward whatever keeps those systems running.

What you'll learn 👉

What Mason Is Actually Saying

Mason is not dismissing gold. He explicitly says he is not selling it. Gold still plays its role as a store of value. The difference is focus. Gold protects savings. The assets he is buying protect function.

His framework follows a simple chain:

Energy → Electricity → Food → Materials

When money loses credibility, demand doesn’t disappear. It shifts toward the inputs that cannot be substituted or scaled quickly. Oil, gas, power generation, uranium, copper, fertilizers, and industrial infrastructure sit at the base of that chain. Without them, nothing else works.

That is why he describes this as a system trade, not a single-asset bet.

The Capital Rotation Chart Explained

The chart Mason shared breaks history into repeating phases of capital behavior. It marks three broad environments:

- Panic years, when confidence collapses

- Expansion years, when prices are high and risk appetite dominates

- Compression years, when assets are cheap and capital quietly positions

The key detail is timing. These phases do not show up randomly. They cluster around long cycles that tend to repeat over decades. The chart highlights past moments where capital moved away from financial assets and toward real assets tied to production and supply.

Mason circles 2026 as a point where the model suggests another transition. Not a market top call. A rotation call.

Why Energy and Infrastructure Matter Here

Mason’s list is deliberate:

- Oil and gas supply real energy, not narratives

- Electricity sits at the center of modern economies and is already strained

- Uranium supports baseload power that renewables cannot replace

- Copper bottlenecks electrification and grid expansion

- Fertilizers link energy directly to food supply

- Infrastructure underpins everything above it

These sectors share three traits Mason cares about. They generate cash. They sit near cycle lows relative to financial assets. And they cannot ramp supply quickly, even with higher prices.

That last point matters most. When demand rises faster than supply, capital follows.

Read also: Silver Miners vs. Silver: This Ratio Is Screaming Opportunity

The Ratio Signal He Flags

One line in the post stands out: the oil companies to gold miners ratio sitting near historical lows. Mason notes that this relationship does not stay compressed for long. In past cycles, extremes in that ratio showed up near major rotation points, when capital started favoring energy producers over traditional hedges.

This is about gold no longer being the only place capital hides.

Why This Trade Is Quiet

These sectors are not popular. They are capital intensive, politically sensitive, and boring compared to tech or crypto narratives. That is usually how early rotation phases look. Capital moves first. Stories come later.

Mason’s confidence comes from repetition. He points out that he has publicly called major tops and bottoms for over a decade. That track record is why his statement about deploying millions carries weight, even without ticker symbols attached.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.