The price of SUI has increased by more than 100% from its April low of around $1.70. The price has been consolidating for some days, but some fundamental and technical metrics suggest it could still be in for some major spikes.

Sui isn’t just riding on short-term hype. The fundamentals behind the project remain strong—and that’s exactly what Marco Polo (@MarcoPoloMaps) highlighted in a recent X post where he stated, “$SUI is still not done! Structure looks sharp.” His breakdown of Sui’s underlying architecture and ecosystem reminds us why many investors continue to take it seriously.

According to Marco, Sui is a high-performance Layer 1 built by former Meta engineers at Mysten Labs. The blockchain is optimized for scalability and low latency and was designed from scratch to support next-generation Web3 applications.

One of its most powerful features is its object-centric model. Unlike most blockchains that use a traditional account-based structure, Sui allows each object to be handled independently, enabling transactions to run in parallel. This allows the network to hit extremely high throughput with finality in under 400 milliseconds.

Marco also points out that Sui’s smart contracts are written in Move: a secure, purpose-built language initially created by Meta for the Diem blockchain. Move’s architecture focuses on resource control and safety, giving Sui an edge in contract execution and digital asset management.

The Sui ecosystem is growing fast, too. Marco highlights active DeFi protocols like Suilend and NAVI—NAVI alone accounts for around 40% of the chain’s $1B in total value locked. On the gaming side, developers like Netmarble and Lucky Kat are building Web3 experiences powered by Sui’s NFT infrastructure. SuiNS, a decentralized naming service, is also adding utility to everyday interactions.

But what really underlines long-term confidence is the growing institutional attention. Marco notes that ETF filings from Canary and 21Shares, along with partnerships with Fireblocks, are early signs of deeper financial integration. These aren’t just speculative plays—they’re signs that serious capital is watching Sui closely.

SUI Price Action Signals More Upside

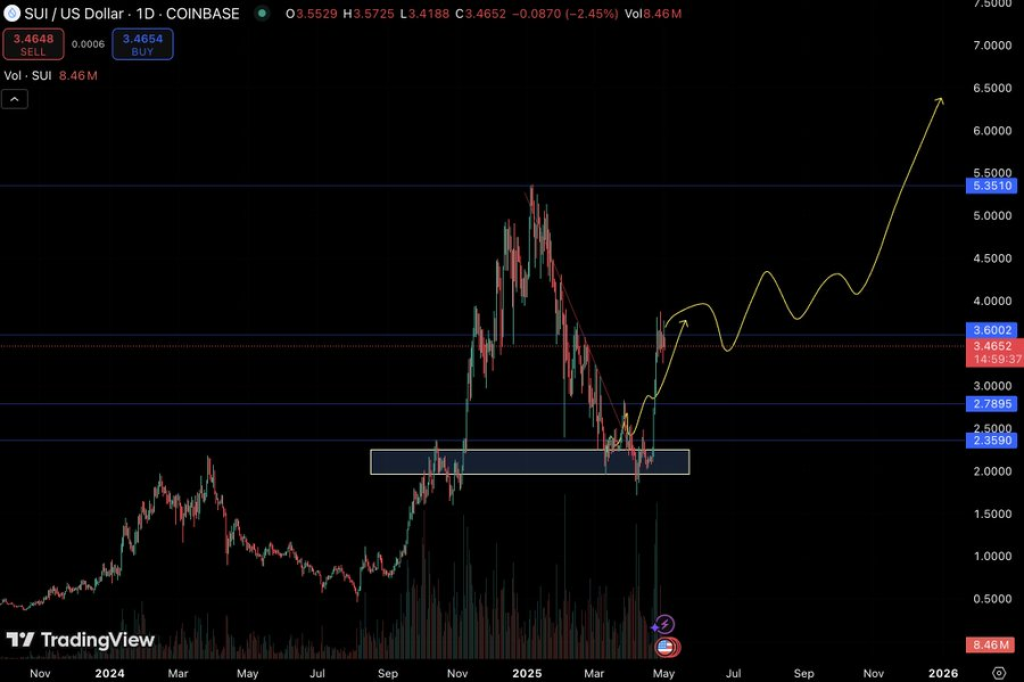

On the technical side, SUI’s chart tells a strong story. After bottoming near $1.70 in early April, the price bounced sharply from a major support zone between $2.35 and $2.50. This area had previously acted as resistance during the 2024 accumulation phase, making the reversal even more convincing.

From there, the SUI price surged past $3.60, breaking out of a multi-month downtrend. That breakout came with volume, a good sign that this wasn’t just a weak relief rally. Since then, the price has been consolidating just below that $3.60 zone, which now acts as a key level to watch. A clean flip above it could trigger the next leg higher.

The structure of the current price action looks like a textbook bullish continuation pattern. The chart shows higher lows forming, with price winding up for a potential staircase-like move through the next resistance levels.

Analysts like Marco Polo believe this is just the beginning. His chart suggests that the next targets are around $5.35, a previous local high, and then potentially $6.50 if momentum continues and Bitcoin holds up. From a structure perspective, there’s no sign yet of exhaustion—just healthy consolidation.

Read Also: We Asked AI to Predict Hedera (HBAR) Price in May

When you combine the strong fundamentals outlined by Marco Polo with the clean technical setup on the chart, the bullish case for SUI becomes hard to ignore. The blockchain’s architecture is innovative, the ecosystem is expanding, and investor interest is rising across both retail and institutional fronts.

If SUI can hold above the $3.60 level and break out from current consolidation, this could be the start of a larger trend. As Marco put it, “SUI is still not done!”—and based on what we’re seeing, he may be right.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.