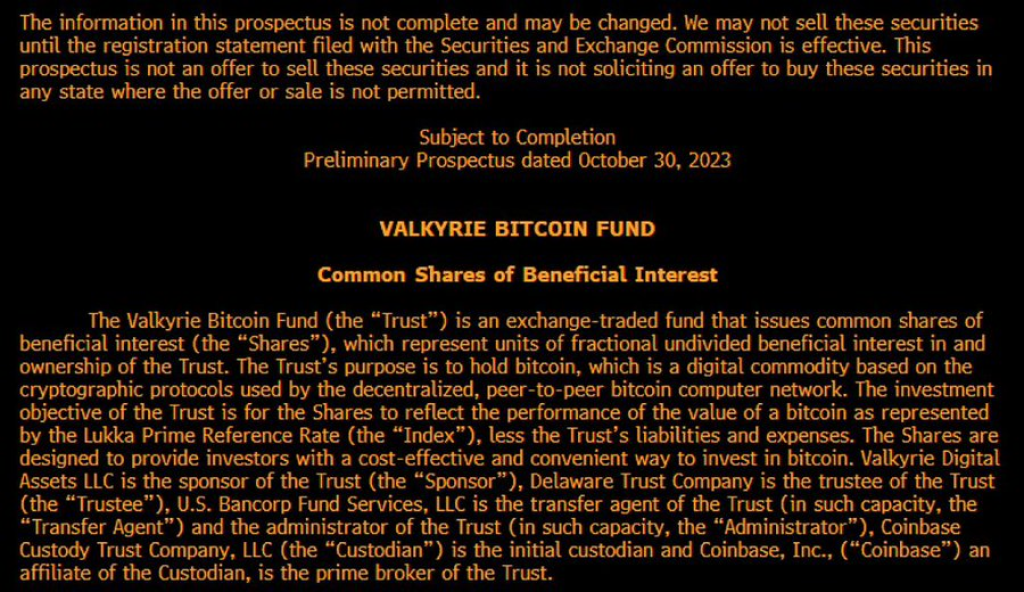

Valkyrie Investments has just updated their filing for a bitcoin ETF, in a potential sign of progress for a spot bitcoin exchange-traded fund (ETF).

This update comes after months of conversations between Valkyrie and the Securities and Exchange Commission (SEC), suggesting the regulatory agency is working closely with applicants to improve their filings, as reported by Crypto Rover on X (Twitter).

The crypto market has been eagerly awaiting the approval of a spot bitcoin ETF, which many believe could significantly drive institutional adoption and positive price action. While the SEC has rejected over a dozen bitcoin ETF applications so far, their willingness to provide feedback and allow applicants to amend their filings points to a change in attitude.

“The latest update to the Valkyrie filing shows the SEC is no longer stonewalling bitcoin ETF applications, but rather engaging with applicants in a collaborative way,” said crypto analyst Petar Jovanović and CaptainAltcoin’s Head of Content “This gives me optimism that we could see the first approval later this year or early next.”

In addition to Valkyrie, several other high-profile asset managers have bitcoin ETF applications under review, including Fidelity and Grayscale. The SEC has been clear that any approved ETF would need to have robust surveillance-sharing agreements in place with regulated bitcoin exchanges. However, their guidance and cooperation makes it appear these structural issues are solvable.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.