Nervos Network (CKB) has spiked 20% in the past 24 hours alone, while Stacks (STX) has risen 16% within the same time period. This price increase is coming as many other cryptocurrencies have also started to recover in price, preparing for a potentially epic altcoin season. But how far can these cryptos go?

What you'll learn 👉

CKB Poised for a 200% Price Surge

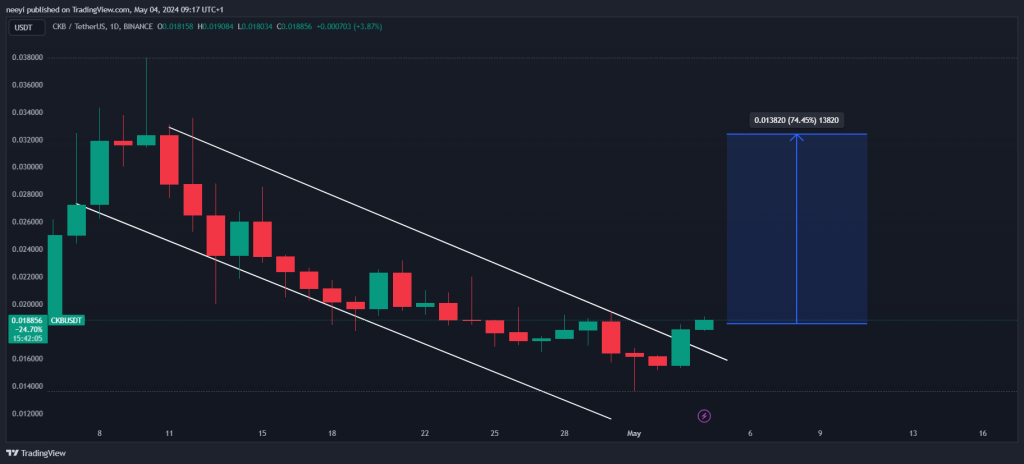

Nervos Network’s CKB seems to have bottomed after it had a long reversal wick three days ago, followed by a low volume red candlestick two days ago. The bullish spike started yesterday and closed as a bullish engulfing candlestick. It was also the longest green candlestick seen so far on the CKBUSD price chart since April 8, before the price fall started. This increase in volume could be signaling the beginning of an upward move.

With this in place, the bulls may start to target the top of the channel where the drop started, which is at $0.03. This represents around a 200% price increase from the present price of $0.01.

Stacks (STX) Eyes 20% Breakout

Stacks’s STX is also recovering, with similar price action as CKB. However, the price is currently struggling at around a resistance area. A successful breakout from that area, which is at $2.4, should propel the price to an upward trajectory and spike as high as $2.9, a 20% run.

As the broader cryptocurrency market regains momentum, both Nervos Network (CKB) and Stacks (STX) are positioning themselves for major upside potential. Investors will be closely watching these two assets as they attempt to break through critical resistance levels and potentially embark on impressive rallies.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.