As the highly anticipated Bitcoin halving event draws near, cryptocurrency analysts and traders are preparing for a potential shift in market dynamics that could render traditional technical indicators less reliable. In a series of tweets, two prominent analysts, @StockmoneyL and @CryptoYoddha, shared their insights on what to expect from Bitcoin’s price action in the coming months.

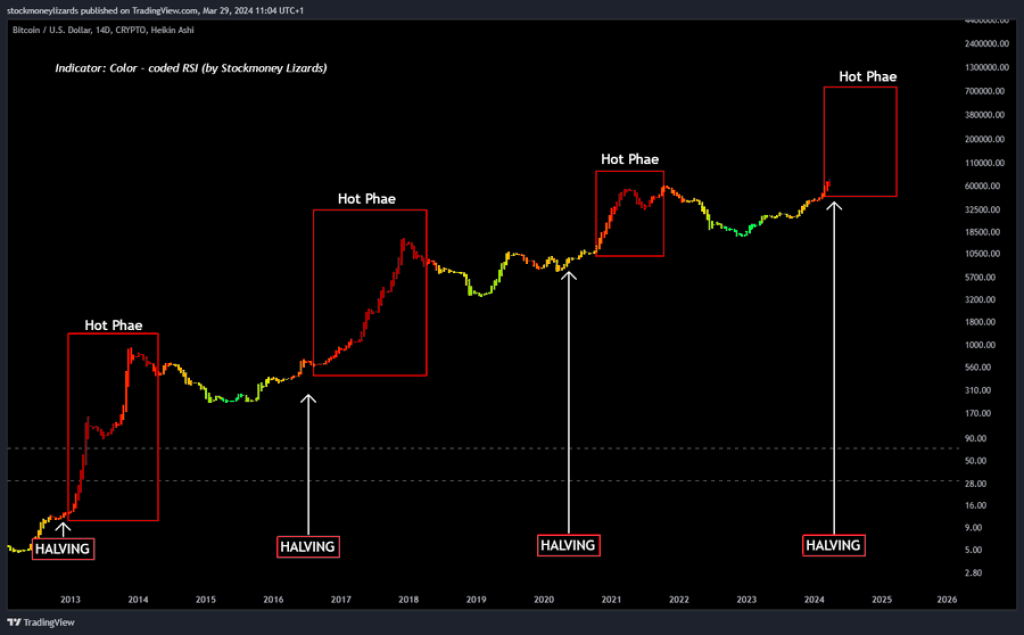

@StockmoneyL, known as “Stockmoney Lizards,” highlighted that Bitcoin has entered a “hot momentum phase,” a period typically associated with the cryptocurrency’s halving cycles. During this phase, the analyst suggests that traditional momentum indicators like the Relative Strength Index (RSI) may not accurately reflect overbought or oversold conditions.

“Bitcoin has entered the hot momentum phase. Around halving, it is usually time to forget about what you learned about RSI as indicating ‘overbought’ or ‘oversold’ levels. It will stay overbought for a long time,” @StockmoneyL stated, implying that Bitcoin’s price could remain elevated for an extended period without experiencing significant corrections.

The RSI is a popular technical analysis tool that measures the speed and change of price movements. Traditionally, an RSI value above 70 is considered overbought, while a value below 30 is deemed oversold, indicating potential price reversals. However, @StockmoneyL’s observation suggests that these traditional interpretations may not hold true during Bitcoin’s halving cycles.

Adding to the narrative, @CryptoYoddha, known as “Yoddha,” provided insights into the potential price behavior of Bitcoin in the coming months. According to the analyst, if Bitcoin can establish stability above the $70,000 level, it could form a “nice distribution range” near the target area, potentially setting the stage for a volatile period.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +“Bitcoin Stability above $70,000 can help BTC form a nice distribution range near the target area. The coming few months will be like a rollercoaster,” @CryptoYoddha tweeted, emphasizing the potential for significant price swings in the lead-up to the halving event, which is expected to occur in approximately 20 days.

The Bitcoin halving is a pre-programmed event that occurs every four years, during which the reward for mining new blocks is cut in half. This event is widely anticipated to impact Bitcoin’s supply and demand dynamics, potentially leading to increased scarcity and upward price pressure.

As the halving approaches, traders and investors are advised to exercise caution and remain vigilant, as the market dynamics may deviate from traditional patterns. While technical indicators can provide valuable insights, it is essential to consider the unique circumstances surrounding Bitcoin’s halving cycles and adapt trading strategies accordingly.

You may also be interested in:

- Dogecoin Successfully Retests Macro Downtrend and Breaks Out from Its Bull Flag: How High Can DOGE Go?

- 7 Tokens Accumulated by Insider Wallets with Potential for 6X Growth

- Analyst Shares Key Tips for Maximizing Profits from Elon Musk’s Tweets in Bull Market

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.